Raja Koduri To Present at Samsung Event as Intel Mulls Chip Outsourcing

Who gets the chip contracts?

Intel's Raja Koduri is slated to present a "1000X More Compute for AI by 2025" presentation at Samsung's Advanced Foundry Ecosystem (SAFE) Forum next week, which comes as Intel mulls its strategy for outsourcing some of its production to third-party fabs. The presentation comes after Raja Koduri tweeted an image of a visit to Samsung's Giheung plant in Korea last year, sparking rumors that Intel would use Samsung to produce components for its Xe graphics solutions. Those rumors seemed spurious in the past, but Intel's recent announcement that it will outsource some chip production, and this week's revelation that the company still hasn't decided just what or where it will outsource, makes Koduri's latest interaction with Samsung's foundry all the more interesting.

Intel is certainly at a crossroads. After a decade of dominance fueled by the company's own process tech, the company announced that problems with its 7nm node had forced it to consider outsourcing some components built on leading-edge process tech to third-party foundries, a first for the company. But the company still hasn't developed an outsourcing strategy, as evidenced by Intel CEO Bob Swan's comments in the company's Q3 2020 earnings call. Hence, it's possible we could see the company use either TSMC or Samsung foundries to produce its next-gen flagship chips, or even both.

Swan said that even though Intel will now engage third-party foundries as strategic partners, it will continue to develop its own leading-edge nodes and has deployed a "fix" for its own 7nm node (though that fix has led to an untenable delay). For now, Intel's problem is deciding just where it will build its chips that will come to market in 2023.

Swan said that Intel hasn't decided which chips it will use external foundries for, but did note that "we feel confident in the ability of us being able to port to TSMC," marking the first time the company has mentioned a specific third-party foundry in the context of using it for leading-edge production. That makes it clear that Intel is already working with TSMC, at least in some form.

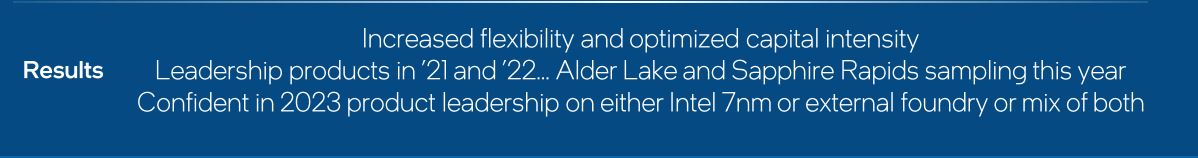

But there are still plenty of questions to be answered, and that uncertainty is crystal clear in the snippet above from Intel's Q3 earnings deck. Intel says that it is "confident in 2023 product leadership on either Intel 7nm or an external foundry or mix of both."

Intel will likely leverage its packaging tech to reduce the number of externally-sourced components required to build a full chip. Swan says that Intel will decide if it will turn to outside foundries as a stop-gap or invest in its own 7nm equipment, and also where and what to outsource, by "really early next year."

Even though Intel's chips built with externally-sourced components won't come to market until 2023, long lead times require Intel to make a decision soon so it can allow its future partners to build enough production capacity.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

But therein lies the problem - any third-party foundry that accepts a contract will likely have to build out significant capacity just for Intel. TSMC is already capacity-constrained and tends to command a premium for leading-edge wafers. Swan also noted that Intel is confident that it can "port back in" from TSMC to Intel's own process tech, meaning the company could move back to its own foundries once it has fixed its own 7nm node. (We imagine those architectures would still require significant re-tuning that wouldn't necessarily classify as a traditional 'port.')

The idea of Intel moving back to its own 7nm probably doesn't seem like an attractive possibility to TSMC, which already has plenty of demand for its 7nm tech. It likely isn't interested in short-term or sporadic business – especially given the large upfront investments required. That means Intel will likely have to commit to procuring a significant amount of capacity from TSMC to secure a contract, much like AMD did with its wafer supply agreement (WSA) with GlobalFoundries.

Meanwhile, Samsung's wafers are relatively less expensive. The company also currently doesn't have as much demand as TSMC, meaning it could have more available production capacity – or at least be willing to dedicate more capacity to Intel's orders.

That leaves plenty of room for Intel to secure at least some of its future chips from Samsung. It certainly doesn't have to be a TSMC "or" Samsung decision: Targeted designs can defray some of the disadvantages of using Samsung's nodes, which are generally less performant than TSMCs, and not all chips have to be on the highest-performing node.

Intel could also seek a licensing deal that allows it to build chips based on an external foundries' process, but in its own facilities. GlobalFoundries employed a similar strategy when it licensed Samsung's 14nm process technology back in 2014, and it's possible the company would be open to a similar deal in the future. Conversely, Intel could also approach TSMC with a similar request, so anything remains possible.

The one thing we do know for sure is that Intel will announce its decision early next year, and it certainly has several options at its disposal. In fact, that's the beauty of embracing the third-party foundry approach: The ability to source different nodes from different vendors based on each product's specific needs affords plenty of flexibility. If Intel fully embraces the third-party model, we could likely see the company source from both TSMC and GlobalFoundries.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

Kamen Rider Blade I don't think Intel would want to empower it's #1 Foundry opponent, TSMC.Reply

Samsung would be a safe bet, it's at least far ahead enough that it can produce something of value, and they have cheap waffer prices and capacity. -

JayNor from the CC:Reply

"Now we've deployed the fix and made wonderful progress."

Note that Xe-HPG is being built in an external fab, and Intel announced it is back in the lab already.

Intel also builds their eyeq5 ADAS chip in tsmc 7nm since 2018. -

zodiacfml Don't like Intel since Pentium 4 but these executives are killing Intel by saving a lot of money on R&D or expenses since 14nm. If they don't change leadership, Intel will continue to lose market share since Intel will be on the same process node and manufacturing expenses as AMD.Reply -

vinay2070 Reply

But look how its going for nvidia, even with its good design and architecture.Kamen Rider Blade said:I don't think Intel would want to empower it's #1 Foundry opponent, TSMC.

Samsung would be a safe bet, it's at least far ahead enough that it can produce something of value, and they have cheap waffer prices and capacity. -

TerryLaze Reply

"These executives" made intel double their net income the last two years with the current and third year shaping up to be the same.zodiacfml said:Don't like Intel since Pentium 4 but these executives are killing Intel by saving a lot of money on R&D or expenses since 14nm. If they don't change leadership, Intel will continue to lose market share since Intel will be on the same process node and manufacturing expenses as AMD.

Intel is losing market share from the 100% market share they had,so yes they are losing market share but they also never should have had so much of the market share in the first place and only had it because AMD had no product of any importance at all available.

Intel is making tons of money because 14nm is much cheaper to make than buying 7nm from TSMC as AMD is forced to do, AMD has barely made any money from zen because they are forced to give all their margin to the fabs making the chips for them. -

JamesSneed ReplyTerryLaze said:"These executives" made intel double their net income the last two years with the current and third year shaping up to be the same.

Intel is losing market share from the 100% market share they had,so yes they are losing market share but they also never should have had so much of the market share in the first place and only had it because AMD had no product of any importance at all available.

Intel is making tons of money because 14nm is much cheaper to make than buying 7nm from TSMC as AMD is forced to do, AMD has barely made any money from zen because they are forced to give all their margin to the fabs making the chips for them.

You are right about Intel's earnings but I think what we will see is the Intel executives focused on the business side not the R&D tech side which has resulted in more short term revenue. At least its looking like that right now. So yes they have done well marketing Intel products but there competitor has pushed as hard as they can to innovate and as of now has just passed Intel on performance in every metric. Unless Intel can pull a rabbit out of there hat they are going to have one hell of a 2021.

AMD is making OK margins(I think there 4th quarter will show that) and those will increase over 2021 as they charge more with a superior product to Intel. Intel's 14nm is cheaper but it Intel is now the performance looser so they will have to sell those products at a lower price than AMD. Long term Intel's strategy is going to to hurt. The only real hope is they escalate there 7nm EUV development as 10nm is not going to cut it. By the time 10nm is in full production AMD will be on or very close to 5nm EUV from TSMC which should be a vastly superior process compared to TRSMC's current 7nm. -

TerryLaze Reply

Making the same amount of money and even double that from the same arch for 5 years is short term while burning through a new node/arch each year to make any money is long term?JamesSneed said:You are right about Intel's earnings but I think what we will see is the Intel executives focused on the business side not the R&D tech side which has resulted in more short term revenue. At least its looking like that right now.

Also intel has already researched several future architectures several nodes a new iGPU/GPU whole system on a PCI CPU on a nvme hard drives on memory slots and those are just the better known things they already have out.

As of now no they didn't, in two weeks when zen 3 comes out we will see if it passes intel or just equals them.JamesSneed said:and as of now has just passed Intel on performance in every metric. Unless Intel can pull a rabbit out of there hat they are going to have one hell of a 2021.

Even if ZEN 3 is better intel will release rocket lake in a few months and it will be back to the current balance. -

JamesSneed ReplyTerryLaze said:Making the same amount of money and even double that from the same arch for 5 years is short term while burning through a new node/arch each year to make any money is long term?

Also intel has already researched several future architectures several nodes a new iGPU/GPU whole system on a PCI CPU on a nvme hard drives on memory slots and those are just the better known things they already have out.

As of now no they didn't, in two weeks when zen 3 comes out we will see if it passes intel or just equals them.

Even if ZEN 3 is better intel will release rocket lake in a few months and it will be back to the current balance.

Yes that same arch over 5 years is very short sided. Sure they milked it for every penny and increased share holder value but they lost sight of making the best possible product they can. I know they were thinking they didn't want to compete with themselves but stagnating to increase revenue never works out for very long in any industry but doubly so in high tech.

No Rocket Lake is not going to compete with AMD's Zen3 especially in the server and HPC markets. Intel simply can not get to the higher core counts on a monolithic design, the power usage is going to be much higher which matters a ton for servers/hpc/supercomputers, and don't have a CPU design that is as high bandwidth. Rocket Lake may compete on the desktop but even there AMD will have 12-16 core parts that Intel cant touch.

I get where you are coming from but mark my words Intel is going to have a terrible 2021 as market share slowly dwindles. I do think Intel's 7nm EUV is going to be great and along with that EMIB/Foveros chiplet designs will be more elegant than AMD but we are looking later 2022 until then AMD is in full domination. -

Kamen Rider Blade Reply

Those are temporary issues that will get dealt with time & experience in mass production.vinay2070 said:But look how its going for nvidia, even with its good design and architecture.

You got to remember, those sweet Per Waffer savings is what will attract "Bean counters" to Samsung, and we know Intel is run by a "Bean Counter" currently. -

TerryLaze Reply

Sure if they don't have anything new it's very bad but why do you think that they don't have anything new?JamesSneed said:Yes that same arch over 5 years is very short sided. Sure they milked it for every penny and increased share holder value but they lost sight of making the best possible product they can. I know they were thinking they didn't want to compete with themselves but stagnating to increase revenue never works out for very long in any industry but doubly so in high tech.

The best possible product is the one that makes them the most possible money and until now at least 14nm was making them exactly that.

They didn't need anything better

as a FAB they don't need to attract new customers,

because as a chip maker they already sell all they can

for prestige?! They are already seen as the top player in the industry.

Because you say so?!Why do you think RL won't compete? Intel claims the same 20% IPC increase that AMD claims and intel has the brand name and the volume, let alone the 5Ghz + all core clocks.JamesSneed said:No Rocket Lake is not going to compete with AMD's Zen3 especially in the server and HPC markets. Intel simply can not get to the higher core counts on a monolithic design, the power usage is going to be much higher which matters a ton for servers/hpc/supercomputers, and don't have a CPU design that is as high bandwidth. Rocket Lake may compete on the desktop but even there AMD will have 12-16 core parts that Intel cant touch.

Servers and the like need specialized hardware which is why everybody makes AI chips and bakes them into GPUs, rumors say that AMD is trying to buy into AI for 30 billion that they don't have and which will ruin them if they go through with it.Anything that they would need x86 for they can also easily run on arm which is even more power conscience than zen.

Desktop users don't need that many cores and won't need them for a lot of years to come, there are a decent number of desktop users that buy many cored CPUs but you can't build your success on that, the most sold CPUs are still dual cores for all the office PCs in the world.

Intel can lose half their income in '21 and they will end up where they were before ZEN, you can call that terrible if you want to but intel will still be making around 10 billion more than what amd will be making.JamesSneed said:I get where you are coming from but mark my words Intel is going to have a terrible 2021 as market share slowly dwindles. I do think Intel's 7nm EUV is going to be great and along with that EMIB/Foveros chiplet designs will be more elegant than AMD but we are looking later 2022 until then AMD is in full domination.

Intel makes 20 bil a year the last two years ,this year they made around 15bil until now and they have another quarter to go.

AMD net income for the twelve months ending June 30, 2020 was $609M, a 218.85% increase year-over-year.

Intel net income for the twelve months ending September 30, 2020 was $21.947B, a 13.49% increase year-over-year.

https://www.macrotrends.net/stocks/charts/AMD/amd/net-income