PC CPU Shipments See Steepest Decline in 30 Years

These may even be the worst declines in x86 CPU history.

It is no secret that the PC business and tech industry at large is going through a bit of a rough patch. However, a new report penned by Dean McCarron of Mercury Research paints an incredibly bleak picture of the state of things. Probably the biggest bombshell is that figures show the x86 processor market has just endured “the largest on-quarter and on-year declines in our 30-year history.” Based on previously published third-party data, McCarron is also reasonably sure that the 2022 Q4 and full-year numbers represent the worst downturn in PC processor history.

The x86 processor downturn observed has been precipitated by the terrible twosome of lower demand and an inventory correction. This menacing pincer movement has resulted in 2022 unit shipments of 374 million processors (excluding ARM), a figure 21% lower than in 2021. Revenues were $65 billion, down 19 percent YoY. McCarron shines a glimmer of light in the wake of this gloom, reminding us that overall processor revenue was still higher in 2022 than any year before the 2020s began.

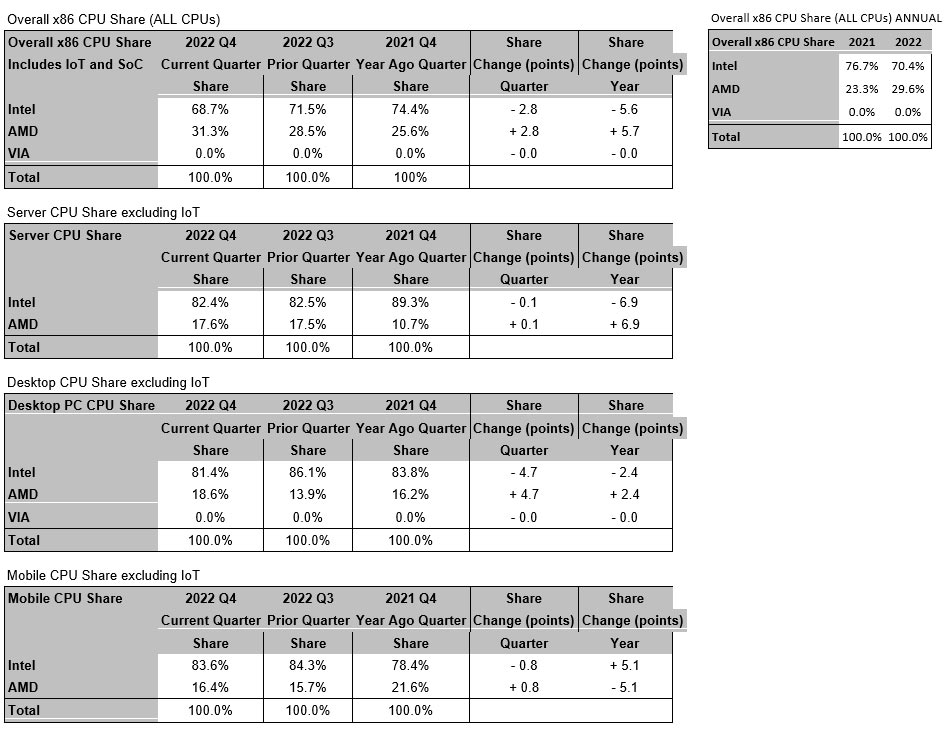

Another ray of light shone on AMD, with its gains in server CPU share, one of the only segments which saw some growth in Q4 2022. Also, AMD gained market share in the shrinking desktop and laptop markets. For more AMD-specific financials and sales performance data, please refer to our coverage of its Q4 and FY 2022 results. Also, Mercury shared some charts for those interested in poring over x86 CPU market shares overall and per segment. A key observation here is AMD’s overall market share growth spurt from around 23% of the x86 market in 2021 to nearly 30% in 2022.

Inventory Adjustments May Be Having a Bigger Negative Impact Than Reduced Sales

McCarron was keen to emphasize that Mercury's gloomy stats about x86 shipments through 2022 do not necessarily directly correlate with x86 PC (processors) shipments to end users. Earlier, we mentioned that the two downward driving forces were inventory adjustments and a slowing of sales – but which played the most significant part in this x86 record slump?

The Mercury Research analyst explained, "Most of the downturn in shipments is blamed on excess inventory shipping in prior quarters impacting current sales." A perfect storm is thus brewing as "CPU suppliers are also deliberately limiting shipments to help increase the rate of inventory consumption… [and] PC demand for processors is lower, and weakening macroeconomic concerns are driving PC OEMs to reduce their inventory as well."

Mercury also asserted that the trend is likely to continue through H1 2023. Its thoughts about the underlying inventory shenanigans should also be evidenced by upcoming financials from the major players in the next few months.

We have seen several big tech firms and analysts seemingly indicate that H2 2023 is going to be a turning point, an inflection point where downtrends will be broken. Again this seems to be the case with Mercury's report, and of course, we hope that there will be enough highly inspiring CPU, GPU and related technology improvements coming through in H2 2023 to ignite the PC market yet again (in addition to world peace).

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

hannibal Well last few years were the biggest so calm down is only natural. In five year we will get to normal.Reply -

TechieTwo No surprise here with everyone buying hardware during two years+ of COVID lockdowns and now a world wide economic recession and a war in Ukraine.Reply -

10tacle ReplyTechieTwo said:No surprise here with everyone buying hardware during two years+ of COVID lockdowns

^^This. You beat me to it. However, I'm not so sure how much (if any) the Ukraine war is affecting CPU sales, but I'm sure we can get YoY sales figures from Intel and AMD from that nation prior to the Russian invasion. I can't imagine they did a lot of regular PC hardware upgrades as builder enthusiasts or OEM PC/laptop buyers.

And along that note, I'd like specifically to see a breakdown of OEM desktop chip sales to the likes of HP, Dell, etc. and then to retailers who just sell the CPUs for the builder community. The PC builder community was in a tight bind due to zero availability of the latest GPUs starting near the end of 2020. That started with crypto demand then the CPU shortage hit from fab closures. I had to wait well into 2021 before I could even get a chance to buy my RTX 3080 Ti in a shuffle lottery win purchase option from NewEgg.

We know what went on with laptops as there was most definitely a spike around the world for their demand, at least in North America and the UK/EU nations, of families (and municipalities that could afford it) buying laptops for their children for remote schooling. Same with companies splurging on new laptops for the push to full time remote working (I was one of those beneficiaries three years ago next month who now works remote full time as our office complex permanently closed). -

PiranhaTech Not surprised, and hopefully it'll make Nvidia, Intel, and AMD cool down their damned prices. During Covid, everyone seemed to want a PC. Remote workers, cryptominers, gamers that did both console and PC that saw it as a good time to upgrade the PC, people with time that wanted to get into streaming, remote/home schooling, etc.Reply

Even the crappiest laptop PC lasts 2-3 years, and I have gotten 8 years out of a good CPU/motherboard/RAM combo (I usually upgrade the GPU more frequently). -

pointa2b Quoting the article...Reply

Probably the biggest bombshell is that figures show the x86 processor market has just endured “the largest on-quarter and on-year declines in our 30-year history.”

I think what really matters is how these current figures compare to 2019, before these unique events over the last few years disrupted the usual. As stated countless times before, the climate of the world caused an explosive increase in hardware, and obviously that upward spike wouldn't last forever. Its probably the same reason why so many large tech companies experienced unprecedented growth during the pandemic, and are beginning to crash/come back down to baseline as of recent. -

hotaru251 imagine a global pandemic, forcing remote work, forcing/encouraging people to upgrade PC's.Reply

Yes, pandemic was best tiem for pc market (As a seller) but that comes at cost of short term (in yrs term) lower sales.

also fact that cpu upgrades have very little difference to most ppl anymore (so don't feel need to upgrade frequently)

CPU, unlike GPU, have little generational performance thats easily noticeable. -

LOUTZ! Reply

??10tacle said:^^This. You beat me to it. However, I'm not so sure how much (if any) the Ukraine war is affecting CPU sales, but I'm sure we can get YoY sales figures from Intel and AMD from that nation prior to the Russian invasion. I can't imagine they did a lot of regular PC hardware upgrades as builder enthusiasts or OEM PC/laptop buyers.

And along that note, I'd like specifically to see a breakdown of OEM desktop chip sales to the likes of HP, Dell, etc. and then to retailers who just sell the CPUs for the builder community. The PC builder community was in a tight bind due to zero availability of the latest GPUs starting near the end of 2020. That started with crypto demand then the CPU shortage hit from fab closures. I had to wait well into 2021 before I could even get a chance to buy my RTX 3080 Ti in a shuffle lottery win purchase option from NewEgg.

We know what went on with laptops as there was most definitely a spike around the world for their demand, at least in North America and the UK/EU nations, of families (and municipalities that could afford it) buying laptops for their children for remote schooling. Same with companies splurging on new laptops for the push to full time remote working (I was one of those beneficiaries three years ago next month who now works remote full time as our office complex permanently closed).

Zzzzzz -

SSGBryan Not surprising.Reply

I built my current PC in 2019 - in 2022, rather than replacing an entire system I just upgraded, I replaced my Ryzen 2700 with a Ryzen 5700 and replaced the RX 570 (8Gb) with an RTX 3060 (12Gb). I am looking at replacing the 3060 with an A770 (Blender & AV1 encoding - gaming is not a major issue for me)

I'll get a new system in 2 years, which will be a Ryzen 8000 series CPU and probably a Battlemage GPU (assuming Intel doesn't whack their GPU division). -

bigdragon Pandemic, surge of work-at-home options, and stimulus money certainly affected the market. Threats of rising inflation also pushed a huge drive to buy things before they got more expensive. Part of the reason I upgraded my PC last year was to beat the higher prices that are strangling products now.Reply

Those higher prices are here, stimulus is gone, and work-at-home is being taken away. I don't think computer shipments will improve later this year given the prices and specs I've been seeing. 10-30% price increases don't make me want to upgrade anymore. x86 is being challenged strongly by Apple's chips too. Apple's OSes and Valve's Steam OS are likely starting to take a chunk out of Windows x86 too. Lots of headwinds for the PC industry in 2023.

I'd like to replace my old Yoga 720, but I'm having trouble finding a 2-in-1 that has decent performance and isn't overpriced. I feel like system vendors have become disconnected from their customers. -

InvalidError In just about anything ever, an exceptional boom is usually followed by an equally exceptional crash that wipes out most of the excess and returns the average closer to the long-term trend. PC sales had been steadily declining for the last 10+ years prior to COVID and the "record sales decline" from the last year are offsetting excess sales from the two years of out-of-cycle COVID upgrades. This shouldn't be surprising anyone.Reply

Price gouging from the last three years doesn't help with maintaining sales either. Companies that got too comfortable with 50+% gross profit margins may have to learn to make-do with more reasonable 30-40% margins again.