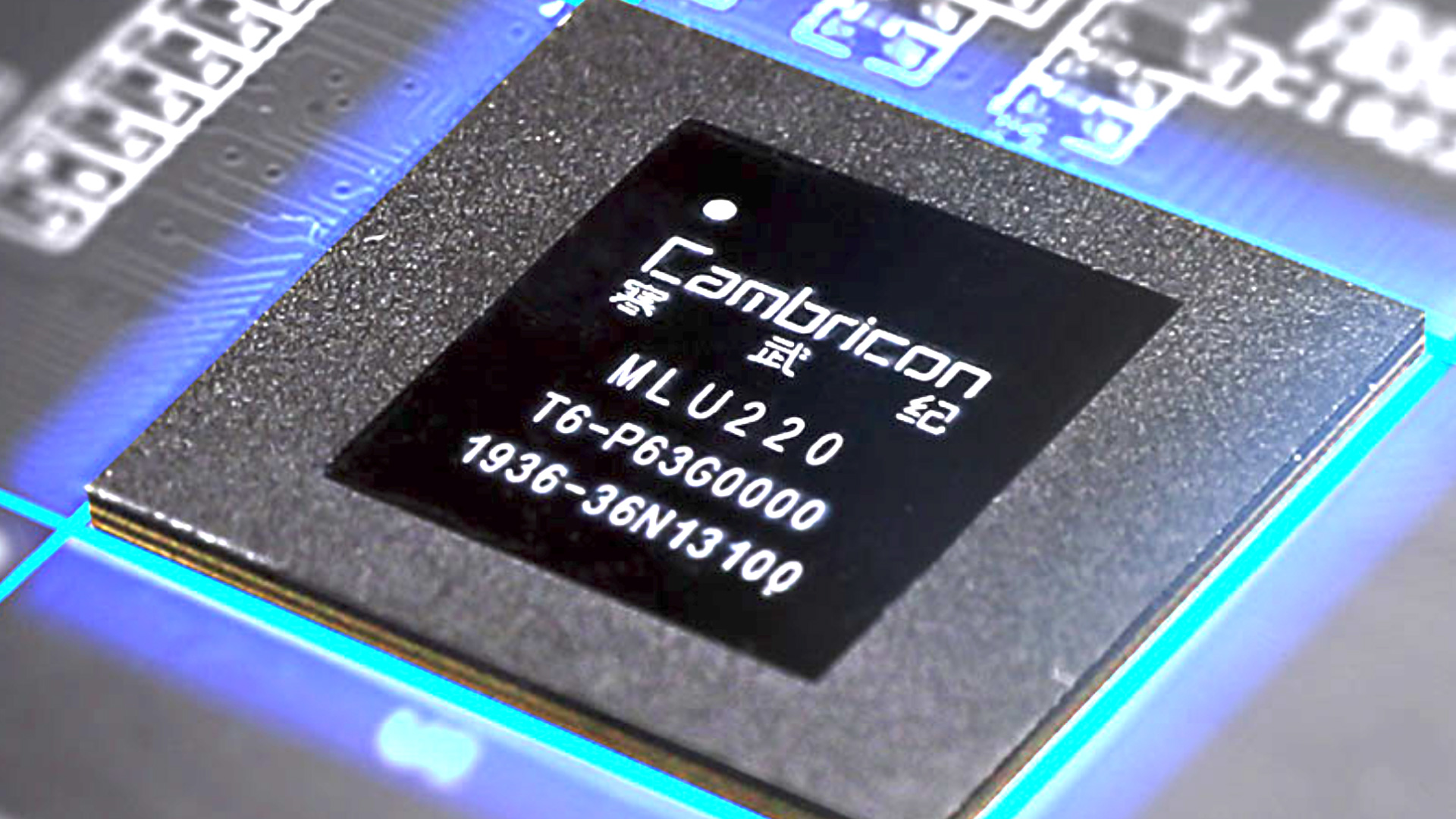

Chinese tech firm Cambricon looks to step into Nvidia void, triple AI chip production next year — seeks to rival Huawei, but production remains a concern

Where it will make all those chips, though, is anyone's guess

Chinese tech firm Cambricon Technologies has plans to triple its production of domestic AI chips in 2026, according to Bloomberg. Although not officially announced, people familiar with the matter reportedly claim Cambricon is looking to fill the void left by Nvidia's pullback from the region over trade issues and government mandates, as well as to compete more effectively with national giant Huawei.

Questions still remain, however, over how Cambricon will achieve these aims, as it's not clear whether the fabrication capacity exists for it to complete its goals in such a short time frame.

Over the past year, Chinese access to high-end AI inferencing and training hardware from companies like Nvidia has been mixed. On-again, off-again trade tariffs and chip embargos made them an inconsistent source at best, even with robust smuggling schemes. As a result of this, combined with a growing sentiment that semiconductor manufacturing had become a national security issue as well as an economic one, China has been pushing for its national companies to rely more on Chinese-produced chips, especially for AI workloads.

This marks an enormous opportunity for companies like Huawei, and indeed Cambricon, as the few companies actually making money from AI are the ones selling the hardware. Huawei has already announced it will be doubling its own chip production output. But producing it is still not going to be easy, especially as these companies are competing for some of the same underlying wafers.

According to Bloomberg's sources, Cambricon is looking to ramp up to half a million AI accelerator chips in 2026, including 300,000 of its flagship Siyuan 590 and 690 chips. That's more than triple the 142,000 it is expected to make in 2025, according to Goldman Sachs estimates. For next year's totals, it will reportedly lean on Semiconductor Manufacturing International and its "N+2" 7-nanometer process node.

Cambricon may have the kind of money it needs to grab a fair share of the wafer supply, though. Its revenue for the last quarter reportedly jumped 14 times, showing an enormous surge in interest from domestic companies. It's reportedly secured contracts and interest from many of China's biggest AI firms, including Alibaba and ByteDance, as the government pushes them towards domestic suppliers.

The quality of local fabrication may prove problematic, though. Cambricon's 590 and 690 chips have a reported yield rate of just 20%, meaning only one in every five of the chips produced is actually viable for use. Even if it can secure production capacity from Semiconductor Manufacturing International for its chips, a sizeable portion of what it pays for may be unusable.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Although inefficient yields in cutting-edge chip fabrication aren't unusual, Bloomberg points out that Taiwanese tech giant TSMC's latest 2nm process technology (as many as seven generations ahead of what SMIC is fabricating) has a yield rate as high as 60%, making it much more efficient to produce.

Don't forget memory

Like every other company around the world making anything technological, Cambricon may face the trouble of memory shortages. The companies it hopes to supply are unlikely to have an easy time getting the HBM and LPDDR they need for their data center projects, which could hamper the orders it expects to receive.

Still, Cambricon has benefited enormously from the AI boom and is likely to continue to do so with plenty of government assistance. As the US and China move into a multi-polar world of AI chip development and supply, China will continue to build out its industry with enormous investment - even if the underlying technology it has available is fundamentally years behind that produced by Western companies like Nvidia, AMD, and Intel.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Jon Martindale is a contributing writer for Tom's Hardware. For the past 20 years, he's been writing about PC components, emerging technologies, and the latest software advances. His deep and broad journalistic experience gives him unique insights into the most exciting technology trends of today and tomorrow.