Arm-Based 128-Core Ampere CPUs Cost a Fraction of x86 Price

Lowest price per core.

Ampere's flagship 128-core Altra Max M128-30 may not be the world's highest-performing processor, yet it packs an unprecedented number of general-purpose 64-bit cores, has a reasonable power consumption and is priced at a fraction of what AMD and Intel charge for their flagship EPYC and Xeon Scalable offerings.

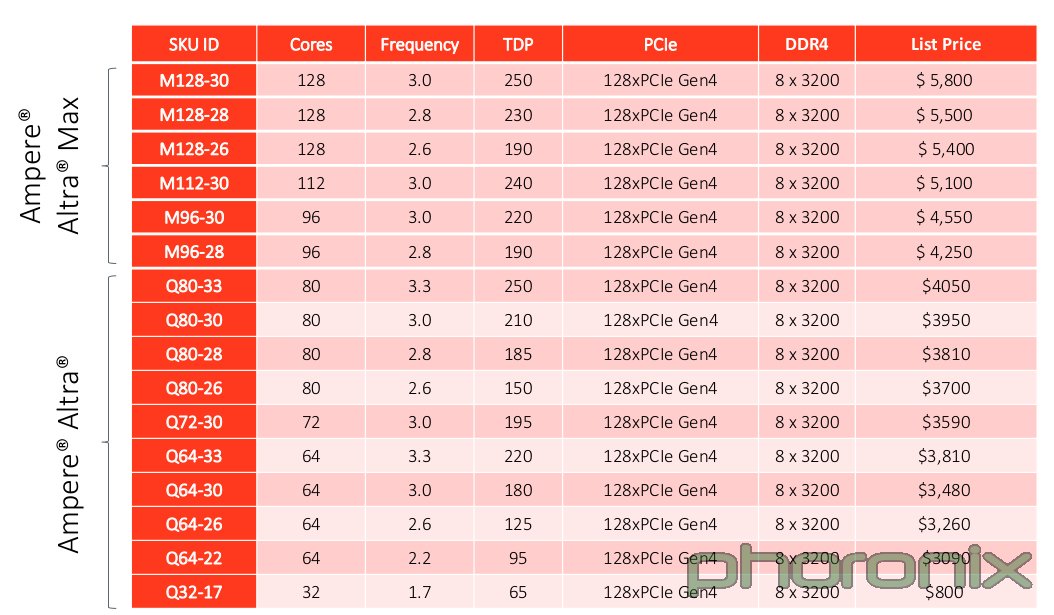

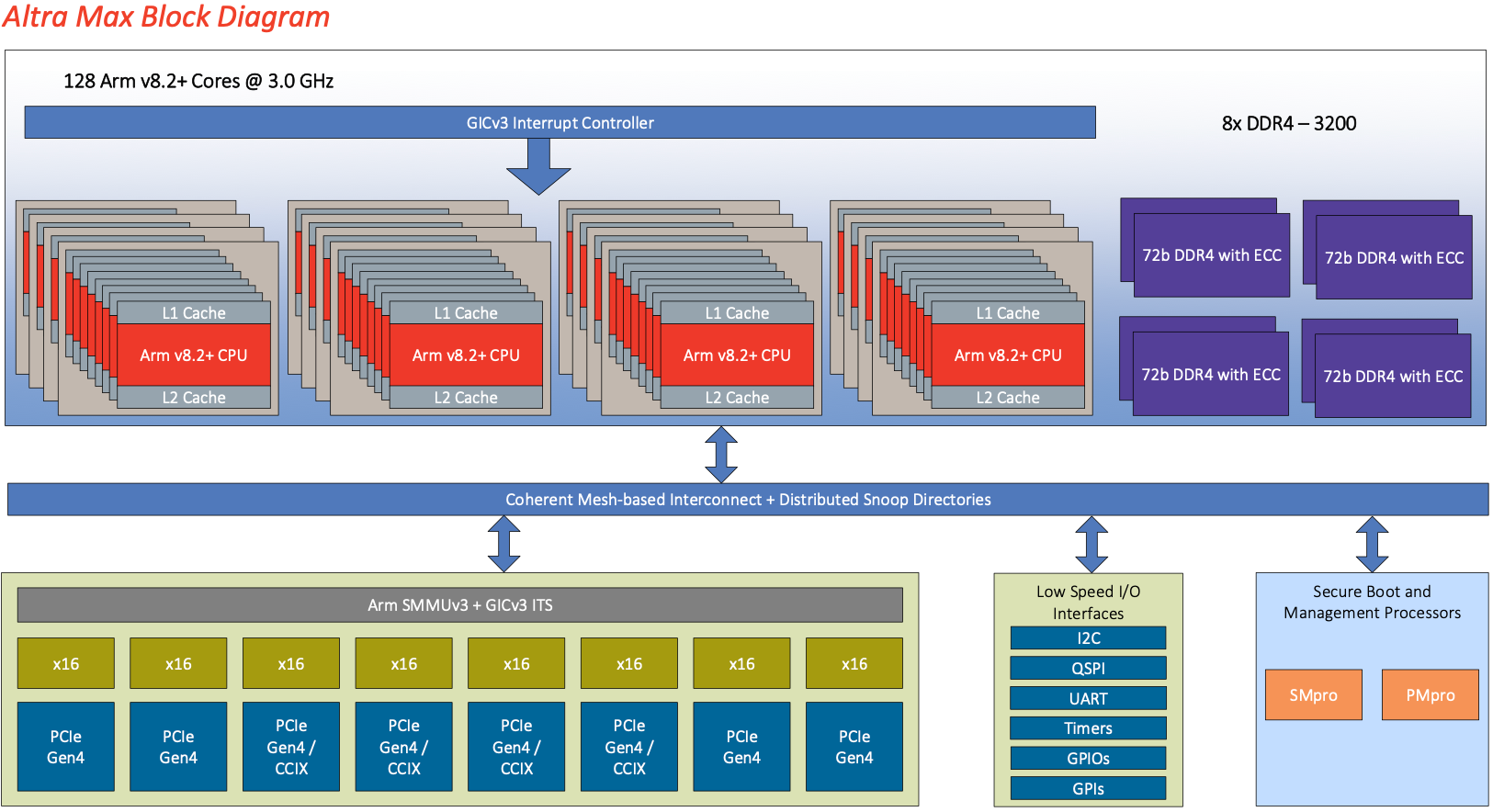

Ampere charges $5,800 for its top-of-the-range Altra Max M128-30 processor that features 128 Arm Neoverse N1 cores operating at up to 3.0 GHz, 128 PCIe Gen4 lances, and eight memory channels, according to Phoronix. By contrast, AMD's top-of-the-line EPYC 7763 CPU with 64 cores that can work at 2.45 GHz – 3.50 GHz is priced at $7,890 whereas Intel's Xeon Platinum 8380 processor with 40 cores functioning at 2.30 GHz – 3.40 GHz costs $8,099.

In fact, even the cheapest 32-core Ampere Altra Q32-17 with 32 cores at 1.70 GHz and 128 PCIe Gen4 lanes is priced at $800, which is below AMD's 16-core EPYC 7302 that costs $978. Meanwhile, Intel has Xeon Silver 'Ice Lake-SP' processors that cost around $500, but these chips only feature eight cores.

Arm's Neoverse N1 cores are not as advanced as AMD's Zen 4 or Intel's Ice Lake-SP cores, but they are small enough to pack 128 cores into a chip that consumes no more than 250 watts and still get viable yields.

Ampere positions its Altra and Altra Max processors with up to 128 core largely for hyperscale providers of cloud services. Those providers can develop software that scales well with the number of cores (and is less dependent on per core performance) and is optimized for AArch64 in general as well as Neoverse N1 in particular. That leaves the company with a fairly limited number of potential customers. Therefore, Ampere has to offer an indisputable advantage over offerings from AMD and Nvidia, which seems to be its price per core.

For high-volume white box servers used by hyperscale cloud giants that that run relatively limited number of applications, such an advantage may be quite tangible. For example, with Ampere's Altra-based servers Oracle can offer an Arm general-purpose core at one cent per hour, which translates to $30.72 for a 128-core processor per day.

Meanwhile, for high-performance machines used in the enterprise a lower CPU price will not matter much since the cost of processors in many types of enterprise servers does not play a huge role as these machines are equipped with plenty of memory as well as a high-performance storage subsystem.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

n addition to Ampere and Oracle, there are other companies that are pushing Arm-based enterprise-grade processors to servers. Fujitsu, which A64FX processors power Fugaku supercomputer (which is soon to be replaced from the No. 1 sport in the Top 500 list by the upcoming AMD EPYC/Instinct-powered Frontier machine) is offering similar chips to various enterprises. Huawei is deploying its Arm-based SoCs primarily in its own data centers.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

waltc3 It doesn't take much imagination to figure out why the EPYCs are selling so much better...there are very likely a lot of reasons why people pay more. You guys should understand that the number of cores is but one consideration when companies buy these high core-count CPUs. There are many other considerations, as well, that explain it. Check into it...;)Reply -

mikewinddale Wooh, Alchian-Allen effect!!!!Reply

"Meanwhile, for high-performance machines used in the enterprise a lower CPU price will not matter much since the cost of processors in many types of enterprise servers does not play a huge role as these machines are equipped with plenty of memory as well as a high-performance storage subsystem."

This is an example of a phenomenon described by Armen Alchian and William R Allen, and since called the "third law of demand." To quote Wikipedia:

"It states that when the prices of two substitute goods, such as high and low grades of the same product, are both increased by a fixed per-unit amount such as a transportation cost or a lump-sum tax, consumption will shift toward the higher-grade product. This is because the added per-unit amount decreases the relative price of the higher-grade product."

For example, suppose mediocre apples cost $1 while excellent apples cost $3. If there's a $10 shipping charge, then their prices rise to $11 and $13. The mediocre apples are still cheaper, but the excellent apples are now barely more expensive, being only 13/11 times more expensive rather than 3/1 times. So if apples must be shipped for $10, then consumption will relatively shift in favor of $3 excellent apples against $1 mediocre apples. Thus, the law is sometimes called the "good apples ship out law," because it implies that whenever a good is exported with a relatively high transportation charge, only the highest quality will be worth shipping. The mediocre goods will stay in the vicinity of where they were produced.

In this case, the memory and storage are a high fixed cost, similar to a transportation charge. -

TerryLaze Reply

EPYCs are selling so much better, than what?!waltc3 said:It doesn't take much imagination to figure out why the EPYCs are selling so much better...there are very likely a lot of reasons why people pay more. You guys should understand that the number of cores is but one consideration when companies buy these high core-count CPUs. There are many other considerations, as well, that explain it. Check into it...;)

You gotta give some context here.

According to AMD they sold 1.6 bil worth of Enterprise, Embedded and Semi-Custom segment, so including ps5 and xbox.While they sold 2.25 bil of "normal" CPUs/GPUs.

So EPYCs don't even sell as well as AMD CPUs, you gotta add some context on what you meant.

https://ir.amd.com/news-events/press-releases/detail/1014/amd-reports-second-quarter-2021-financial-results -

OriginFree Replymikewinddale said:Wooh, Alchian-Allen effect!!!!

"Meanwhile, for high-performance machines used in the enterprise a lower CPU price will not matter much since the cost of processors in many types of enterprise servers does not play a huge role as these machines are equipped with plenty of memory as well as a high-performance storage subsystem."

This is an example of a phenomenon described by Armen Alchian and William R Allen, and since called the "third law of demand." To quote Wikipedia:

"It states that when the prices of two substitute goods, such as high and low grades of the same product, are both increased by a fixed per-unit amount such as a transportation cost or a lump-sum tax, consumption will shift toward the higher-grade product. This is because the added per-unit amount decreases the relative price of the higher-grade product."

For example, suppose mediocre apples cost $1 while excellent apples cost $3. If there's a $10 shipping charge, then their prices rise to $11 and $13. The mediocre apples are still cheaper, but the excellent apples are now barely more expensive, being only 13/11 times more expensive rather than 3/1 times. So if apples must be shipped for $10, then consumption will relatively shift in favor of $3 excellent apples against $1 mediocre apples. Thus, the law is sometimes called the "good apples ship out law," because it implies that whenever a good is exported with a relatively high transportation charge, only the highest quality will be worth shipping. The mediocre goods will stay in the vicinity of where they were produced.

In this case, the memory and storage are a high fixed cost, similar to a transportation charge.

We covered a similar concept (both microeconomics) back in the late ... OMG I'm getting old ... 1980s with marginal utility theory. Different perspective but same end result. The additional benefit between the two items are always the same but the cost for that benefit drops as additional costs are factored in until the "higher-grade product" is effectively cheaper on a per unit of benefit basis. Or something like that, it has been 30+ years. -

Rob1C Sadly for us x86 fans ARM is doing well with this chip: https://www.phoronix.com/scan.php?page=article&item=ampere-altramax-benchmarks&num=4Reply

But I'm awaiting 2022-2023 Epyc, with the dozen groundbreaking hardware changes coming. I also prefer the software legacy for x86.

If only IBM Power could be so low priced, that's the ship I'd jump for.

I'll stick to keeping ARM in my phone, which I'm quite happy with; and x86 I'd not prefer.

If only there were a motherboard that accepted one z16 mainframe processor, I'd switch for the coolness factor; if only there were shareware software, instead of ARM and Kidney priced application suites.