U.S.-China Trade War Could Make All Memory Fabs in China Inefficient

No EUV for China.

The ongoing U.S.-China trade war is multifaceted in nature, so it affects or will affect dozens of industries and tens of thousands of companies. Apparently, the confrontation between the two powers could make all computer memory fabs in China inefficient compared with facilities outside of the country as the U.S. does not want leading-edge equipment to be installed anywhere in China. According to Reuters, this has already affected SK Hynix's plans for its fab in Wuxi.

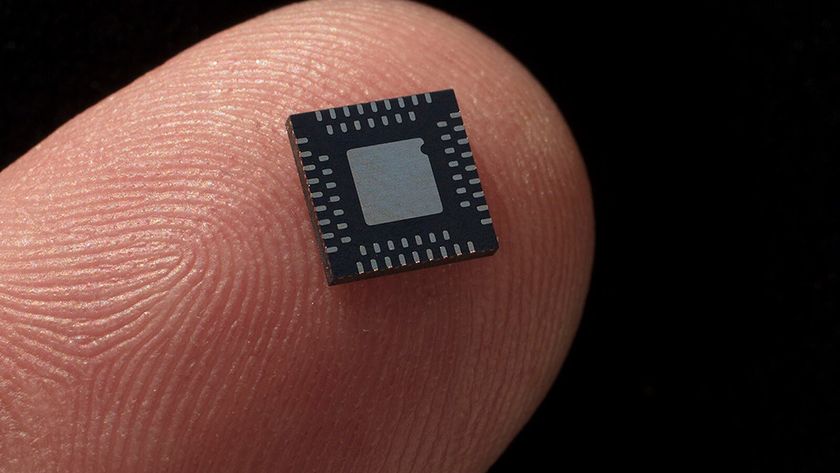

SK Hynix's C2 semiconductor fabrication plant in Wuxi, China, produces a substantial portion of the company's DRAM output and some NAND memory. Over the past few years SK Hynix expanded cleanroom space at the fab at least once, but in a bid to introduce next-generation DRAM process technologies to the facility, it needs to equip it with extreme ultraviolet (EUV) lithography tools and other leading-edge machinery. But it looks like the company is going to face some problems with this, reports Reuters.

One of the things that the U.S. government is particularly worried about is China's access to leading-edge semiconductor production technologies, such as extreme ultraviolet lithography tools. The U.S. government cannot directly prohibit ASML, a Dutch company, to sell its EUV tools to companies in China, but the Trump government reportedly managed to persuade the Dutch authorities to block exports of ASML's Twinscan NXE tools to Semiconductor Manufacturing International Co. (SMIC) citing the Wassenaar Arrangement several years ago. Apparently, the same can now be done with EUV tools for SK Hynix's C2 fab.

"They are really caught between a Chinese rock and a U.S. hard spot," said Dan Hutcheson, chief executive officer of VLSIresearch, in a conversation with the news agency. "Anyone who puts an EUV tool in China gives China the capacity. Once it's there, you have no idea where it will go after that. The Chinese could always seize it or do whatever they wanted to do."

Next-generation DRAM production technologies from SK Hynix and Samsung Electronics make use of EUV lithography and without them the fab in Wuxi will not be able to adopt the new nodes and produce advanced DRAM products (such as high-capacity DDR5 or LPDDR5/LPDDR5X devices). As a consequence, sooner or later it will become considerably less economically efficient than DRAM manufacturing facilities in South Korea and Taiwan, where EUV tools are or will be used. This concerns not only SK Hynix, but also Samsung, which also has DRAM capacity in China. Ultimately, China-based DRAM makers will also not be able to upgrade their fab with EUV tools, which will make them less competitive than their foreign rivals.

As a mid-term solution, SK Hynix may repurpose its C2 fab for 3D NAND production as at present its flash memory does not require EUV lithography. But in the long-term future 3D NAND will move to EUV tools too, so the fab will have to be re-purposed once again. For example, for production of CMOS image sensors or other chips using mature process technologies.

SK Hynix did not comment on the story. ASML said it abides by all export control laws, but it warned that extensive use of export controls could worsen semiconductor supply chain issues and global chip supply.

Stay On the Cutting Edge: Get the Tom's Hardware Newsletter

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.