AMD Powered Server Revenue Grew 112 Percent YoY, ARM Also Increasing Rapidly

Intel pressured on two fronts

AMD's EPYC Rome CPUs have slowly chewed away market share from Intel's data center processors, and according to a new report from industry bean counter IDC, AMD-powered servers grew by 112.4% year-over-year. Meanwhile, ARM processors are also stealing away sockets from competing x86 chips at a quickening rate with a 430.5% yearly growth, albeit with the caveat that though the nascent ARM ecosystem stills represents a small portion of the market.

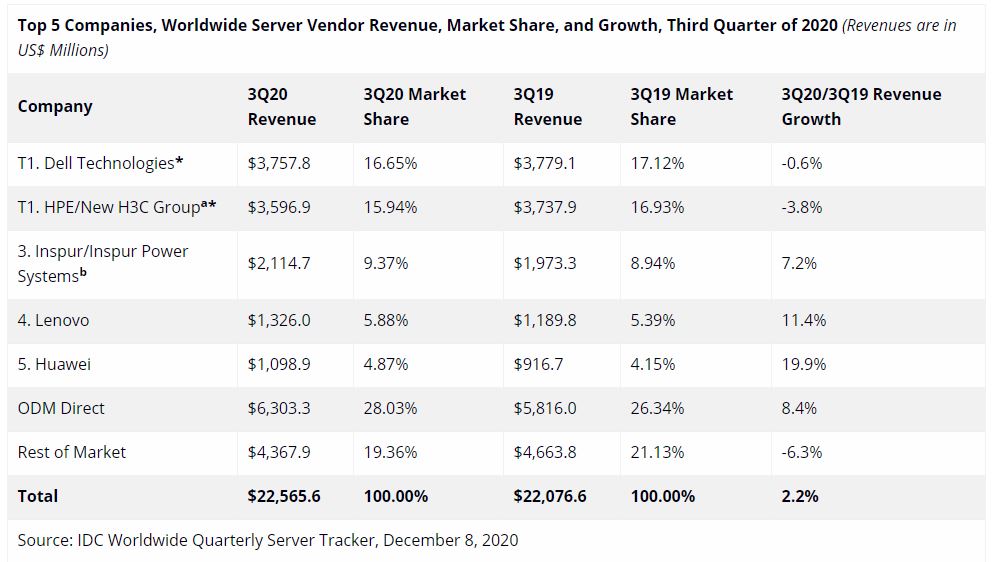

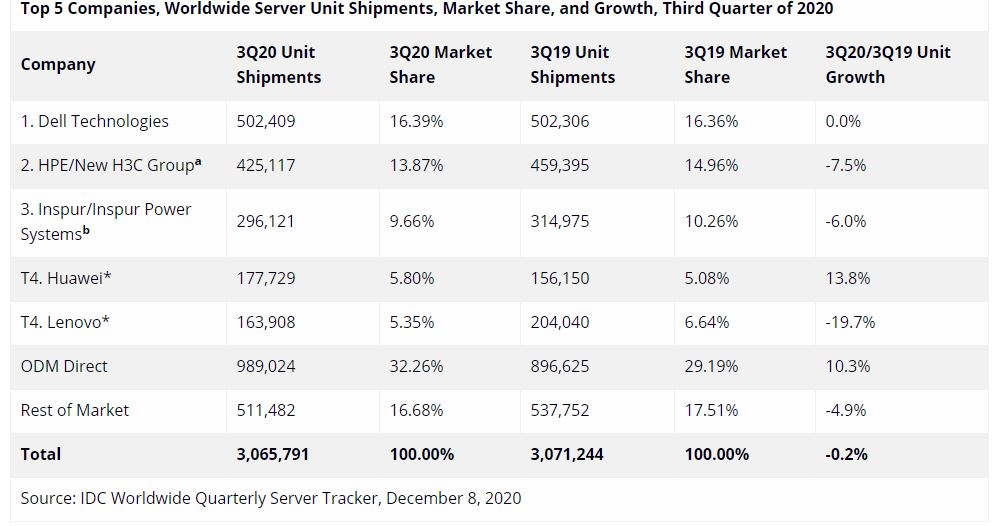

The Internation Data Corporation's (IDC) worldwide quarterly server tracker report covers revenue trends for the large server vendors that sell both OEM and ODM solutions. The third-quarter results show that the segment grew by 2.2% year-over-year to $22.6 billion. However, the number of units declined slightly to 3.1 million.

The most interesting tidbits from the report come from the firm's calculations for Intel's competitors. Despite Intel's commanding lead in the server market, currently pegged at 93.4% of single- and dual-socket servers by Mercury Research, AMD's server chips continue to experience an accelerating adoption rate on the strength of the company's EPYC Rome processors.

It's fair to expect the company to broaden its adoption rather quickly over the coming year as its impressive Zen 3 architecture comes to data centers in the form of the EPYC Milan processors. With a ~19% uptick in IPC, along with a host of other fine-grained optimizations that improve both performance and efficiency, the EPYC Milan processors have already enjoyed tremendous uptake in the form of HPC and supercomputer wins, and that will expand into the server market soon.

AMD recently told us that it is on track for volume production this quarter, and shipments are headed to select cloud service providers and HPC customers. The public launch, which will mark the arrival of Milan for OEM and ODM systems, is slated for Q1, 2021. The Milan processors will square off with Intel's Ice Lake chips, which debut in a similar time frame.

IDC's report also notes that ARM revenue grew 430.5% year over year, but that those gains come from a 'very small revenue base,' meaning that the chips still comprise a small percentage of the market, making revenue gains appear more impressive on the surface.

While the ARM-based OEM and ODM segment remains small, recent developments of AWS expanding its ARM-based Graviton 2 ecosystem to the edge, along with Nvidia's newfound interest in expanding the ARM ecosystem and accelerating its roadmap due to its pending $40 billion buyout of ARM, not to mention Apple's M1 processors, are broadening the ARM assault.

Stay On the Cutting Edge: Get the Tom's Hardware Newsletter

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

As such, we can expect the ARM server base to increase further over the coming year. Who knows, we could even possibly see Nvidia-branded ARM CPUs in the future, which would surely only help to boost adoption.

Paul Alcorn is the Managing Editor: News and Emerging Tech for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

JayNor "The Milan processors will square off with Intel's Sapphire Rapids chips, which debut in a similar time frame."Reply

What's new in Milan? -

thGe17 Reply

Milan ist a Zen3-based drop-in replacement for Rome. Nothing "fancy" as far as I know. Faster of course because of Zen3 IPC gains, but still up to 64 cores. Major changes and improvements will be implemented with Zen4/Genoa in 2022 (e.g. DDR5, PCIe 5 and more cores in 5 nm).JayNor said:"The Milan processors will square off with Intel's Sapphire Rapids chips, which debut in a similar time frame."

What's new in Milan?

Btw ... the sentence is wrong. I guess the author meant Ice Lake SP, not Sapphire Rapids SP. Ice Lake SP with 8 memory channels, DDR4 and possibly up to 36 cores (?) should arrive in 1Q21. Sapphire Rapids SP will show up in the second half of the year, most likely at the end and volume shippment possibly even starts at the beginning of 2022 (?) ... According to Intel, Sapphire Rapids SP has already entered or will enter sampling phase within a few weeks (it has been promised to take place until the end of 2020), therefore ... no release within the next few months. ;-) -

PaulAlcorn ReplythGe17 said:Milan ist a Zen3-based drop-in replacement for Rome. Nothing "fancy" as far as I know. Faster of course because of Zen3 IPC gains, but still up to 64 cores. Major changes and improvements will be implemented with Zen4/Genoa in 2022 (e.g. DDR5, PCIe 5 and more cores in 5 nm).

Btw ... the sentence is wrong. I guess the author meant Ice Lake SP, not Sapphire Rapids SP. Ice Lake SP with 8 memory channels, DDR4 and possibly up to 36 cores (?) should arrive in 1Q21. Sapphire Rapids SP will show up in the second half of the year, most likely at the end and volume shippment possibly even starts at the beginning of 2022 (?) ... According to Intel, Sapphire Rapids SP has already entered or will enter sampling phase within a few weeks (it has been promised to take place until the end of 2020), therefore ... no release within the next few months. ;-)

Opps, thanks :) fixed.