Nvidia expected to produce 450,000 Blackwell AI GPUs in Q4 — potential $10B in revenue for the chipmaker

Represents potential $10+ billion opportunity.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

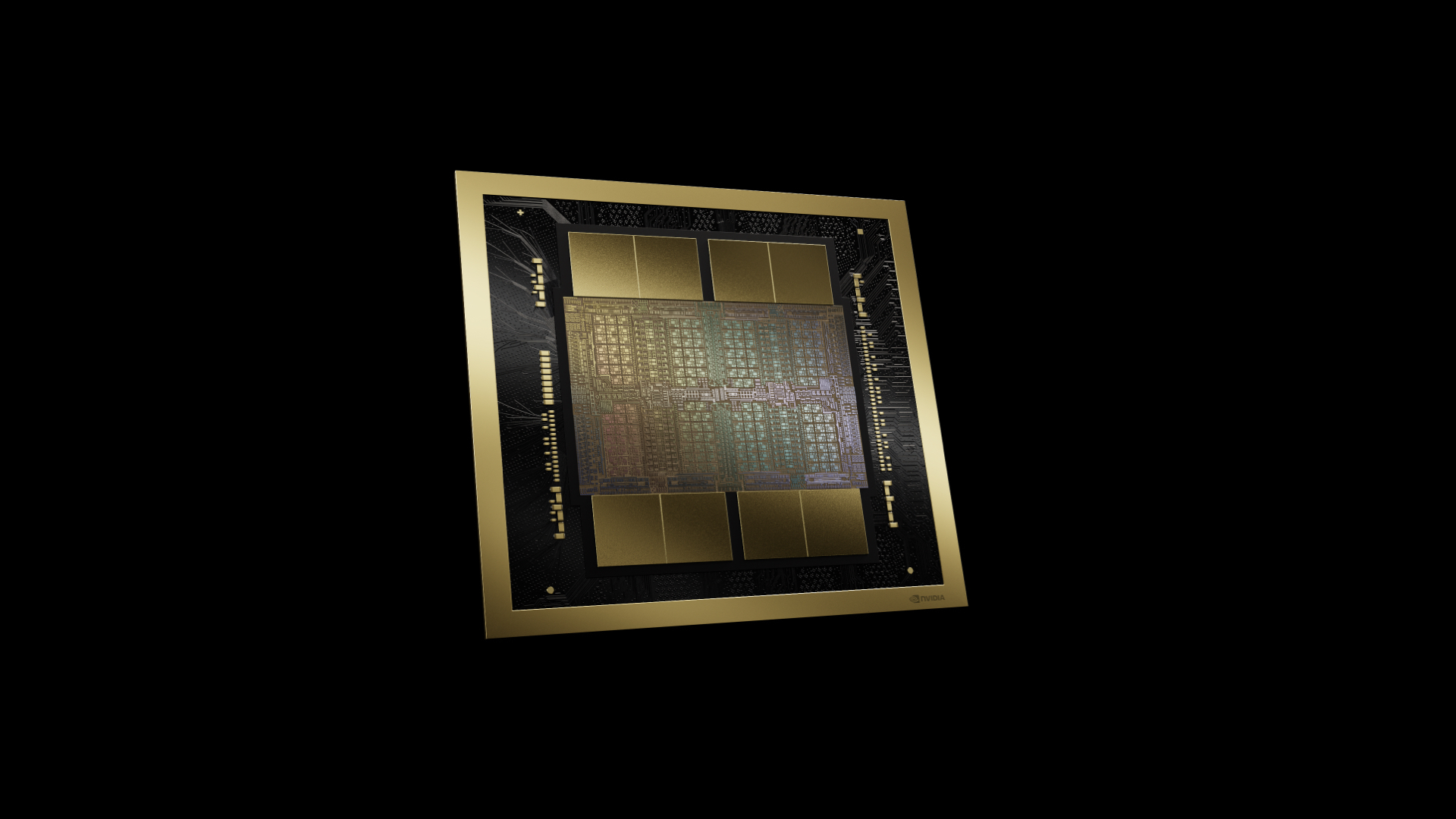

Analysts from Morgan Stanley believe that despite low yields caused by a significant yet easy-to-fix design issue, Nvidia will produce around 450,000 AI GPUs based on the Blackwell architecture. If the information is accurate and the company manages to sell these units this calendar year, this could translate into a revenue opportunity of over $10 billion.

"Blackwell chips are expected to see 450,000 units produced in the fourth quarter of 2024, translating into a potential revenue opportunity exceeding $10 billion for Nvidia," analysts from investment bank Morgan Stanley wrote in a note to clients, reports The_AI_Investor, a blogger that tends to have access to this kind of notes.

While the $10 billion and 450,000 numbers look significant, they indicate that Nvidia will sell its high-demand Blackwell GPUs in short supply for around $22,000 per unit, down significantly from the rumored $70,000 per Blackwell GPU module. Although the actual pricing of data center hardware depends on factors like volumes and demand, selling the very first batches of ultra-high-end GPUs at lower prices compared to Nvidia's current-generation H100 is a bit odd.

Nvidia would, of course, prefer to sell 'reference' AI server cabinets powered by its Blackwell GPUs: the NVL36 featuring 36 B200 GPUs, which is expected to cost $1.8 million – $2 million, and the NVL72, with 72 B200 GPUs inside, which is scheduled to start at $3 million. Selling cabinets instead of GPU, GPU modules, or even DGX and HGX servers is much more profitable, and earning $10 billion by selling such machines is not unexpected. However, in this case, Nvidia will not need to supply 450,000 GPUs to earn $10 billion in revenue.

In late August, Nvidia said that it had to change the codenamed B100/B200 GPU photomask design to improve production yield. The company also noted that the GPUs will enter mass production in the fourth quarter and continue into fiscal 2026. In the fourth quarter of fiscal 2025 (which begins in late October for the company), Nvidia is expected to ship 'several billion dollars in Blackwell revenue,' significantly lower than the sum mentioned by Morgan Stanley analysts.

According to a SemiAnalysis report, a mismatch in the coefficient of thermal expansion (CTE) of Blackwell chiplets and packaging materials caused the failure. Nvidia's B100 and B200 GPUs are the first to use TSMC's CoWoS-L packaging, which links chiplets using passive local silicon interconnect (LSI) bridges integrated into a redistribution layer (RDL) interposer. The precise placement of these bridges is crucial, but a mismatch in CTE between the chiplets, bridges, organic interposer, and substrate causes warping and system failure. Nvidia reportedly had to redesign the GPU's top metal layers to improve yields but did not disclose details, only mentioning new masks. The company clarified that no functional changes were made to the Blackwell silicon, focusing solely on yield improvements.

Due to the necessity of changing the design of B100 and B200 GPUs and the shortage of TSMC's CoWoS-L (a vastly different method from the proven CoWoS-S technology) packaging capacity, analysts did not expect Nvidia to ship many Blackwell-based GPUs in the fourth quarter of calendar 2024 or the fourth quarter of the company's fiscal 2025.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

JRStern 450k? This just sounds so wrong. How many go to the top three customers, about 400k?Reply

That's if they actually take them, what are the penalties for order cancellation?