Intel's share of the discrete GPU market drops to 0% as sales in the overall market increase

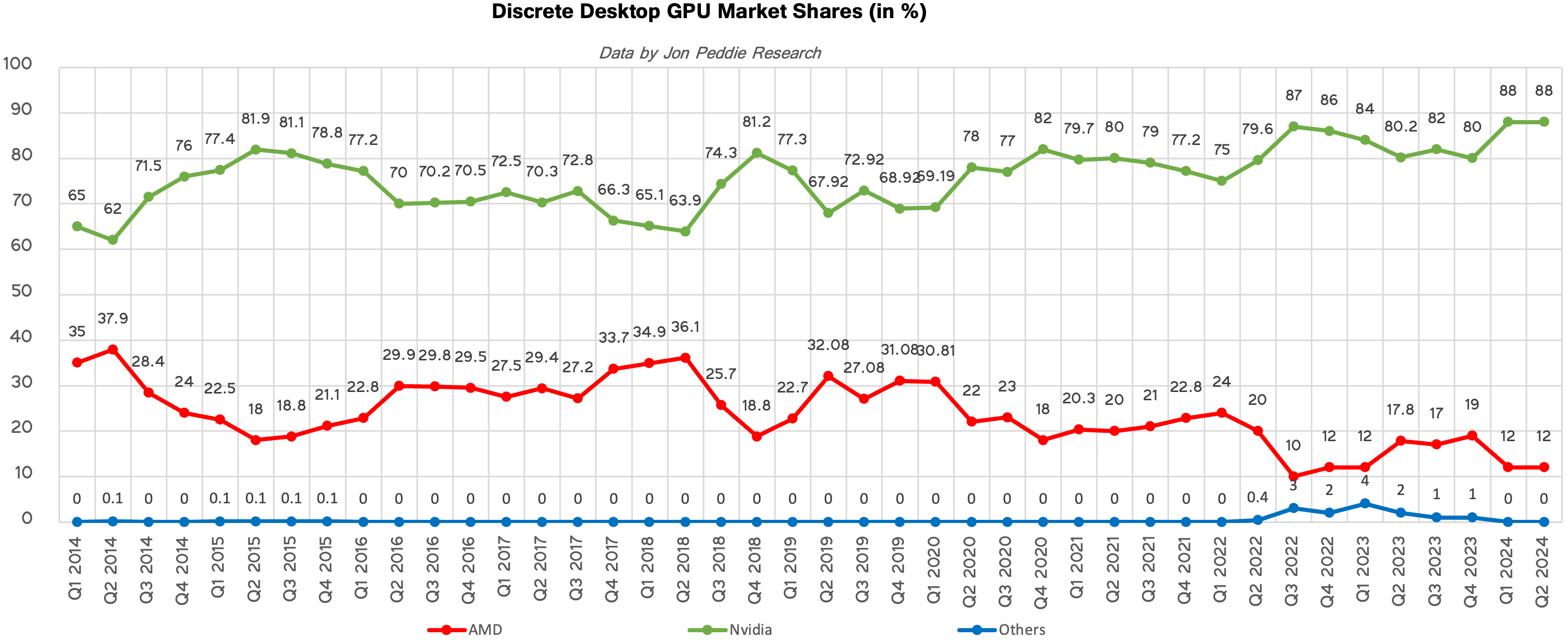

According to Jon Peddie Research, shipment of discrete graphics cards for desktop PCs increased to 9.5 million units in the second quarter of 2024. However, only Nvidia benefited from the higher demand for standalone GPUs for desktops as it continued to dominate the market. By contrast, sales of AMD Radeon add-in-boards (AIBs) stagnated, and so did market share, whereas the share of Intel's Arc dropped to around 0%.

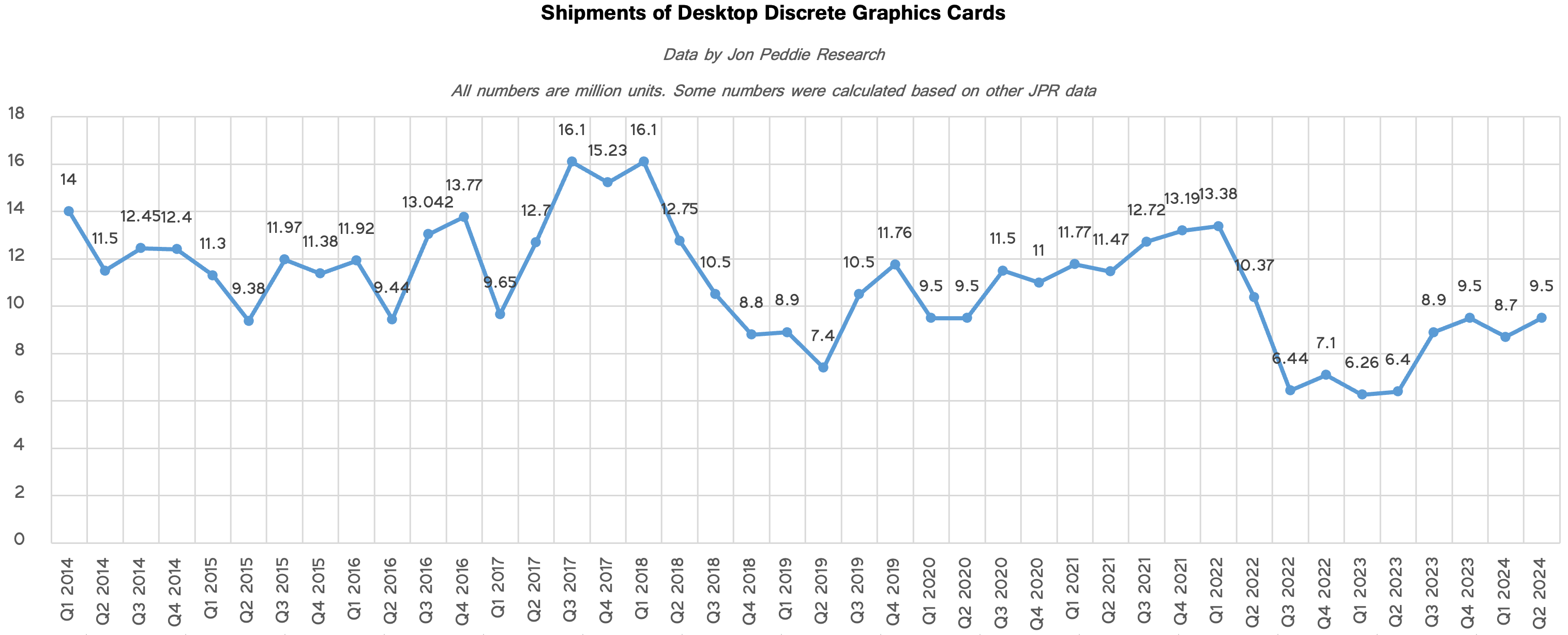

GPU sales for desktop PCs totaled 9.5 million units in the second quarter, up around 9.4% sequentially and 48% year-over-year, according to JPR. Traditionally, shipments of standalone AIBs stagnate or drop in the second quarter compared to the first quarter, but that wasn't the case in 2024, as graphics card shipments increased, defying normal seasonality.

"The increase in shipments in Q2 bucks normal seasonality; the surge can be attributed to the release of new AIBs in Q1 and a slight drop in prices in the market overall," said C. Robert Dow, an analyst for Jon Peddie Research. "Prices should remain flat until next-generation AIBs are released in late 2024 or 2025."

When it comes to market shares, Nvidia continued to dominate with an 88% market share, AMD kept trailing with a 12% share, and sales of Intel's Arc collapsed, so based on data from JPR, it held 0% of the market in Q2 2024.

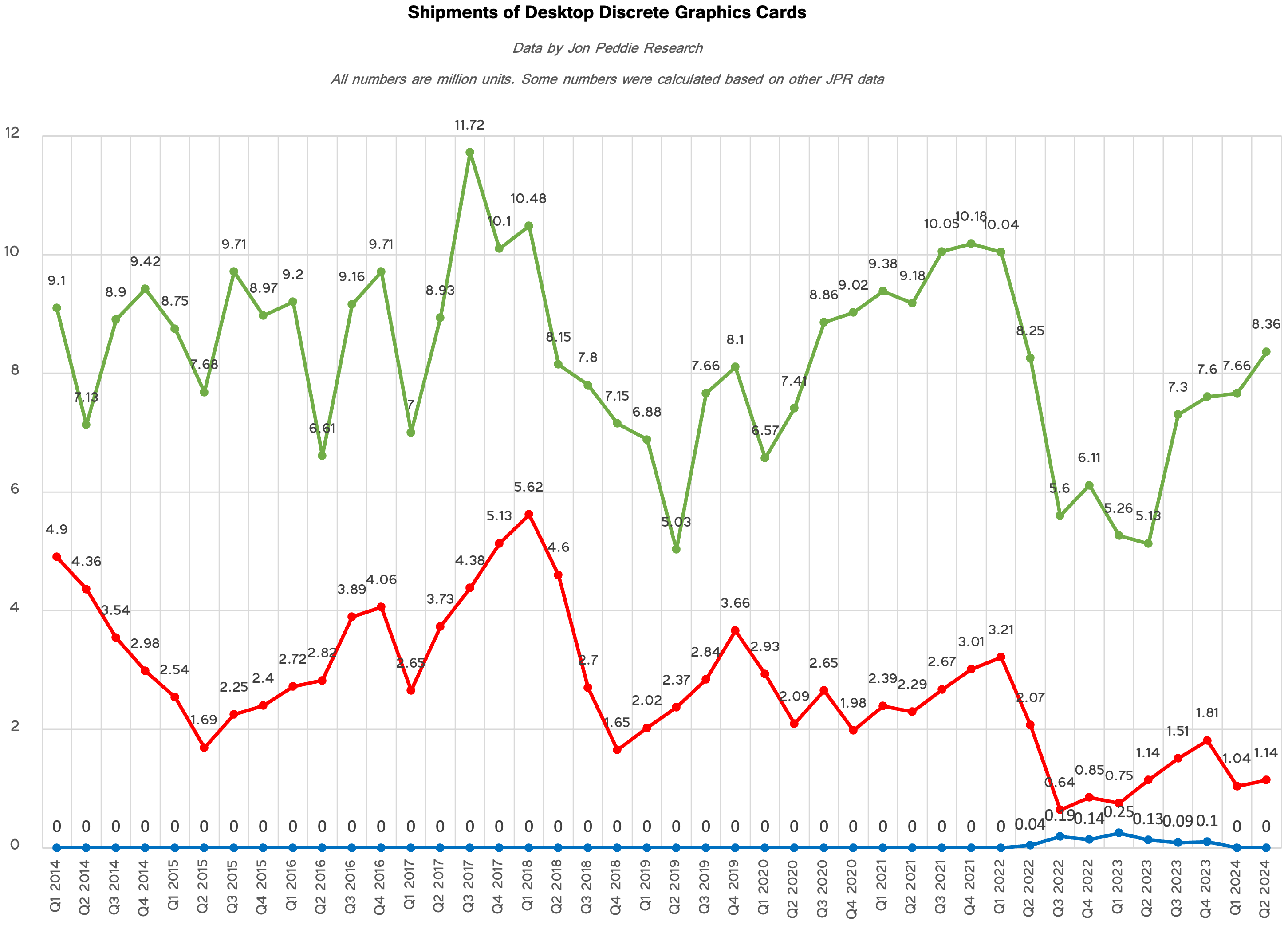

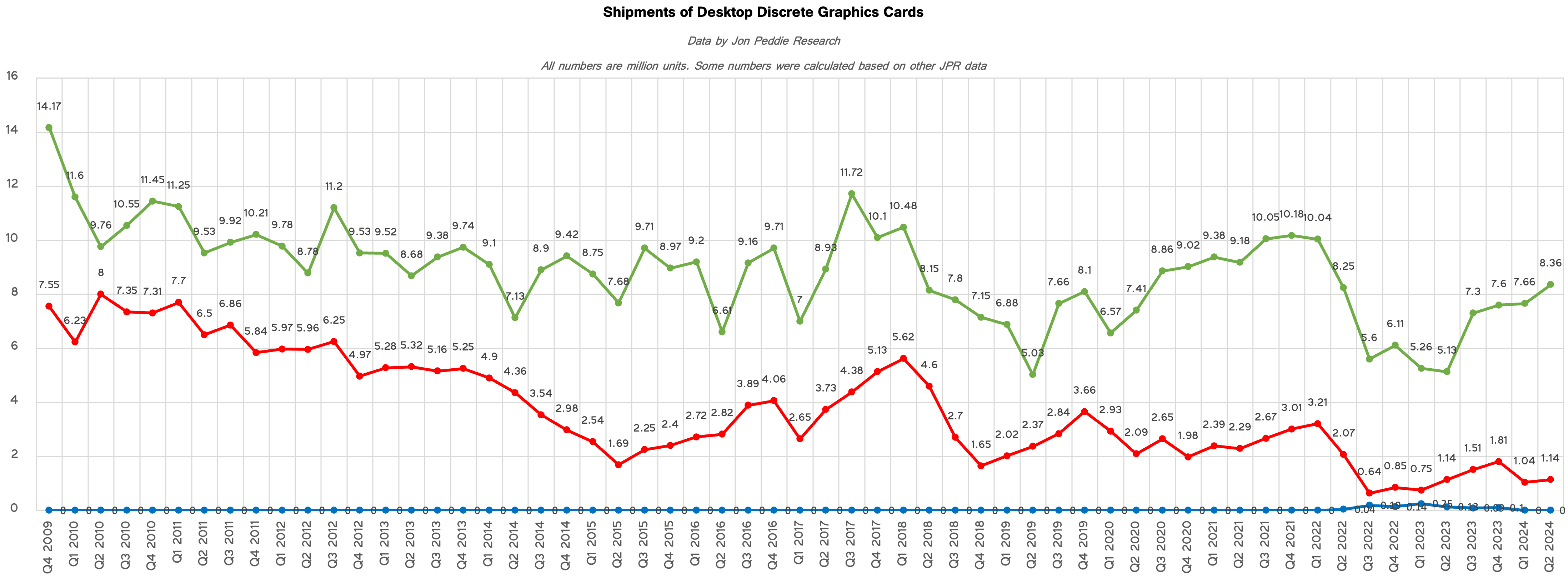

As far as actual sales numbers are concerned, Nvidia supplied 8.36 million GPUs for desktop graphics cards in the second quarter, up from 7.66 million in the first quarter, which is its best result since Q2 2022. In fact, Nvidia managed to increase its desktop discrete GPU sales by 9.7% quarter-over-quarter and a whopping 61.9% compared to the same quarter a year ago, a massive success, but one should keep in mind that the first two quarters of 2023 were the worst quarters for sales of graphics cards in two decades.

AMD shipped around 1.14 million standalone GPUs for desktops in the second quarter, up 9% from roughly 1.04 million in Q1 2024 and virtually flat compared to the second quarter of 2023. Apparently, interest in AMD's Radeon RX 7000-series graphics boards for desktops remains weak among the consumer, even though some of them are among the best graphics cards around.

"The add-in board market continues to surprise and astonish market watchers who have been predicting its doom for decades," said Dr. Jon Peddie, president of Jon Peddie Research. "With one little dip in Q1 (seasonally normal), we have seen four quarters of growth. But, overall shipments are down compared to two years ago, so that’s not encouraging. However, we remain optimistic about the future, and the fantastic games that are coming that will take all the performance an AIB can offer."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Gururu It is because they are still way too expensive. Intel should have just dropped them to like $50 dollars to clear inventory and get the name out. Heck I would buy a 770 for even $100.Reply -

Pierce2623 Reply

Yep a GPU that I won’t touch with a ten foot pole at $280, I’d happily try out at $150. The a580 at $100 could take the budget market by storm.Gururu said:It is because they are still way too expensive. Intel should have just dropped them to like $50 dollars to clear inventory and get the name out. Heck I would buy a 770 for even $100. -

thesyndrome Reply

"Pride cometh before the fall"Gururu said:It is because they are still way too expensive. Intel should have just dropped them to like $50 dollars to clear inventory and get the name out. Heck I would buy a 770 for even $100.

I'm guessing they didn't want to lose face by selling the GPUs at bargain-bin prices, but considering their current financial difficulties, this seems like a really bad decision.

I'd probably pick up an A770 for $100 just to experiment with it, or to put it into a secondary PC that has a specific purpose outside of playing intensive games (like a media server or something) -

jlake3 Reply

It would be a bad look to fire-sale the cards to that degree… and might actually cost them even more money? If there’s an official price change, they might owe AIBs and distributors a rebate on inventory in the channel. And it would make anyone still buying your cards mad that if they waited just a bit longer it would have been massively cheaper.thesyndrome said:"Pride cometh before the fall"

I'm guessing they didn't want to lose face by selling the GPUs at bargain-bin prices, but considering their current financial difficulties, this seems like a really bad decision.

I'd probably pick up an A770 for $100 just to experiment with it, or to put it into a secondary PC that has a specific purpose outside of playing intensive games (like a media server or something)

If the contracts are written in a way where they don’t have to issue a rebate, then everyone is gonna try to cost average existing inventory with new inventory… but sales are poor and Alchemist is rapidly headed towards discontinuation, so discounts on future restocks aren’t a good incentive. And trying to stick partners with your mistakes is gonna burn the few bridges you barely built. There’s already rumors that one AIB is not coming back for Battlemage.

Letting what little is left in the system drip through with a smallish promo might be seen as preferable to a big cash hit all at once that also torches your brand image. -

vanadiel007 Never understood why they wanted to compete in that market segment. They should have competed in the mobile GPU market.Reply -

Giroro It looks like sales of this generation overall are poor.Reply

If Intel cared about making moves to gain market share, they would have gotten Battlemage on store shelves by now. AMD's has the same problem with their strategy of always waiting for Nvidia to move first and copying their price/perf. You can't become a leader by being a follower. -

Giroro Replyvanadiel007 said:Never understood why they wanted to compete in that market segment. They should have competed in the mobile GPU market.

Because you can sell a GPU for the price of an entire laptop. The potential profit margins are a lot higher. -

Eximo They certainly did. Not too many discrete Arc mobile chips made it into desirable products.Reply

And they have switched over to Xe cores for graphics in general on the SoCs.

Hard to sell laptop GPUs if you have no reputation. It would have been a different story if they had managed to deliver on time during the GPU shortages. A750 would have been a big hit if they hadn't delayed. -

Notton Reply

The ARC cards were priced with almost no margin for Intel. If they sold them at cost, they would be canned by investors and you wouldn't even see Battlemage.Gururu said:It is because they are still way too expensive. Intel should have just dropped them to like $50 dollars to clear inventory and get the name out. Heck I would buy a 770 for even $100.

If Intel drops out, Nvidia would have zero incentive to offer an RTX4060Ti 16GB for $200, which is what you really want. -

thestryker These figures are referring to shipments not sales which just means Intel isn't moving any new cards out. It makes sense that they're probably not manufacturing Alchemist GPUs still.Reply