Global SSD shipments fell by more than 10% last year, according to TrendForce market research data

And the current year isn’t expected to be stellar.

IT industry market research outfit TrendForce has published its latest report on worldwide SSD shipments. The source headlines with the interesting observation that global SSD shipments were down 10.7% YoY in 2022. It also looks at the brands jostling to sell the most units in the global rankings and some of the reasons behind the shipment volume fall.

The report claims that the various supply and demand issues that had plagued the SSD industry were largely resolved in 2022. In particular, TrendForce says that the problem with constrained SSD controller supplies was resolved last year. We must assume that supplies of the other major component, NAND flash, were also flowing without issue.

Despite the seemingly free-flowing supplies of key SSD components, TrednForce is basing this percentage on its figure of 114 million SSDs being shipped during 2022. Of course, we don’t have full-year 2023 figures yet.

So, what happened to cause the significant decline in SSD shipments last year? TrendForce doesn’t address that question directly but does mention that the global economy is still struggling in 2023. Indeed, 2022 saw the pandemic-inspired IT sales bubble burst (with a resulting drop in PC sales), and recessionary forces like inflation and layoffs were frequently in the news. The Russia-Ukraine war has also had impacts far beyond the region.

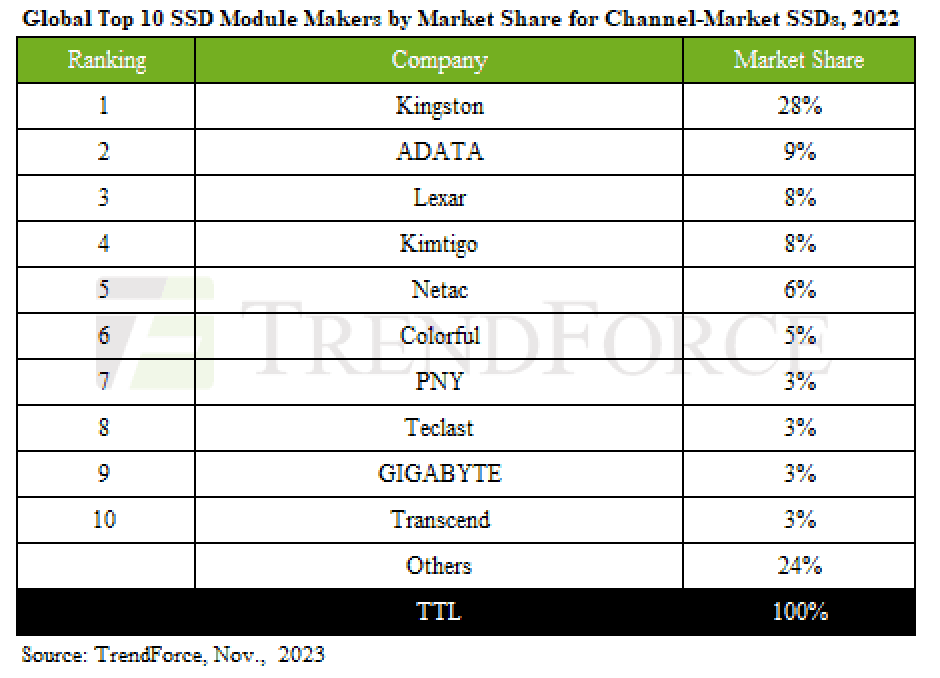

A larger part of TrendForce’s analysis was of the competition between the top SSD makers, as evidenced by shifting market shares. It was noted that the top five SSD brands increased their combined market share from 53% to 59% from 2021 to 22. Meanwhile, Kingston is clearly dominant, closing on controlling nearly a third of the market on its own. TrendForce says Kingston has been putting roots down in the industrial control and OEM markets to both expand and strengthen its grip. Another interesting observation is that while worldwide shipments were down, Kingston and Adata managed to consolidate their market dominance.

As for 2023, TrendForce paints a picture of the global economy continuing to struggle and the big players continuing to use their muscle to grow. We have previously reported on the aggressive production cuts by NAND suppliers in search of better prices. However, Chinese NAND and controller suppliers might be keen to address any gaps left by more established brands. Trying to create artificial scarcity to push market prices higher seldom pays off in a truly competitive market. TrendForce notes that there is already evidence of China’s Longsys becoming more international, with acquisitions in Brazil, for example.

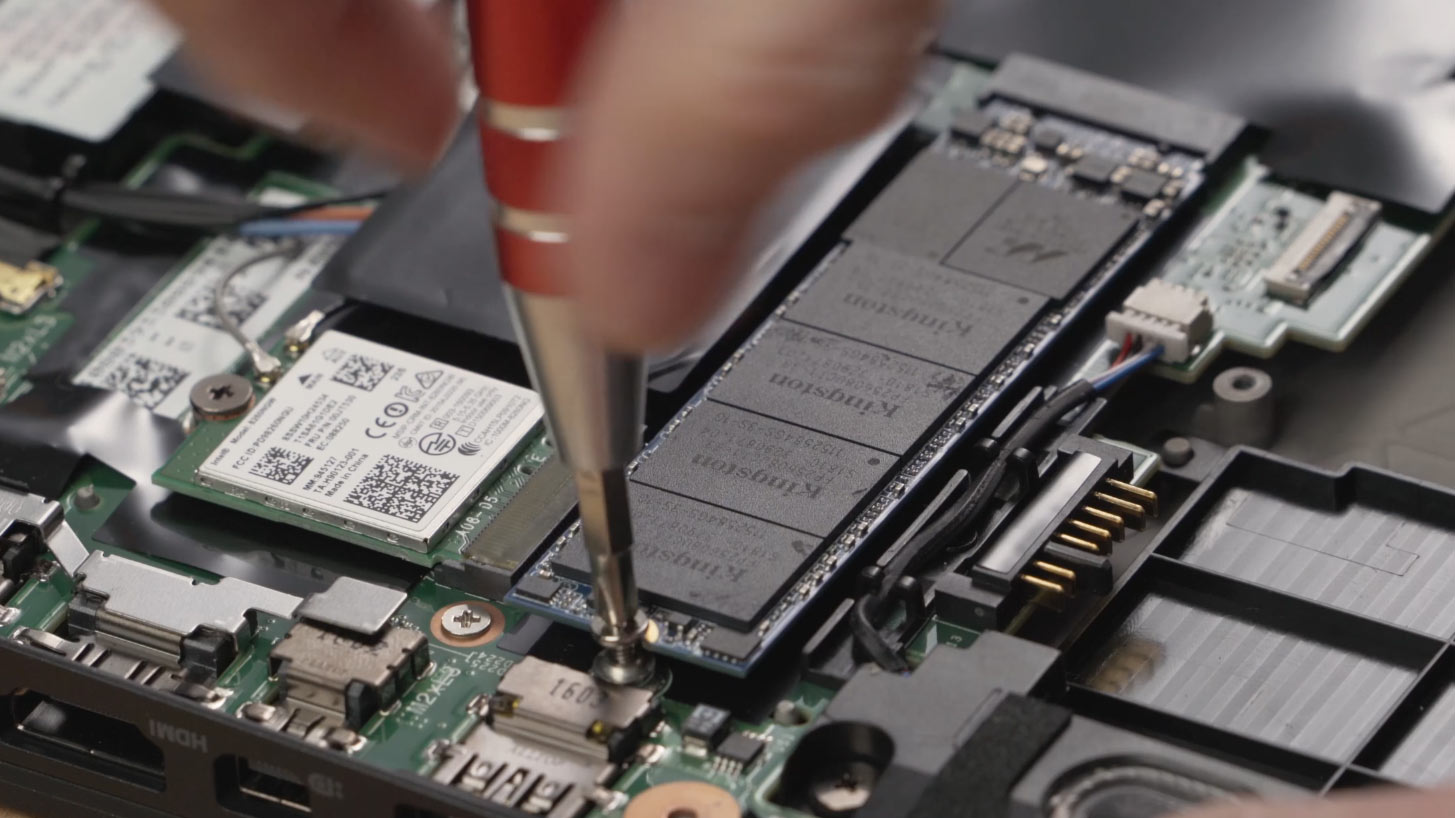

It still seems to be a good time for those wanting to add more SSD storage to their systems. However, there are warning signs that consumer SSD prices are leveling out, or even starting to increase.

Stay On the Cutting Edge: Get the Tom's Hardware Newsletter

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

Order 66 not surprising considering the fact that PC shipments as a whole fell by a lot recently as well.Reply