Intel data center CPU sales hit the lowest point in 13 years

But that was expected.

Sales of Intel’s data center CPUs in 2024 hit their lowest level in more than a decade due to increased competition from AMD, the transition to higher-core count models amid a drop in the number of CPUs, and a market shift to AI servers that use up to eight GPUs and just two CPUs. As analysts from SemiAnalysis observed, unit sales of Intel’s data center CPUs in 2024 dropped by 20% from 2011 levels and over 80% from 2021.

"DCAI revenue increased by $182 million from 2023, primarily driven by an increase in server revenue," Intel's recently published Form 10-K reads. “Server ASPs increased by 12% from 2023, primarily due to a higher mix of high-core-count products. Server volume decreased by 10% from 2023 due to lower demand in a competitive environment and a higher mix of high-core-count products."

There are multiple possible reasons why Intel’s server-grade CPU sales have hit their lowest level in 13 years in 2024.

Intel's server CPU chip volume hit the lowest in last 14 years for the second straight year in 2024. It's <50% of the previous peak of 2020. With Intel admitting the competitive gap even with Granite Rapids and Clearwater Forest pushout, the product chief has once again dropped… pic.twitter.com/0QpWzJFVtgFebruary 3, 2025

Intel’s data center CPU sales began to ascend sharply in the mid-2010s due to the rise of cloud data centers. Back then, Intel did not have any real competitors, so the number of cores did not increase quickly, which stimulated cloud service providers to buy more CPUs to meet the performance demands of their customers.

Then, Intel processor sales increased in 2018 due to Meltdown and Spectre mitigations that reduced the performance of already installed CPUs and prompted CSPs to buy more servers with Intel CPUs in 2018. Competition from AMD became stronger in 2019, which is why sales of Intel CPUs for data centers slightly dropped that year.

Then came COVID-19, and demand for cloud computing increased again in 2020 and 2021, further driving sales of Intel server CPUs.

However, in 2022, demand for general-purpose servers slowed down while AMD unveiled its 4th Generation EPYC processors with up to 96 cores, far exceeding the number of cores in Intel’s top-of-the-range Xeon CPUs. As a result, the blue team’s unit shipments dropped in 2022 and then collapsed in 2023.

Stay On the Cutting Edge: Get the Tom's Hardware Newsletter

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

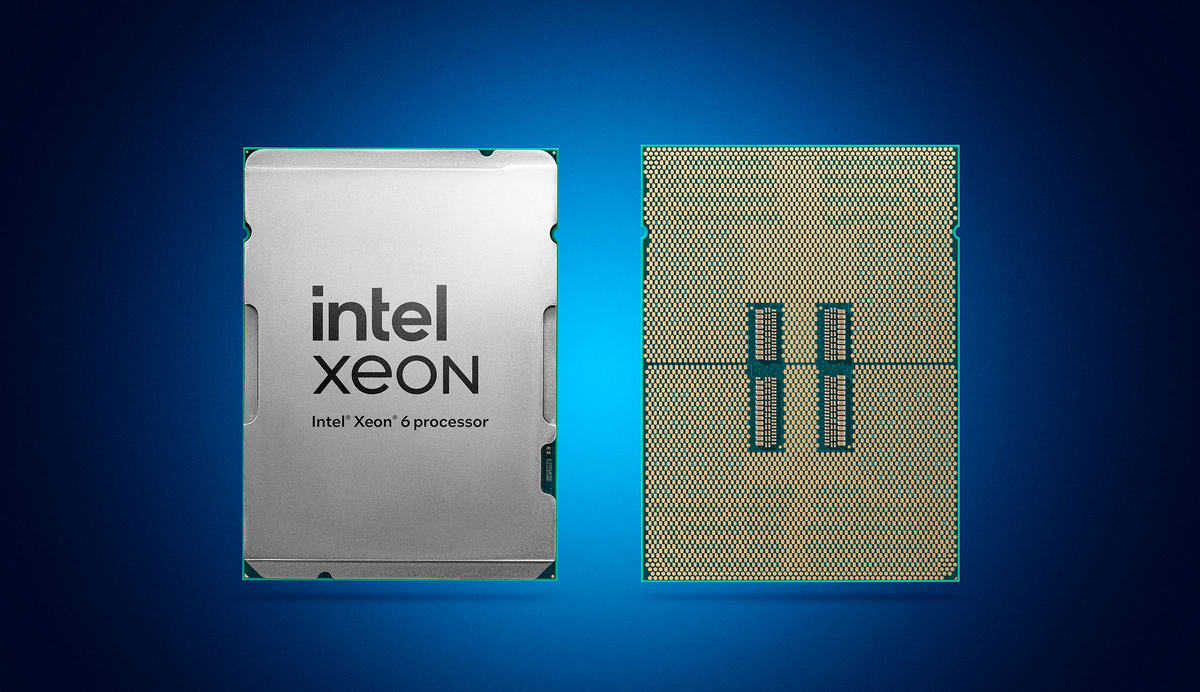

In 2024, Intel finally released its Xeon 6 processors with up to 128 high-performance cores or 144 energy-efficient cores, so unit sales of Intel server CPUs declined slightly once again as customers switched to high-core-count models. The good news is that Intel’s data center average selling prices have increased, but it isn't yet clear if the company can regain share in a market that has now shifted focus, and spend, to AI accelerators.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

bit_user Reply

No mention of ARM? Amazon, Microsoft, and Google all have their own ARM-based server CPUs. That's got to be taking a bite out of the x86 server CPU sales volume, especially with more server workloads migrating from on-prem servers to cloud.The article said:Sales of Intel’s data center CPUs in 2024 hit their lowest level in more than a decade due to increased competition from AMD, the transition to higher-core count models amid a drop in the number of CPUs, and a market shift to AI servers that use up to eight GPUs and just two CPUs.

Also, nothing about China and their push to become self-reliant for their infrastructure? While their server CPUs don't yet seem very competitive, I'd imagine they're getting to a point where Intel and AMD are starting to see some tapering in Chinese demand for them.

It's these macro factors that are largely out of Intel's control. China isn't coming back to them, no matter what. The same is largely true of everyone who's already jumped on the ARM train. Intel's best chance with them would probably be to start designing its own ARM or RISC-V cores. -

DS426 Reply

Yep, ARM and China are definitely factors as well; increased core-count CPU's and competition from AMD haven't driven Intel's server CPU's down 50% in ~5 years by themselves. Cloud computing and AI datacenters have also grown rapidly, so while server racks and blades have been consolidating due to higher core counts, I'm pretty certain that there's been a net increase in the number of CPU's required (and therefore sold) to fuel all that growth.bit_user said:No mention of ARM? Amazon, Microsoft, and Google all have their own ARM-based server CPUs. That's got to be taking a bite out of the x86 server CPU sales volume, especially with more server workloads migrating from on-prem servers to cloud.

Also, nothing about China and their push to become self-reliant for their infrastructure? While their server CPUs don't yet seem very competitive, I'd imagine they're getting to a point where Intel and AMD are starting to see some tapering in Chinese demand for them.

It's these macro factors that are largely out of Intel's control. China isn't coming back to them, no matter what. The same is largely true of everyone who's already jumped on the ARM train. Intel's best chance with them would probably be to start designing its own ARM or RISC-V cores.