Nvidia will reportedly start Blackwell server deliveries in early December — the first servers will go to Microsoft

Microsoft first to get Nvidia's Blackwell machines.

After resolving yield-killing issues with the packaging of B100 and B200 AI GPUs, Tim Culpan reports that Nvidia is set to begin shipping its GB200 servers to major cloud service providers in early December. According to the analyst, key clients like AWS, Meta, Microsoft, and Oracle are lined up to receive Nvidia's next-generation AI servers only a month behind schedule. However, the exact volumes are unclear.

Microsoft set to get first GB200-based servers

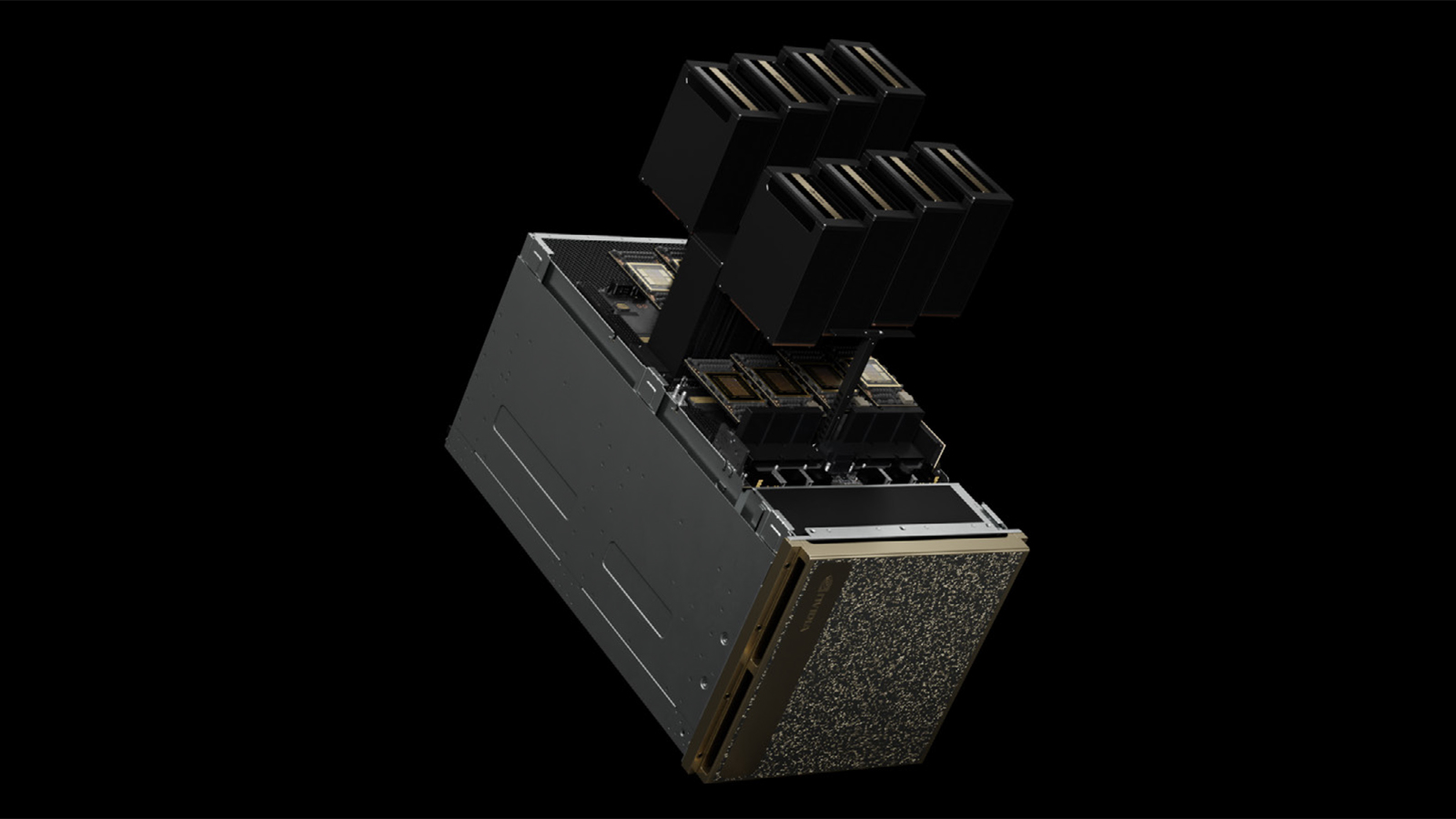

As expected, Nvidia will first ship its NVL36 and NVL72 servers. The revised delivery schedule means that the GB200-NVL36 (with 36 Blackwell GPUs) and GB200-NVL72 (with 72 GPUs) server versions, initially planned for late October and early November, respectively, will now ship in the first week of December, Culpan claims. Unfortunately, the number of machines set to be shipped in December is unknown.

According to the analyst, Microsoft is expected to receive one of the largest allocations of these servers. AWS, Meta, and Oracle are also among the alpha clients for Blackwell. Despite the production hiccup, demand for the GB200 servers remains strong.

In August, Nvidia acknowledged that it had to produce 'low-yielding Blackwell material' to meet demand, negatively affecting its profit margins. These low-yielding B200 GPUs will likely be used in the first GB200-NVL servers, which might affect their volumes.

Jensen Huang, Nvidia's chief executive, stated last month that all necessary design changes for the Blackwell B100 and B200 GPUs had been completed. The company is on schedule to start mass production in the fourth quarter, which, in Nvidia's case, begins in late October. Given TSMC's 4NP production cycle of around three months, the refined Blackwell GPUs will be ready in late January as soon as possible unless TSMC finds a way to expedite its production and packaging process.

Meanwhile, Blackwell GPU module makers and system integrators already have qualification samples of the reworked GPUs (which is about time), according to Culpan. Once they qualify for the new silicon, they can assemble appropriate products.

How Blackwell servers are made

Nvidia handles the sale of its Grace CPUs and Blackwell GPUs directly with clients like Microsoft or Oracle. However, the latter gets actual servers from manufacturers, who have to win contracts with customers that can allocate GPUs from Nvidia. Here is how it works.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

TSMC handles silicon production and packaging using its CoWoS-L process, rumored to be the reason for Blackwell's production hiccup. Once Grace GPU and GPU packages are ready, they are sent to companies like Foxconn Industrial Internet (FII) for module assembly. After that, modules can be installed on the boards of Ariel (one Grace CPU, one Blackwell GPU) or Bianca (one Grace CPU, two Blackwell GPUs).

These components are sent directly to system integrators, who assemble and deliver the final server racks to the customers. Foxconn and Quanta are the primary integrators that will deliver the first Blackwell-based servers to Nvidia's clients. Others, including brands like Asus, Gigabyte, Luxshare, and Wiwynn, can also assembly that reference NVL machines, but before they get components, they need to win contracts with a significant customer, which would negotiate GPU allocation with Nvidia.

Initially, all server assembly will take place in Taiwan. However, Nvidia is considering expanding production to other regions, including Mexico and Texas, in the first quarter 2024. This would increase production capacity as demand (and supply of B100 and B200 GPUs) grow.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.