AMD Ryzen: Good For Enthusiasts, Bad For Investors

The recent news that AMD took a drubbing in the stock market was quite unexpected, especially considering the company's solid revenue growth. It's always tricky to understand the moods and the movings of the market, but one item in particular stood out to some investors in the aftermath of AMD's most recent earnings report: the drop in margin guidance for Q2. And even if it doesn't completely explain the bewildering cratering of AMD's stock price--although margins are always an important investment decision factor--that margin projection is interesting nonetheless.

But behind the vagaries of the stock market and its fickle fluctuations are some tangible issues that AMD has to deal with--meaning, the ramifications of its hardware decisions around Ryzen. These include the lack of integrated graphics, unlocked multipliers for all models, the same underlying eight-core architecture, and the impact those decisions could have on AMD's Ryzen product mix.

The Market Slump

Anchilees research weighed in with its take on the slump:

Advanced Micro Devices shares dropped sharply on Tuesday after the company's margin outlook for the current quarter shocked investors. Though the company's revenues and earnings were "in-line" with analysts' consensus expectations, investors took issue with the chip company's gross margin guidance, quickly selling their shares into the weakness. [...] The gross margin guidance did not sit well with investors and was the dominant reason why investors dumped the stock.

The theme continued in Reuters article titled, "AMD's revenue rises 18.3 percent, but margin forecast dissapoints." MarketWatch also weighed in with a tidy summation:

Shares of Advanced Micro Devices Inc. plunged 19% on in active morning trade Tuesday, putting them on track to suffer the biggest one-day loss since Jan. 11, 2005, as investors expressed disappointment over the chipmaker's margin outlook.

The company reported a 34% margin for Q1, but guided down to 33% for Q2. On the surface, a 1% decline doesn't appear to be all that alarming. However, AMD will have Ryzen on the shelves for the entirety of the next quarter, so some analysts appear to think the reduced margin projections may expose a weakness of AMD's new product lineup, at least from a financial standpoint.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

We've noticed a few interesting trends ourselves; there are a few caveats to the company's recent maneuverings that might give us some insight, at least on the CPU side of the AMD operation.

What, No Graphics?

Regarding integrated graphics, AMD is up against a veritable giant in the desktop space, so much of its success depends upon stealing market share from Intel. Enthusiasts don't have much need for integrated graphics, but they are a major factor for volume sales; the majority of the mainstream market does not use a discrete GPU.

As such, integrated graphics are a key factor to unlocking sales in the broader mainstream market. AMD currently has a relatively limited addressable market, which the company will rectify with integrated GPUs in future products. For now, it's a limiting factor that could exacerbate another issue.

Eight Cores For Everyone! (Even If You Can't Use Them)

AMD uses two four-core CCX (Core Complexes) per package, and all of AMD's Ryzen models employ this same design. AMD, like other processor manufacturers, disables cores either due to manufacturing defects or simply to offer a segmented product stack. The primary takeaway is that all of the Ryzen CPUs, be they eight-, six-, or four-core, employ the same underlying eight-core design. Essentially, this means that the company has a similar manufacturing cost for a $499 Ryzen 7 1800X as it does for a $169 Ryzen 5 1400.

| Row 0 - Cell 0 | Price Per Physical Core (Eight) | Price Per Usable Core | MSRP |

| Ryzen 7 1800X | $58.75 | $58.75 | $499 |

| Ryzen 7 1700X | $48.50 | $48.50 | $399 |

| Ryzen 7 1700 | $41.25 | $41.25 | $329 |

| Ryzen 5 1600X | $31.25 | $41.66 | $249 |

| Ryzen 5 1600 | $27.35 | $36.55 | $219 |

| Ryzen 5 1500X | $23.65 | $47.25 | $189 |

| Ryzen 5 1400 | $21.12 | $42.25 | $169 |

We can analyze the pricing impact from a few angles, the most important being the price per physical core. As you can see from the table, AMD charges only $31.25 per physical core for the Ryzen 5 1600X (although you can use only six of them), which pales in comparison to the $58.75 per physical core the company gains for the Ryzen 7 1800X. Because the processors employ the same silicon, the $27.50 loss per physical core equates directly to reduced profit.

As a result, AMD has to have a solid product mix of both high-margin and low-margin models to recoup some of the reduced profit on the low end.

That's where unlocked multipliers present an issue. We love the fact that all of AMD's processors feature unlocked multipliers, but it also means that many reviewers (us included) suggest that you simply purchase the Ryzen 7 1700 instead of the more expensive "X" models (Ryzen 7 1800X and 1700X). For instance, the Ryzen 7 1700 is AMD's most popular Ryzen processor on the Amazon Best Sellers list, although that isn't entirely unexpected given its lower price point.

The "X" and non-"X" processors feature similar overclocking headroom, so for enthusiasts, you can gain quite a bit of extra value by eschewing the more expensive top-end variant. We've also seen similar recommendations for the Ryzen 5 series.

That might not be great for AMD's margins, though, as it disrupts the product mix and skews it toward lower-margin models. Ensuring a healthy overall profit margin depends heavily upon maintaining segmentation. This is one of the key reasons that Intel, the self-crowned king of product segmentation (just listen to its earnings calls, you'll get it), refuses to offer unlocked multipliers on its lesser SKUs. We wouldn't spend the extra cash on an unlocked Core i5-7600K if the cheaper i5-7400 offered the same overclocking ceiling, so Intel locks the multiplier to prevent cannibalizing its own sales on higher-margin products.

Providing unlocked multipliers for all models grants AMD plenty of cachet with enthusiasts, but the company could possibly be punishing itself financially with an "unhealthy" product mix.

Remember, the lack of integrated graphics partially restricts the market to those who are most likely to leverage the unlocked multipliers (enthusiasts), and this group is the most likely to take advantage of the cheaper, unlocked models.

Correcting The Mix?

We've noticed a few Ryzen sales over the past few weeks. We aren't sure if AMD is involved in these recent sales, thus effectively lowering its MSRP, or if retailers are trying to drum up sales independently. However, regardless of AMD's involvement, the sales yield a few interesting points.

First, the Ryzen 7 1800X, the most expensive model and logically where the most margin resides, has been on sale at Amazon for two weeks for between $470 and $465. It's also on sale at Newegg with a $30 discount, although we don't have pricing history to determine the length of that sale. The Ryzen 7 1700X has also experienced a slow creep downward from its $399 MSRP over the last month. The 1700X suddenly dropped drastically on Tuesday, May 2, to $374. That happens to be the day after the company suffered its drop in stock.

The sales apply to the high-end products only. This could mean either that the distributors aren't moving enough of the products or that AMD is attempting to correct its mix by offering lower prices. Cutting the price of the eight-core models would offer an incentive for more people to purchase the expensive variant, while also allowing the company to continue to yield higher margins than it receives for the low-end models. (Of course, neither of those could be the case; it’s impossible to draw conclusions without detailed sales data).

| Row 0 - Cell 0 | MSRP Price Per Physical Core (eight) | Sale Price Per Physical Core | Price Per Usable Core (MSRP) | Sale Price |

| Ryzen 7 1800X | $58.75 | $58.00 | $58.75 | $464 |

| Ryzen 7 1700X | $48.50 | $46.75 | $48.50 | $374 |

| Ryzen 7 1700 | $41.25 | $41.25 - Negligible Change | $41.25 | $323 |

| Ryzen 5 1600X | $31.25 | $31.25 - Unchanged | $41.66 | $249 |

| Ryzen 5 1600 | $27.35 | $27.35 - Unchanged | $36.55 | $219 |

| Ryzen 5 1500X | $23.65 | $23.65 - Unchanged | $47.25 | $189 |

| Ryzen 5 1400 | $21.12 | $21.12 - Unchanged | $42.25 | $169 |

In this table, we've included a column to reflect the sales pricing. As you can see, cutting the price still yields a superior margin for the high-end models compared to the low-end models. It's notable that none of the lower-end models are on sale. AMD likely has restricted pricing flexibility at the low end due to the die design, and as an astute reader recently noted, that could leave the company especially vulnerable to targeted price cuts from Intel on the low end. We have seen zero change to Intel's pricing structure, and the company's recent customer pricing guide also reflects no changes in the near term.

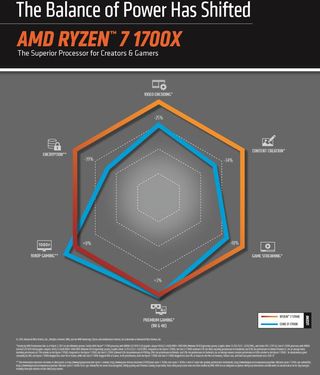

Interestingly, AMD sent an email as we were working on this article that touts the Ryzen 7 1700X's performance in relation to the Core i7-7700K. The timing appears a bit odd, as the company hasn't sent prior communications like this regarding other already-released Ryzen products. It also sent over an interesting graph that outlines the 1700X's key characteristics (according to the company's own internally-derived test data).

In either case, there is no doubt that AMD sells far more low-end chips than high-end ones, so achieving the right mix of high-margin models is critical. In some respects, AMD might be somewhat naked in defense of Intel price cuts on the low end due to the built-in cost overhead of the eight-core design, but Intel hasn't responded as of yet.

As many others have mentioned, the fluctuation in AMD's stock price could be a combination of several factors, including some confusion over cash stockpile maneuvering or higher expectations surrounding Ryzen sales for Q2, but margin expectations also play a role, and it's a situation AMD is going to have to address. Unfortunately, if AMD is having problems with its CPU product mix and that's impacting its margins, it’s going to be a challenge to correct the issue.

Paul Alcorn is the Managing Editor: News and Emerging Tech for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

InvalidError AMD has too many similar and closely priced products. I'd just axe the 1700X and drop the 1800X closer to $400. At the low end, there isn't much that can be done, trying to push 4C 4/8T CPUs cut from the same 8C16T die hurts margins.Reply -

JamesSneed The market is correcting for being overly optimistic on AMD stock however it over-corrected so Q2 should be better for AMD stock. Its rather obvious AMD is trying to get its CPU market share up, which in the long term is going to be better for AMD. The short term they are sacrificing profit per CPU(margins) by having all these unlocked skus. I honestly don't think they need to correct anything with margins until Zen+ is out as they are playing a longer game than most analysts realize. When Zen+ comes out they really should think about an Intel like lineup on unlocked skus to get margins up. More importantly they need big Vega to be very strong, as in Nvidia 1080ti strong, or they will end up having low margins for GPU's as well and that may hurt a bit to much.Reply -

captaincharisma you mean cheap enthusiasts. after how long AMD CPU's have been under performers AMD's user base consists of mainstream users looking for a cheap computer to surf the web and check e-mail while the rest are just AMD fanboys who are against Intel for some ridiculous reason.Reply -

Ricky Brian Considering the estimated cost of each die is about US$42 (assumption: US$8K 14nm wafer, 60% yield, 192mm^2 die size), charging $169 is well above 50% gross margin. This "article" is such a xxxx in my mind.Reply -

salgado18 They should have locked the maximum multiplier of the lower tier CPUs. Like the 1700 should clock up to 3.4, the 1700X up to 3.7 and the 1800X should be fully unlocked. A bit Intel, I know, but enthusiasts would buy the 1800X, professionals would buy the 1700, and the middle ground would buy the 1700X (because 3.7 GHz is good enough).Reply

Then, XFR should be the maximum possible for everyone. The diferentiation would be on overclocking room.

Also, they should have tried to develop, in paralel, a CPU with only one CCX. Even if it took a few months more to release it, and it would take more resources, margins on lower-core products would be much higher, and those would be the volume sellers. Release 8 and 6 core on Q1, release 4 core on Q3, restricted multipliers on non-top SKU, and problem half solved. -

salgado18 Reply19646449 said:Considering the estimated cost of each die is about US$42 (assumption: US$8K 14nm wafer, 60% yield, 192mm^2 die size), charging $169 is well above 50% gross margin. This "article" is such a xxxx in my mind.

And charging $500 for the 8 core is about 91% gross margin. However, that margin has to repay all the investment, AMD sales will start very slow, and lower tier CPUs have more value. The article is spot on, sorry. -

jaber2 Intel's EN was not correct according to the "Balance of Power" diagram, it was leaning towards special.Reply -

synphul Their pricing, whether from amd themselves or the retailers, makes little sense. Take the r7 8 core cpu's. There's currently a $48 difference between the r7 1700 and 1700x. So for $48 you get the addition of xfr and 400mhz extra base speed, 100mhz extra boost speed. But if you spend $100 more than the 1700x you get an extra 200mhz. That's it. The 1700x already has xfr so there's literally a 200mhz difference (300mhz xfr) for $100.Reply

Put another way they're charging over 27% more for less than 6% clock speed. Which begs the question why? What point does the 1800x have? It's no wonder prices have already begun to plummet, that's after the chips lowered in price.

Yes intel's enthusiast cpu's command a much higher price than the mainstream desktop quad cores but even with the gap in price at least consumers are getting additional cores and threads coupled with higher cache and additional pci lanes. Does it justify the price from $340 for a 7700k to $1000 for a 6900k? No, but at least it's something as in double the cpu cores/threads. The 6800k is only $50 more than a 7700k and the user gets 2 additional cores.

$100 for 200mhz, they have to be kidding. Especially when the 1700/1700x can be oc'd and even a slight oc will make up the puny clock speed difference. I notice these glaring issues in the lineup and I'm not even an investor. It's not really surprising investors might be having second thoughts. Even if it's artificially created intel made sure that charging a slight premium for a k vs non k meant overclocking vs factory speeds.

They certainly don't charge a 27% premium to go from an i5 7400 to i5 7500. The i5's are a great example since they offer the same clock speed difference from one model to another that amd's offering between the 1700x and 1800x. The only difference is intel only charges $10 (5% additional) for the speed increase rather than 27%.

Kind of an interesting situation from amd when so many accuse intel of gouging their customers. Flagship products are never the bread and butter for a company but they're supposed to be the poster child for the company's achievements. The current amd flagship is suffering not from performance issues like their last flagship fx 9590 but from price/value perspective this time around.

Most Popular