Nvidia's revenue skyrockets to record $57 billion per quarter — all GPUs are sold out

Nvidia on Wednesday announced its financial results for the third quarter of its fiscal year 2025, once again beating its own sales records as all its data center GPUs were sold out during the quarter. The company's earnings totaled $57 billion, as sales of all its products — except gaming GPUs — were up. Nvidia does not expect its revenue growth to stop, so it models that its revenue will hit $65 billion in Q4 FY2026, and the company expects sales of its Blackwell and Rubin GPU platforms to hit $0.5 trillion by the end of calendar 2026.

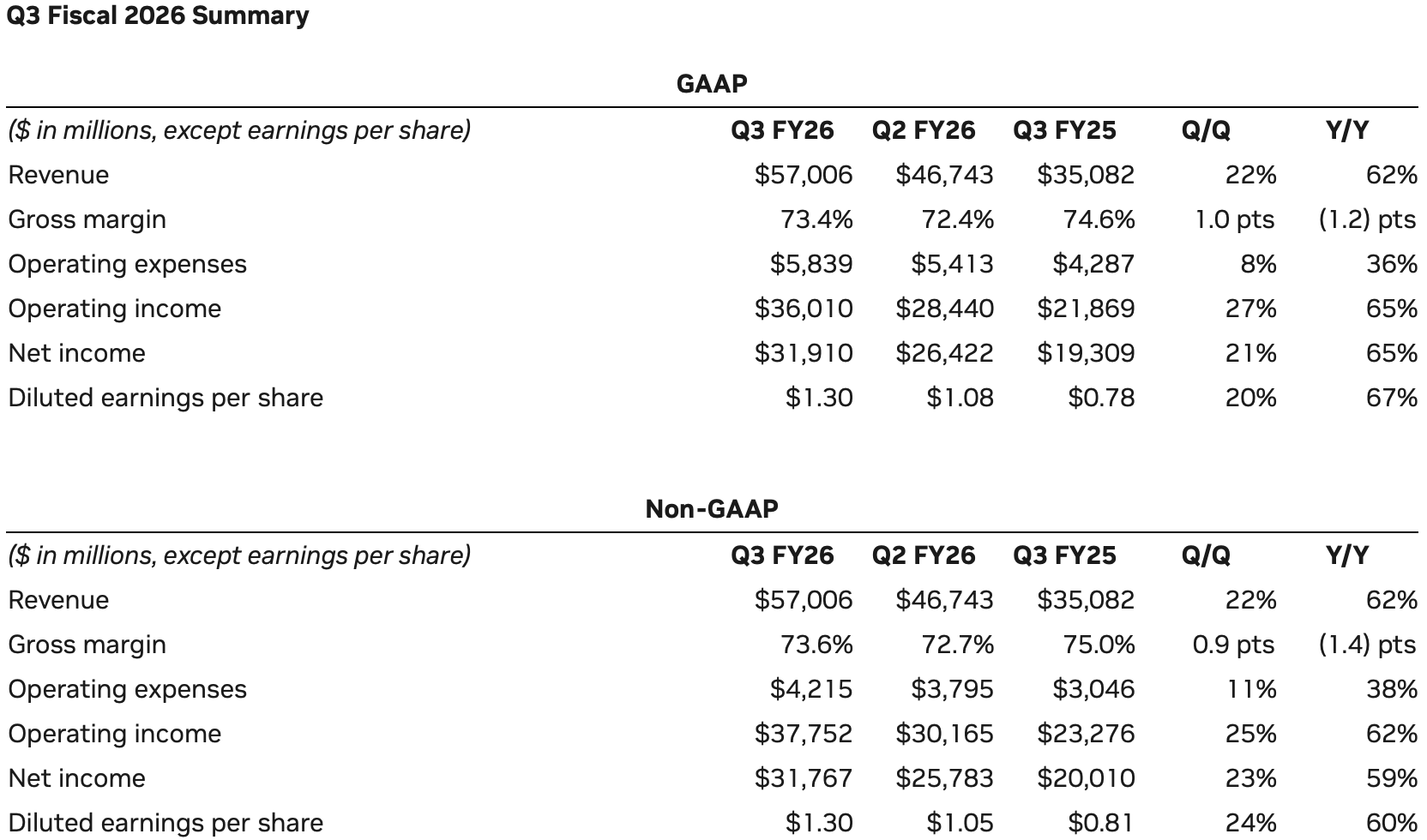

Nvidia's GAAP revenue reached $57.006 billion, up 62% year-over-year and 22% quarter-over-quarter, in the third quarter of the company's fiscal year 2026. The company's net income hit $31.91 billion, a 65% increase compared to Q3 FY2025, while its gross margin totaled 73.4%, up 1% sequentially, but down 1.2% YoY.

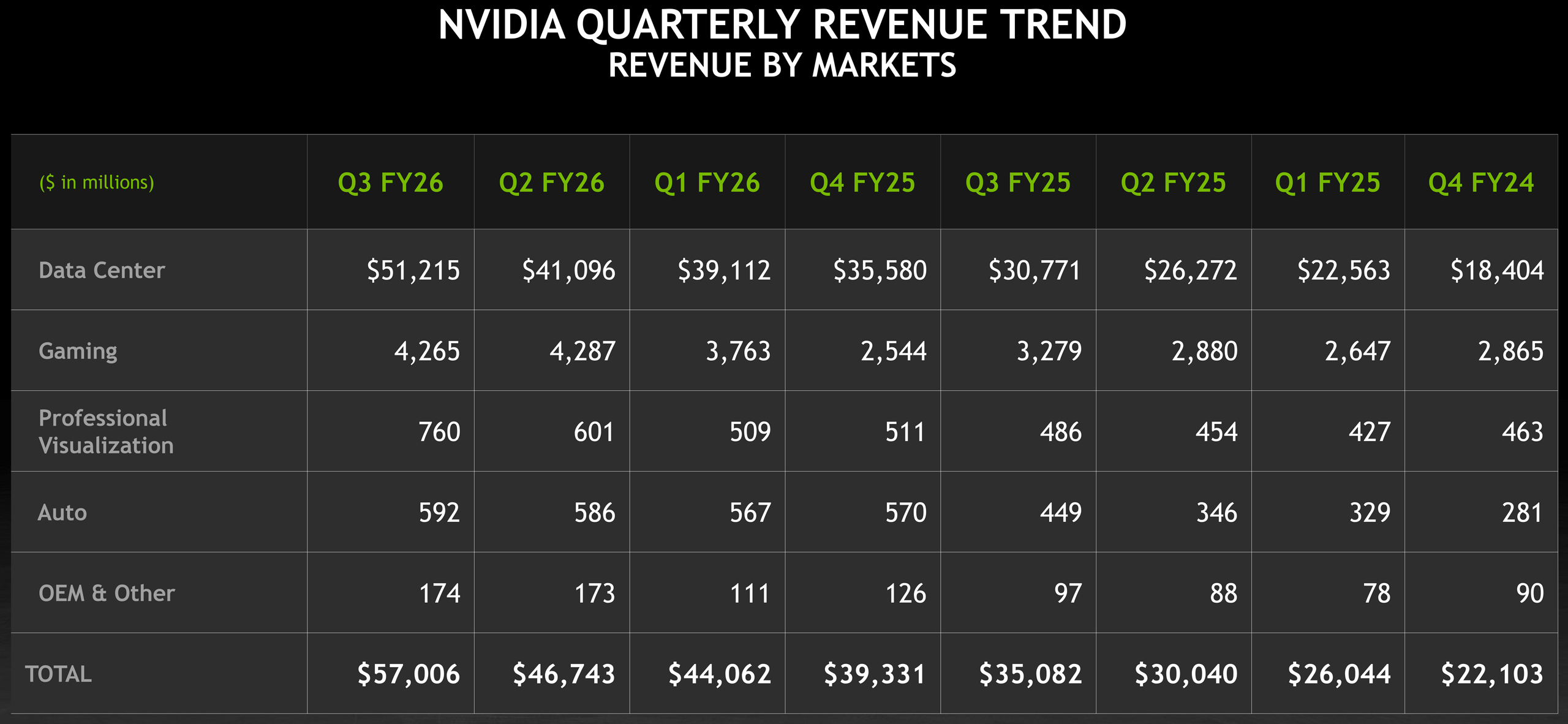

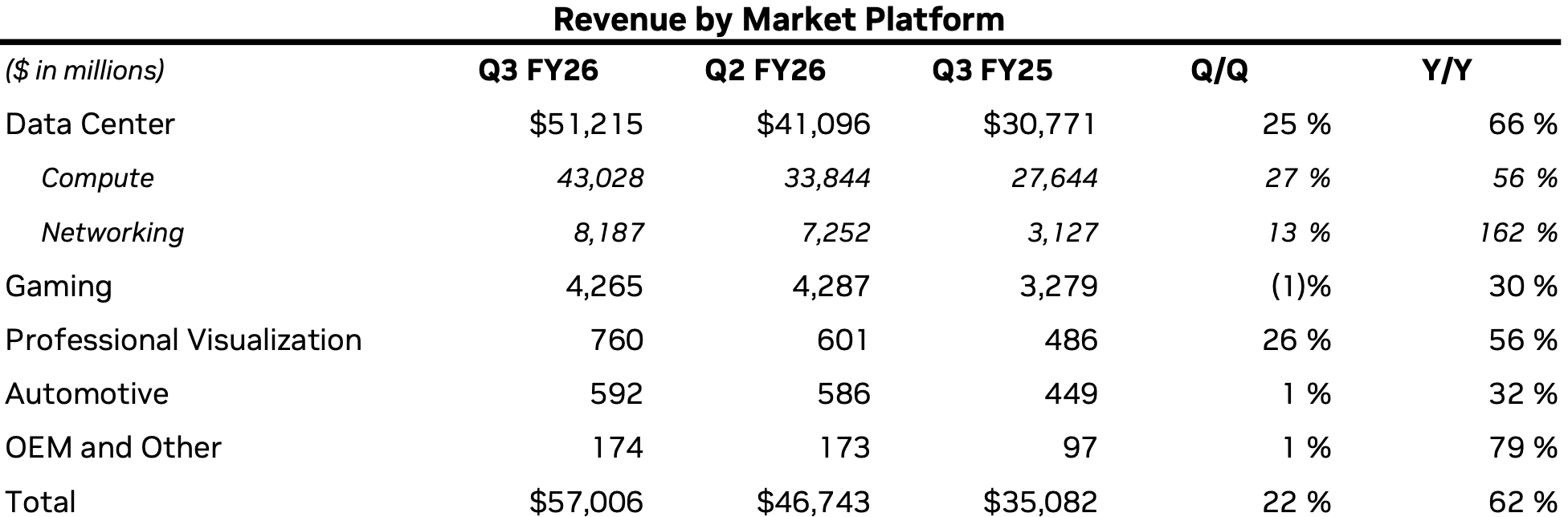

Sales of data center hardware exceeds $51 billion

Nvidia's data center business delivered a rather whopping $51.215 billion revenue in Q3 FY2026, rising 66% year-over-year and 25% sequentially. Within the segment, compute revenue — comprising CPU and GPU sales — reached $43 billion, as the Blackwell and Blackwell Ultra platforms were adopted by all major clients, including cloud hyperscalers, enterprise AI, sovereign AI projects, and industrial. Networking revenue totaled $8.2 billion, up an extraordinary 162% year-over-year, as customers purchased more networking hardware while switching from individual AI servers to rack-scale solutions.

"Blackwell sales are off the charts, and cloud GPUs are sold out," said Jensen Huang, founder and CEO of Nvidia. "Compute demand keeps accelerating and compounding across training and inference — each growing exponentially. We have entered the virtuous cycle of AI. The AI ecosystem is scaling fast — with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once."

Gaming GPUs hit their peak, whereas ProViz solutions set new record

Nvidia's gaming segment generated $4.265 billion in the third quarter of the fiscal year, rising 30% YoY but slipping 1% sequentially, which was a surprise. Nvidia said channel inventories normalized ahead of the holiday season, though GPUs are normally strongest in the third quarter, so it looks like other factors were affecting sales of graphics cards. Nonetheless, at $4.265 billion, Nvidia's Q3 of FY2025 is the company's second-best quarter for consumer GPUs ever, suggesting the market has peaked for the company at this time.

While sales of GeForce RTX graphics cards were so strong in Q2 and Q3 that they could no longer grow, sales of professional visualization solutions increased to $760 million, rising 56% year-over-year and 26% sequentially, setting an all-time record for Nvidia and likely the whole industry. The improvement was driven primarily by the launch and ramp of the DGX Spark AI workstation platform and increased demand for Blackwell-based professional GPUs used in CAD, CAM, DCC, and various emerging creative workflows.

Nvidia's Automotive and Robotics revenue reached $592 million in Q3 FY2026, increasing 32% year-over-year and 1% sequentially, which was driven by continued adoption of the company’s self-driving platforms. During the quarter, Nvidia announced that its next-generation Drive AGX Hyperion 10 Level 4-capable vehicle platform has been adopted by major partners, including Uber, so expect this segment to become even more important for the company going forward.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The OEM and Other segment recorded $174 million in revenue for the third quarter, up 79% year-over-year and 1% sequentially.

Q4 outlook: More money incoming

Nvidia expects another quarter of strong growth, so it guides revenue to $65 billion ±2% and GAAP gross margin of 74.8%. These results will be primarily driven by continued adoption of Blackwell and Blackwell Ultra platforms by various customers in the West. It is noteworthy that the company said nothing about sales of its AI GPUs to China, perhaps reflecting sentiment that this market has largely been lost for now.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

alrighty_then Go big green! AI everywhere - bring it. I want to play a future videogame able to flesh out even the simplest NPC to be realistic in conversations with the power of AI behind every conversation.Reply -

shady28 Odd that they say that they are sold out of GPUs, while I continue to see prices go down on Nvidia cards.Reply -

MergleBergle lol.Reply

alrighty_then said:Go big green! AI everywhere - bring it. I want to play a future videogame able to flesh out even the simplest NPC to be realistic in conversations with the power of AI behind every conversation

I have no issue with these AI datacenters if they can provide their own power. Sadly, not what's happening. They're sucking the grid dry. Soo... "YAY Jensen, thanks for the brownouts in my hometown! But I'm such a fanboy, I don't care if people die due to brownouts!" I'm amazed how many people want to eat this guy's sausage. -

George³ Reply

Hmm, The vast majority of them are not women. What is happening to the world? :DMergleBergle said:lol....I'm amazed how many people want to eat this guy's sausage -

hotaru251 reminder when bubble pops nvidias making world record on largest value lost in a single day.Reply

also going to be largely responsible for the fallout becasue of how massively overvalued it is an once crashes anything tied to stock market is being damaged (including some 401ks) -

Misgar all GPUs are sold outAnyone want to buy a used GeForce GT 630 or a GT 710 at very reasonable prices.Reply

I also have AGP and old PCI cards available.

If I look really hard, I might even find an 8-bit ISA card (CGA or EGA perhaps). -

edzieba Take a look at the OEM segment: Switch 2 launched in Q2, so with Q3 & Q4 revenue flat (and being nearly flat prior to them) that ~60-75m jump is going to be pretty close to the entire Switch 2 SoC income.Reply

Or to put another way, Nintendo would need 700x-800x simultaneous Switch 2 launches for console revenue to match the Datacentre (which is not mostly 'AI') market.

Whilst raw income will go down, margin probably won't change all that much. Nvidia don't own any large fabs or factories that will stop returning on investment, they don't have huge inventory stockpiles, and they will have more than made back their R&D spend with existing profits. If anything, an AI bubble pop would mean their main cost driver (wafer fab costs) will drop as demand plummets. Probably a headcount reduction would occur, but taking a margin hit could be an alternative if Nvidia want to retain talent and institutional knowledge.hotaru251 said:reminder when bubble pops nvidias making world record on largest value lost in a single day.

also going to be largely responsible for the fallout becasue of how massively overvalued it is an once crashes anything tied to stock market is being damaged (including some 401ks)

Unlike OpenAI et al, Nvidia has actual revenue and net profit today, rather than fantasy future revenue and massive losses from spending. -

rluker5 Reply

If Nvidia's customers don't find a way to make the purchase of new GPUs profitable total sales will crash and with the same margins so will profits and stock value. Add to that with less demand the prices of the remaining sales of GPUs will drop reducing margins.edzieba said:Whilst raw income will go down, margin probably won't change all that much. Nvidia don't own any large fabs or factories that will stop returning on investment, they don't have huge inventory stockpiles, and they will have more than made back their R&D spend with existing profits. If anything, an AI bubble pop would mean their main cost driver (wafer fab costs) will drop as demand plummets. Probably a headcount reduction would occur, but taking a margin hit could be an alternative if Nvidia want to retain talent and institutional knowledge.

Unlike OpenAI et al, Nvidia has actual revenue and net profit today, rather than fantasy future revenue and massive losses from spending.

The companies making products for the AI industry are making money and keeping the money they made. Those private companies buying the AI products are not making profits with those products and will slow their purchases. Governments buying them for monitoring us probably won't need to upgrade to the next model frequently making the sales one and done.

There seems to be a competitive rush between model providers to become the "amazon" or "google" of A, but there wiIl just be one of those or they will just have smaller shares. The rush can't continue forever because it is costing a lot. -

jp7189 Though MS doesn't break out the numbers, indications point to copilot being profitable already. I saw news yesterday that OPS did a pilot that showed 3 hours saved per employee per week. That's easily worth $35 per month. As such, they bought a subscription for 15k employees.Reply -

luissantos Reply

That's profit for the consumer, not the provider. The question isn't whether people using OpenAI's products are benefitting financially, it's whether OpenAI's operational costs are lower than their income.jp7189 said:Though MS doesn't break out the numbers, indications point to copilot being profitable already. I saw news yesterday that OPS did a pilot that showed 3 hours saved per employee per week. That's easily worth $35 per month. As such, they bought a subscription for 15k employees.