Memory prices show signs of levelling out, albeit at inflated levels — some RAM modules stabilizing in price, increases on higher-end kits tapering off

Is there light at the end of the tunnel?

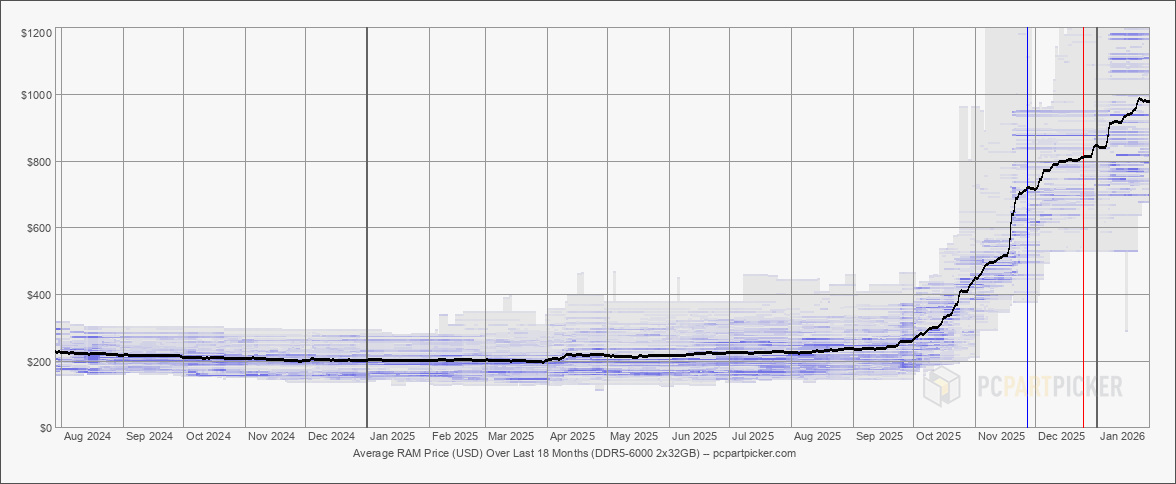

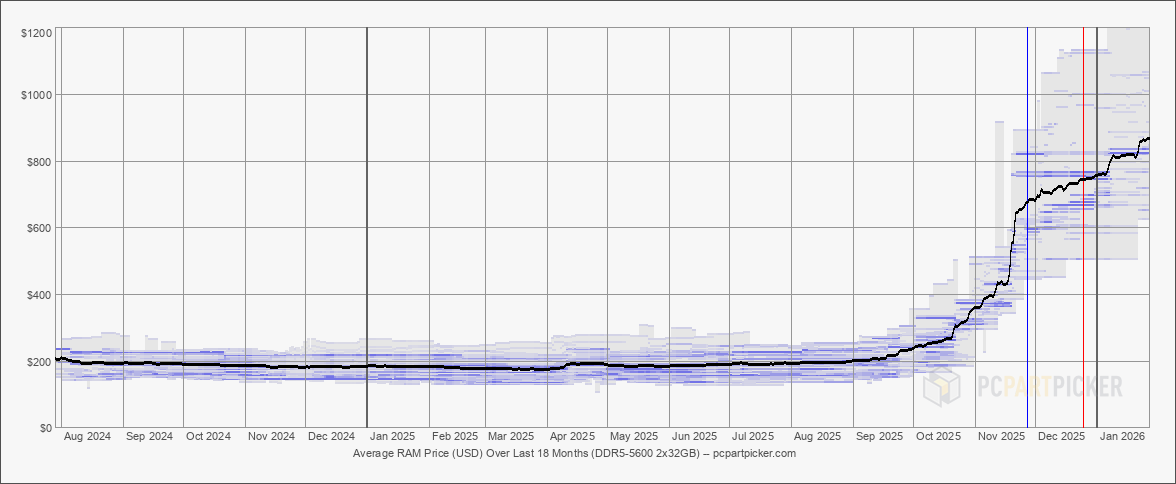

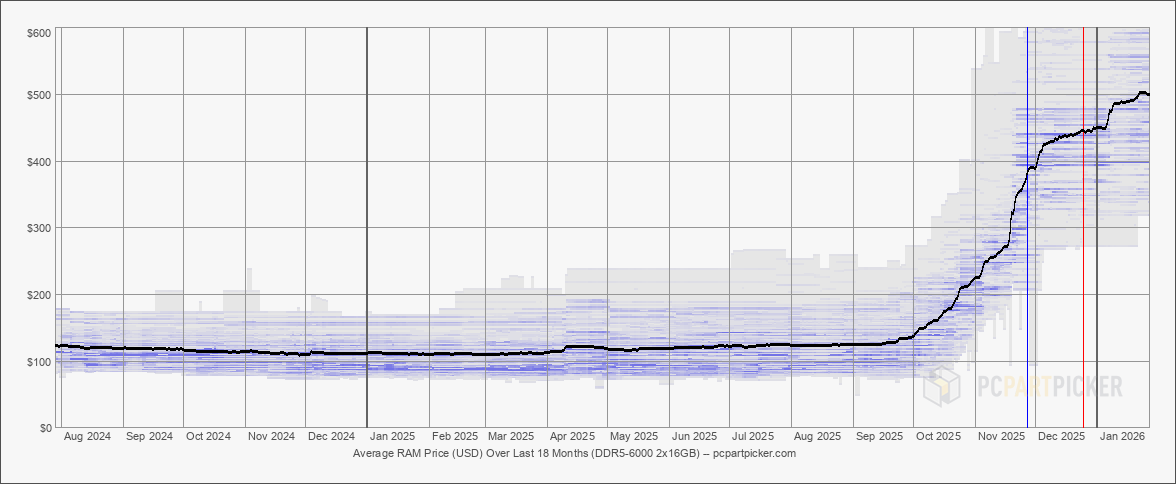

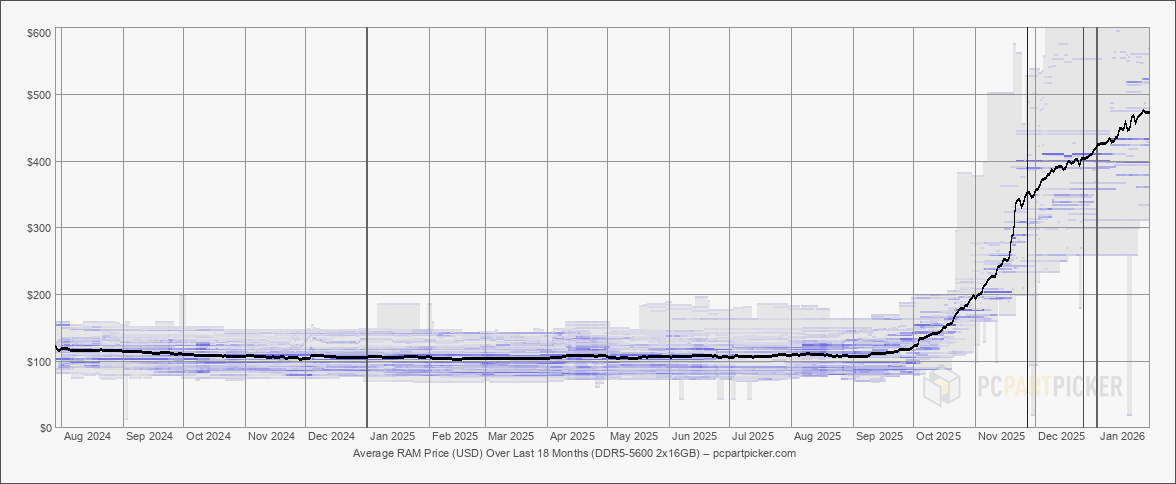

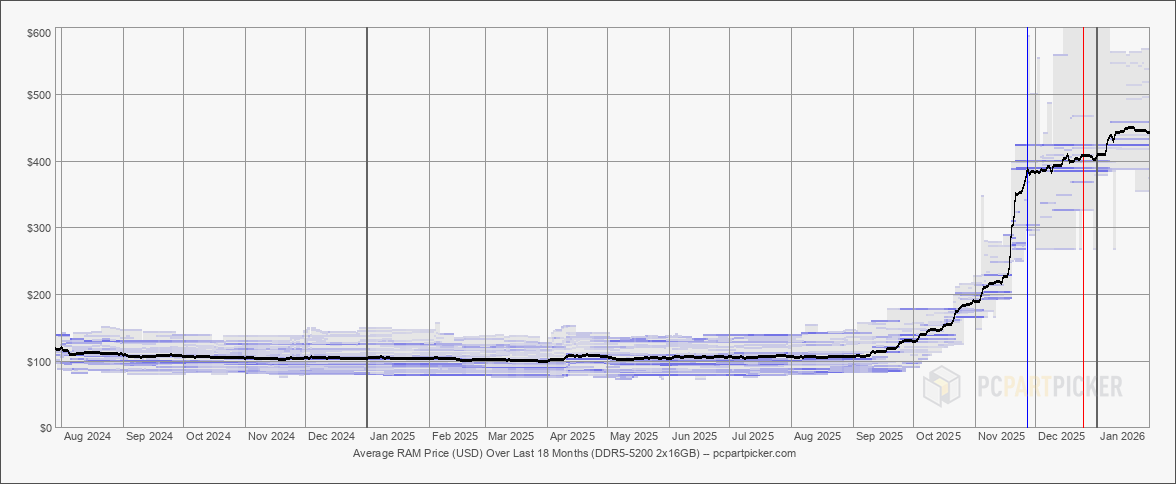

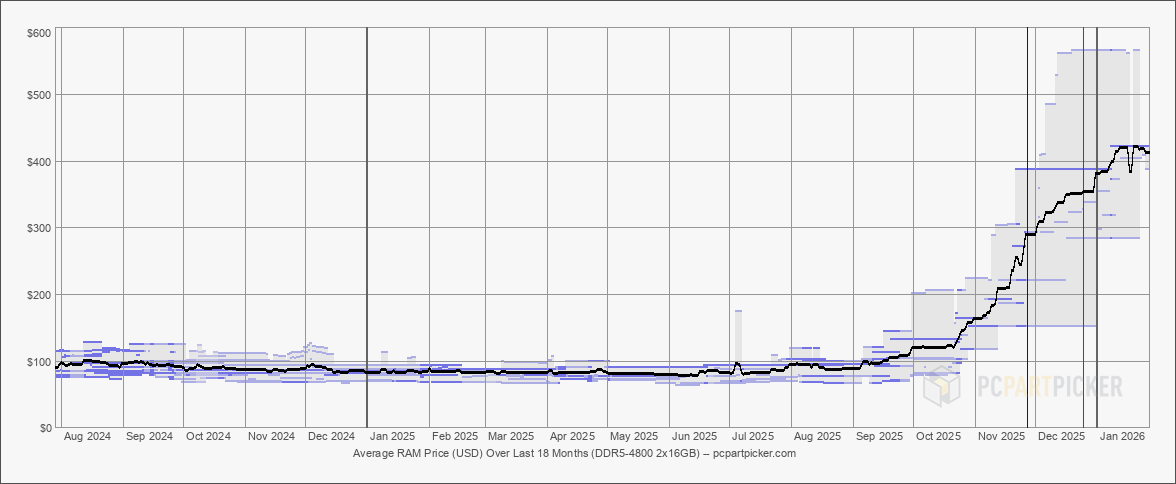

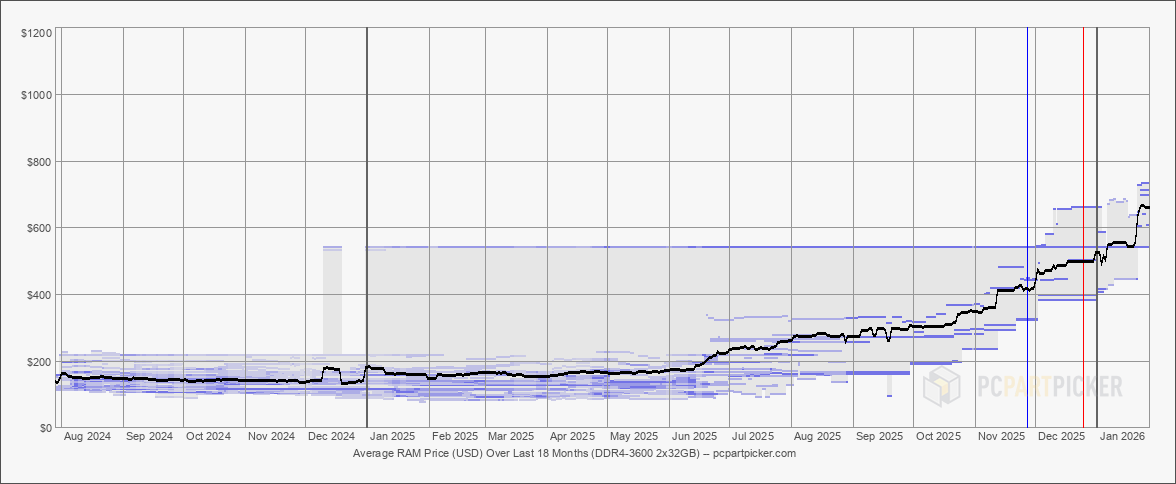

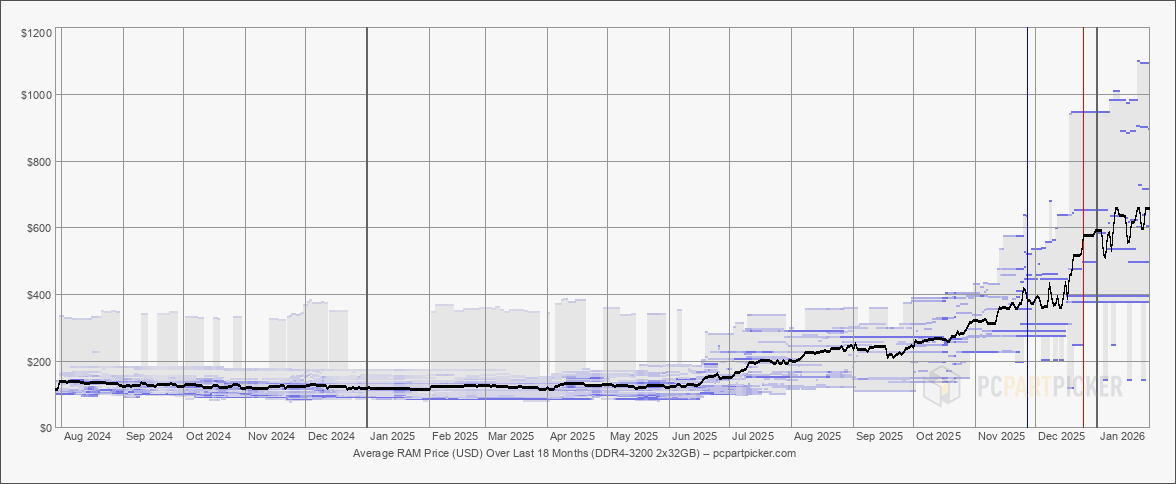

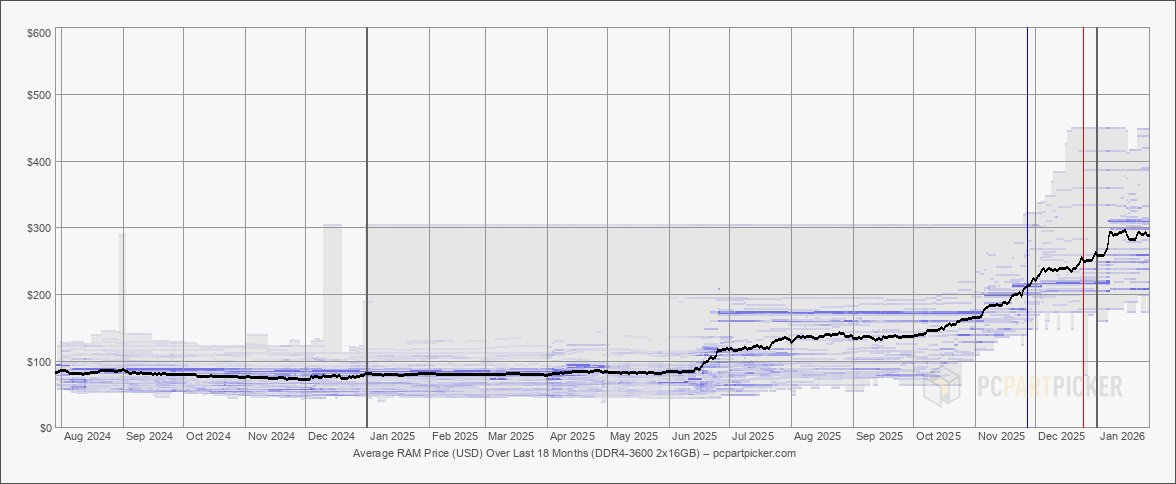

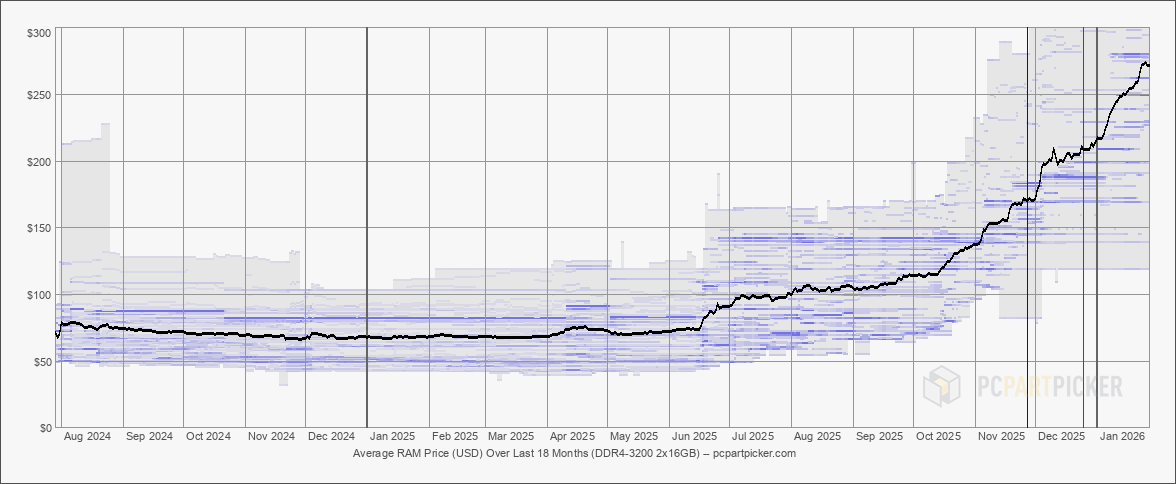

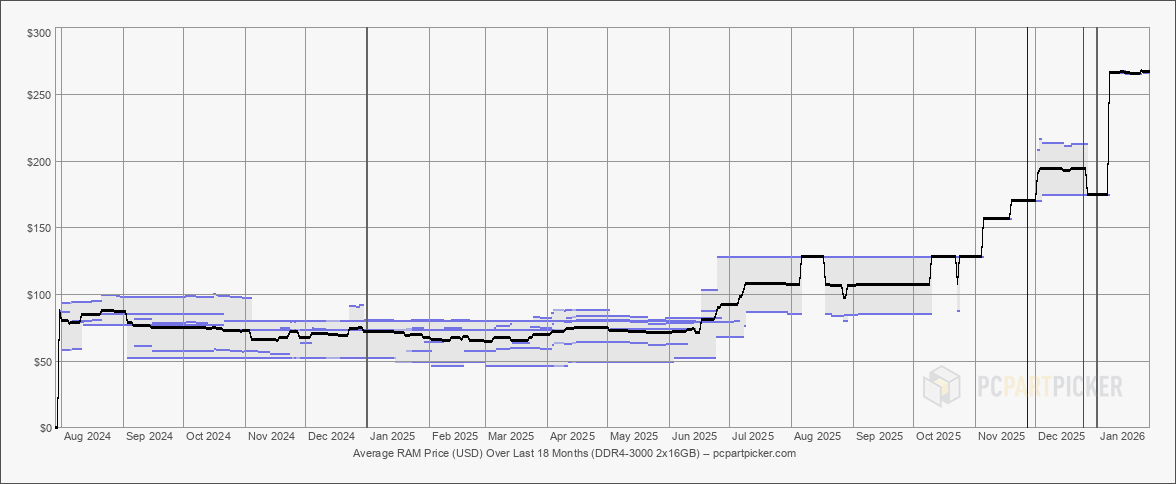

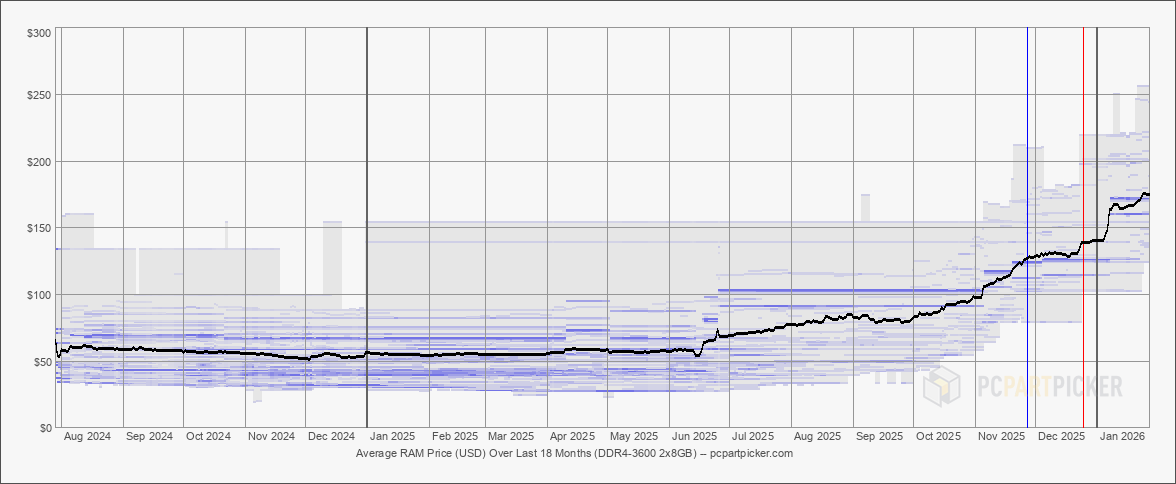

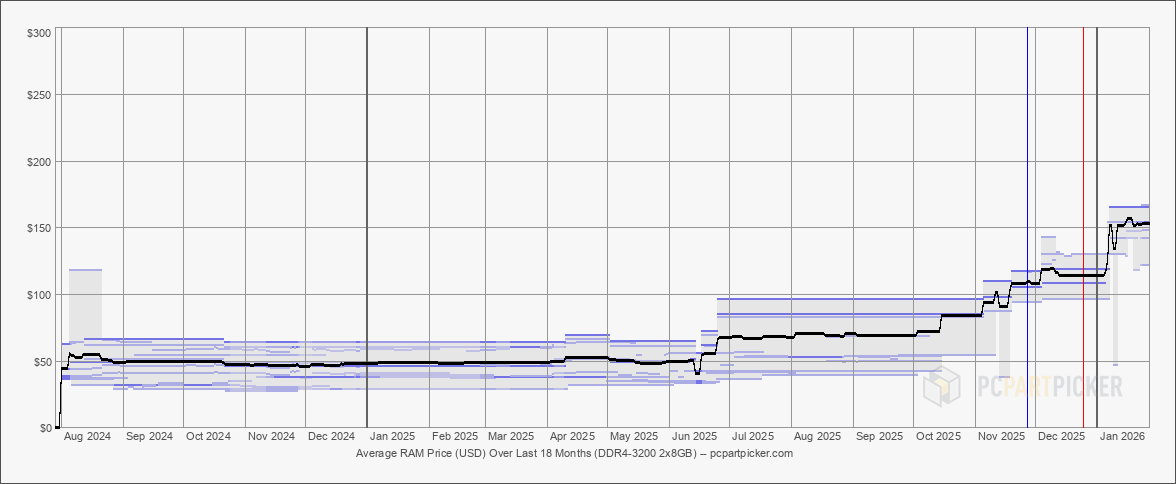

RAM pricing seems to be hitting a plateau after several months of constant hikes. We see this in the pricing data compiled by PC-building platform PCPartPicker.com, with the cost of some DDR4 and DDR5 modules finally hitting a stable value. Memory modules that have leveled off prices include DDR4-3200 (2x8GB), DDR4-3600 (2x16GB), DDR4-3600 (2x32GB), DDR5-4800 (2x16GB), and DDR5-5200 (2x16GB). On the other hand, other high-performance memory modules like the DDR5-5600 and DDR5-6000 still seem to have some upticks, although at a slower pace compared to the previous months.

Beyond these trends, specific examples include the Corsair Vengeance 32GB (2x16GB) DDR5-6000 CL36 on Amazon, which stabilized at $339 between November and January (from a low just over $100), before making another hike to $439 in early January and staying there until today. There’s also the Patriot Viper Elite 5 16GB DDR5-6000 CL30 on Newegg, which was priced at $169.99 since early December 2025, although it only cost $43.99 in October 2025. We also saw this Corsair 32GB Vengeance kit go on sale for a brief period, bringing its price down to $344 from a high of $410.

Indications of a memory shortage started appearing in the third quarter of 2025, when the insatiable demand for HBM by the AI infrastructure build-out coincided with several fabs phasing out DDR4 in favor of higher margin DDR5. We started to fully see its impact by November and December, when retailers in Japan and Germany started rationing memory and storage chip-heavy components, like RAM, SSDs, and even GPUs. This is why a Kingston rep told users that they shouldn’t wait if they need to upgrade their RAM or SSD, as prices will only continue to go up.

For now, chip prices seem to be stabilizing, albeit at a new, inflated price that will be difficult for enthusiasts to stomach. One Sapphire employee predicted in December 2025 that we will eventually hit this plateau in six to eight months — hopefully, the price equilibrium we’re seeing at the moment is the early arrival of this forecast and isn’t just a pause before they start racing up again.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Jowi Morales is a tech enthusiast with years of experience working in the industry. He’s been writing with several tech publications since 2021, where he’s been interested in tech hardware and consumer electronics.

-

Dr3ams And as long as people keep buying them at those prices, then manufacturers (fleecers) will have no motivation to lower the prices. It's a GPU repeat.Reply -

bmtphoenix Reply

Nah. People aren't buying at the kind of volume and pace to sustain these prices on that alone.Dr3ams said:And as long as people keep buying them at those prices, then manufacturers (fleecers) will have no motivation to lower the prices. It's a GPU repeat.

The demands from AI data centers won't last all that long. Efficiency and experience will make buying so much RAM pointless, eventually.

A combination of realizing what "AI" is and/or isn't, running out of big businesses that have the money and the need for their services, and old AI customers realizing that people are still better at a lot of the things they switched to AI, will cause an abrupt halt to current demand.

If we ever build real AI, then that will replace a lot of jobs and the outcome will be different.

What we're experiencing now is not that. This is just a bubble built on marketing. -

Dr3ams Reply

Something similar was said about GPUs and Mining. But, years later the prices are no where near what they were before the Mining and AI rage.bmtphoenix said:Nah. People aren't buying at the kind of volume and pace to sustain these prices on that alone.

The demands from AI data centers won't last all that long. Efficiency and experience will make buying so much RAM pointless, eventually.

A combination of realizing what "AI" is and/or isn't, running out of big businesses that have the money and the need for their services, and old AI customers realizing that people are still better at a lot of the things they switched to AI, will cause an abrupt halt to current demand. -

ezst036 Reply

Here's the fun question:Dr3ams said:Something similar was said about GPUs and Mining. But, years later the prices are no where near what they were before the Mining and AI rage.

Were those low prices incorrect, and now things are actually where they should be? Same for RAM.

Its easy to stop and say that things are a bubble and AI is doing this and AI is doing that, but a market correction may have needed to take place anyways to get prices away from those low-bubble prices. Bubbles do not just pop on the high end. Bubbles also pop on the low end.

Just to state it the reverse way: Simply coming in and saying that the "old" low prices are "what is correct" is an assertion without a basis. I am not asserting either one, BTW, just leaving the question open in my thoughts. -

thestryker Reply

Seeing as companies don't sell things at a loss all we're talking about is their margins. Leading into the most recent crypto boom nvidia had been consistently increasing their margins while board partner margins were dropping. Another important thing here is that nvidia has been optimizing silicon usage to a huge degree which allows them to offset wafer cost increases. The 3060 die is larger than the 5070 die for example so even if the wafer cost was doubled the price of the 5070 is so much higher that they are likely making a higher margin.ezst036 said:Were those low prices incorrect, and now things are actually where they should be? Same for RAM.

Some price increases are certainly expected as prices across the board have gone up, but suggesting that the current state of pricing is about anything other than company profits is disingenuous. -

Dntknwitall So my curious mind got to thinking how fake these prices are. There is no shortage, there is only demand from one sector that should be buying ram from the same market as you or I. These prices are inflated the 3 big manufacturers only and this is just a repeat of the GPU mining crisis that inflated prices when it shouldn't have, but that was more of a scalping price inflation which this is not the case. Anyway what can we expect to be price fixed next, motherboards, CPUs, or even PC cases cause you know they all need their chunk of the pie and do a pump and dump scheme of their own, right?Reply -

abufrejoval Reply

I am sorry to say that this is simply market economy at work.Dntknwitall said:So my curious mind got to thinking how fake these prices are. There is no shortage, there is only demand from one sector that should be buying ram from the same market as you or I.

There is nothing "fake" with these prices, they are simply at the point where demand and supply meet today, as prices go up, demand peters out, resulting at no shortage at that price level.

You'd only arrive at a really "fake" or theoretical price, if nothing would sell: a live mammoth would have a fake price, because none are available.

Well, if the demand was high enough, I'd guess they'd try harder to re-create one... and the price would no longer be fake.

You may be hoping that AI GPU will go the way of the Sabertooth, but I'm not sure that extinction events would result in lower prices for gamers. -

abufrejoval Reply

"just marketing" feels wrong, when it's a collective bet the size of trillions.bmtphoenix said:What we're experiencing now is not that. This is just a bubble built on marketing.

Then again, the Tulip mania of 1634-37 also started with "marketing". -

abufrejoval Reply

I don't think anyone is suggesting that companies have anything but their profits at heart, and that might include cutting losses. I don't know many individuals who sustain their life by acting differently.thestryker said:Some price increases are certainly expected as prices across the board have gone up, but suggesting that the current state of pricing is about anything other than company profits is disingenuous.

But those companies also don't have absolutely exclusive ownership over that market, since there is quite a lot of DRAM already out there. And the fact that we still see trading, when production is exclusively allocated to hyperscalers, implies to me that DRAM already sold is re-entering the market, because selling pre-owned DRAM is better (or less-bad) for the bottom line than to keep it.

Some of it may be 'scalpers', but that's speculation, quite literally moving against the market ("speculus" means mirror in Latin). Speculation tends to result in prices stabilizing at a constantly shifting compromise point.

It's been done with near everything one could think of, including the tulips already mentioned. Now it's hitting gamers again, who unfortunately just happen to share a market with crypto and AI.

Let's be grateful it's not oxygen and light just yet.