Former Intel CEO lays out radical plan to rescue the company — Suggests ousting Lip-Bu Tan and asks for $40 billion investment from Nvidia, Apple, and others

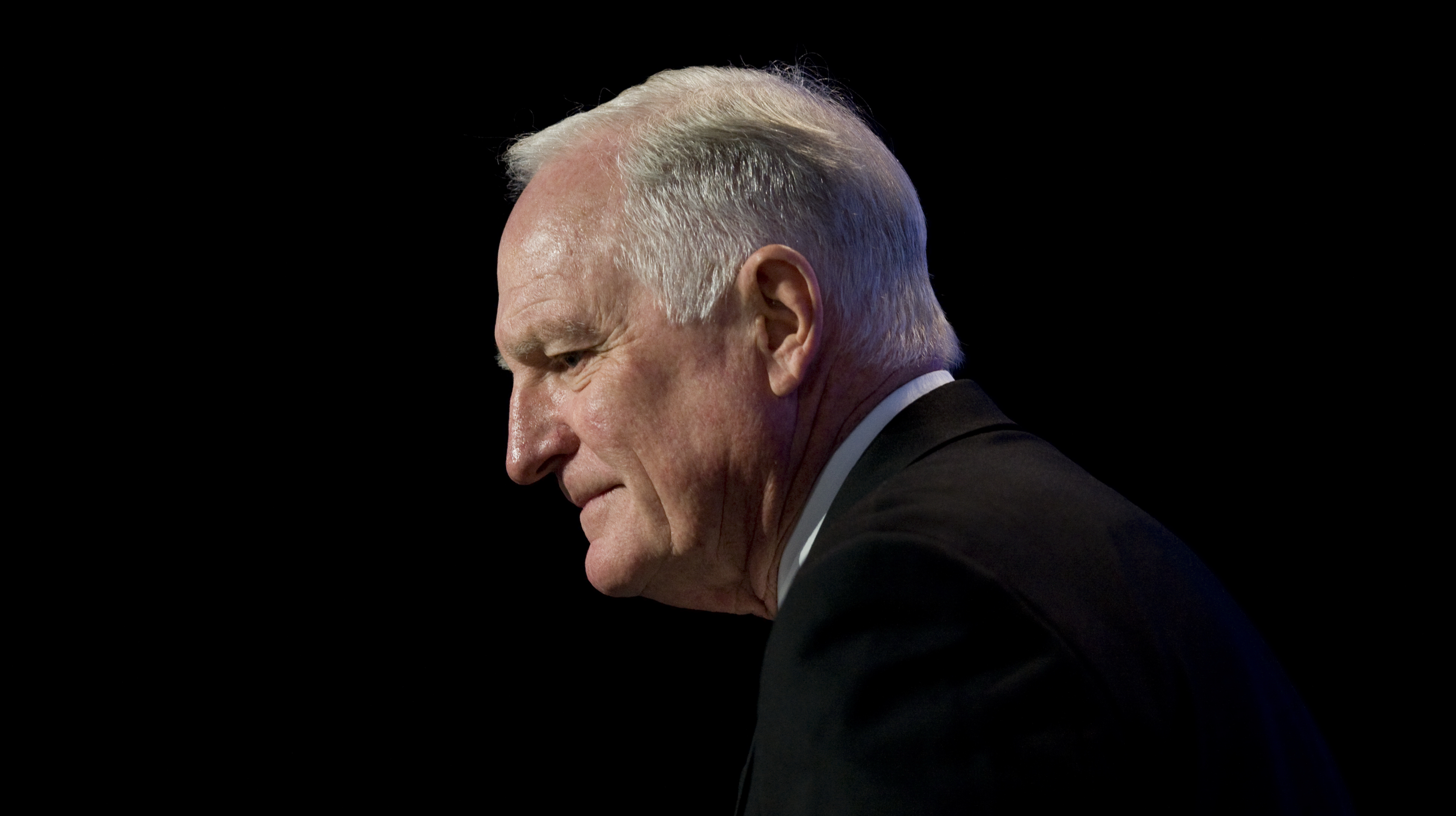

Craig Barrett was Intel's CEO for seven years.

Former Intel CEO and chairman Craig Barrett has laid out a blunt blueprint to rescue both Intel and, by extension, America’s ability to produce state-of-the-art chips. He has warned that without urgent funding, Intel risks ceding critical ground to overseas rivals, which is an unprecedented fate since the company is crucial to America's contemporary semiconductor ambitions. He stressed that leadership in chipmaking requires heavy investment years in advance of demand

Writing in Fortune, Barrett argued that Intel remains the sole US company capable of matching Taiwan’s TSMC at the leading edge—but lacks the capital to scale and modernize its production. With government CHIPS Act funding insufficient to close the gap, he insists the only realistic source of cash is Intel’s own customers. He proposed that Intel’s eight largest customers, including Apple, Google, and Nvidia, should each contribute $5 billion in return for guaranteed domestic supply and pricing leverage against Asian competitors.

Barrett said neither TSMC nor Samsung intends to bring their most advanced manufacturing to US soil, posing long-term risks for American technology companies dependent on imported chips. “The only place the cash can come from is the customers,” he wrote, adding that leadership in manufacturing requires proactive investment years ahead of market demand.

The proposal comes as Intel faces significant headwinds. Under CEO Lip-Bu Tan, appointed in March 2025, the company has been cutting over tens of thousands of jobs and cancelling major projects amid steep losses—$18.8 billion in 2024 and another $2.9 billion in Q2 2025. Intel has also purportedly stuggled with severe yield issues on its 18A manufacturing process, delaying key products and soft-forcing a pivot to its future 14A node. Barrett criticized the current leadership’s reluctance to invest in 14A without pre-existing customer contracts, calling the approach “a joke” and warning it risks falling permanently behind.

Barrett’s plan hinges on two pillars: immediate investment in critical technologies like High-NA EUV and backside power delivery, and potential US tariffs on imported advanced chips to stimulate domestic demand. He rejected calls to split Intel into separate design and manufacturing entities, arguing that the core problem is capital, not structure.

His comments arrive as Intel navigates political turbulence. President Donald Trump has publicly called for Tan’s resignation over alleged ties to China, with the two meeting at the White House today. While not directly addressing the leadership dispute, Barrett framed his proposal as essential for both national security and supply chain stability, warning that the US cannot afford to let Intel’s manufacturing leadership slip away.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Hassam Nasir is a die-hard hardware enthusiast with years of experience as a tech editor and writer, focusing on detailed CPU comparisons and general hardware news. When he’s not working, you’ll find him bending tubes for his ever-evolving custom water-loop gaming rig or benchmarking the latest CPUs and GPUs just for fun.

-

anoldnewb This comes from a guy who led Intel when its "stagnation" was incubated. I.e. he was in charge when poor strategic and tactical decisions were made that led to future process node and CPU architecture problems.Reply

Nonetheless he is correct that

1.) a huge capital infusion is required.

2.) if Intel quits on the 1.8A and future process nodes, America will be dependent on Taiwan for the most advance chips and when China attempts to blockade or takes over Taiwan we are in trouble. -

logainofhades I agree he is correct. Intel needs external help right now. Current CEO was not a good choice.Reply -

hotaru251 Reply

correct? sure. Intels spiraling down to ground, but the way he states it is wrong.logainofhades said:I agree he is correct. Intel needs external help right now. Current CEO was not a good choice.

Wanting the big players (apple/nvidia/etc) to invest 5B each?When Intel doesn't use their own stuff (shows a real lack of faith) & their future existence is questionable....thats a big investment w/ more risk than reward.

...and I will go further and say its in their (big tech companies) best interest to LET Intel die...so they are forced to sell everything and then they can all fight for the parts they want. -

pug_s I don't know if throwing money at it would fix the problem. AMD made the decision to split up its Foundry and CPU business years ago but Intel can't do the same.Reply -

RUSerious Reply

Who do you think wants *any* part of Intel's manufacturing? Or do you mean their broken semiconductor R&D engineering departments.hotaru251 said:...and I will go further and say its in their (big tech companies) best interest to LET Intel die...so they are forced to sell everything and then they can all fight for the parts they want. -

JRStern Intel's capex plans are already (still) about 500% more than they can handle.Reply

Even so they deserve more support.

I just don't know what they're getting already, the $8b is cash but there's more than that in tax credits and such, it's all wonderfully obscure, government doesn't want to say and Intel doesn't want to say. Somebody must have the whole list. -

DS426 nVidia could probably care less about x86 at this point, so I don't see Intel being important to them. If anyone was to throw cash at Intel, it would be Microsoft. If they can't even get their marriage partner to help them, I don't see any other private sector doing it... not in a meaningful enough way (amount of cash that is). Does anyone see where this is going? What happened the last time GM and Chrysler went bankrupt? Uncle Sam bailed out GM and gave Chrysler government-backed loans when private banks saw it as too high-risk, which they actually paid back early.Reply -

doomtomb If it's not already obvious, Lip-Bu Tan was brought in to correct the financial-side of Intel, mainly overspending by Gelsinger. Unfortunately this is probably the wrong move long-term.Reply -

phead128 Nvidia, Apple, Google, AMD are all multi-national corporations with US and global footprints.Reply

TSMC, Samsung, Intel, are all multi-national corporations with US footprints and global footprints.

Why would Nvidia, Apple, Google, AMD favor Intel over TSMC and Samsung, unless you go for some dog whistle how they are foreign, despite having US-based fabs. Well guess what, INTEL outsources to TSMC too, over 40% of Intel's production is outsourced to this "foreign" company. So Intel can't have it's cake and eat it, if it wants to tout American made, but outsources to TSMC too, then Nvidia, Apple, Google will do the same. -

Savage1701 Doesn’t the author mean “ousting “ instead of “outing “?Reply

Time to get that AI retrained, Tom’s!