GlobalFoundries gets $1.5 billion subsidy from U.S. gov't after it was fined for violating export laws to China

GlobalFoundries to expand U.S. semiconductors operations.

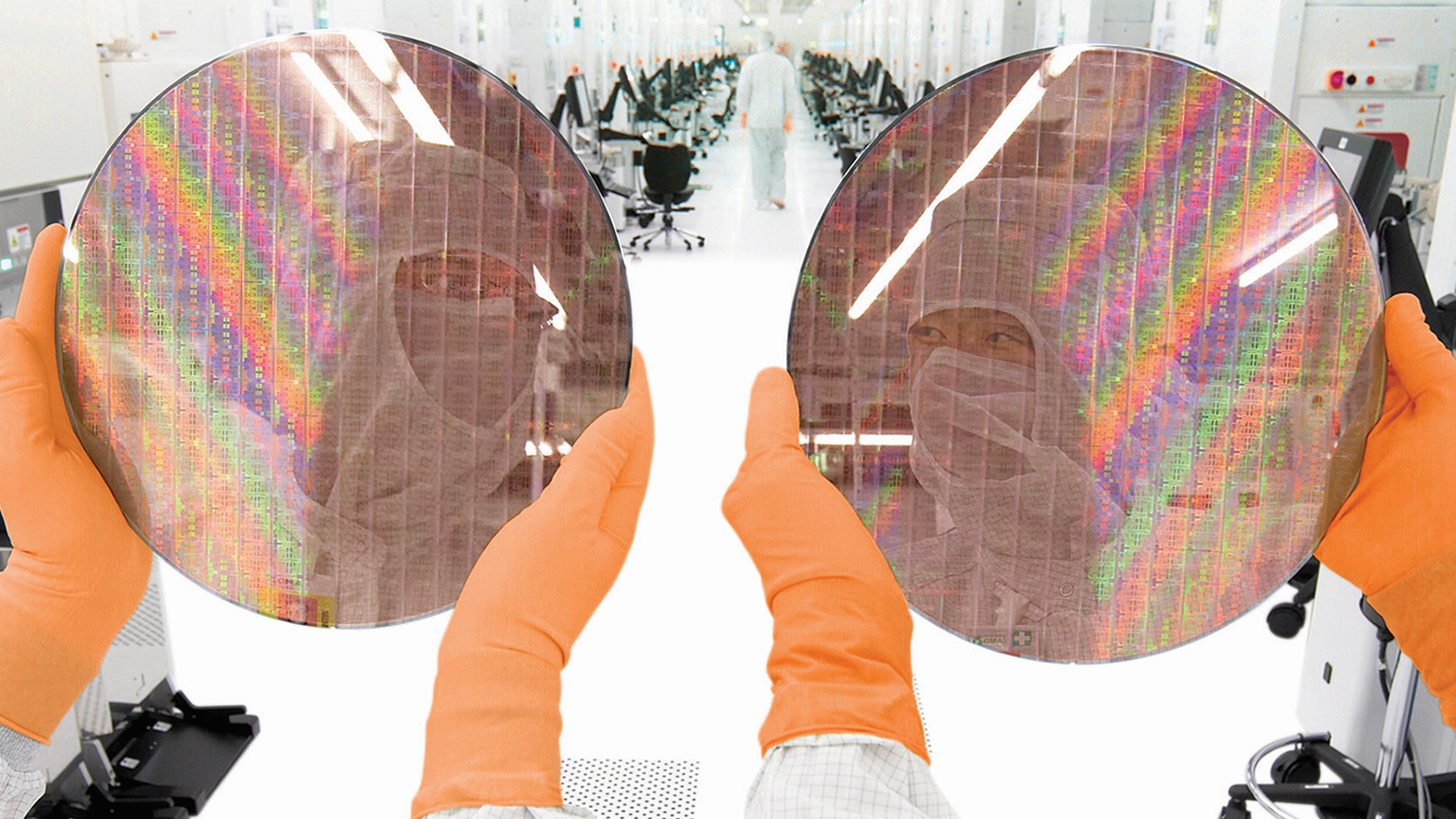

GlobalFoundries (GF) has been awarded up to $1.5 billion under the CHIPS and Science Act to expand its U.S. semiconductor manufacturing operations. The funding will be part of the company’s $13 billion investment plan to expand production capacity at its two U.S. sites over a decade. The U.S. government signed a deal with GF after the company was fined $500 million for violating U.S. export rules, as The Register noticed.

“GF’s essential chips are at the core of U.S. economic, supply chain and national security,” said president and CEO Dr. Thomas Caulfield. “We greatly appreciate the support and funding from both the U.S. Government and the states of New York and Vermont, which we will use to ensure our customers have the American-made chips they need to succeed and win.”

GF will use the funding for three major projects. The first is expanding its Fab 1 facility in Malta, New York, by installing new tools and porting various technologies from its global sites in Singapore and Germany. This will ensure a reliable supply of domestically produced chips for the U.S. automotive sector.

The second project aims to upgrade GF’s Essex Junction, Vermont, fab. The modernization will boost the capacity to produce next-generation gallium nitride (GaN) semiconductors for electric vehicles, data centers, IoT devices, and smartphones.

The third initiative involves constructing another cleanroom module at Fab 1 in Malta, New York. This new facility will manufacture chips for diverse markets, including AI, aerospace, and defense. Over the next decade, this expansion is expected to triple the campus’s chip production capacity.

The combined projects will create nearly 1,000 manufacturing jobs and over 9,000 construction roles. The investment also includes $550 million from New York State’s Green CHIPS Program and contributions from Vermont, GF’s partners, and strategic customers.

We are strategically strengthening every part of the semiconductor supply chain

Commerce Secretary Gina Raimondo

GF’s facilities in New York and Vermont are accredited under the Trusted Foundry program, ensuring secure chip manufacturing to meet the requirements of the U.S. Department of Defense and various agencies. This highlights GF’s important role in domestic chip supply.

Stay On the Cutting Edge: Get the Tom's Hardware Newsletter

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

“By investing in GF’s domestic manufacturing capabilities, we are helping to secure a stable domestic supply of chips that are found in everything from home electronics to advanced weapons systems,” said Commerce Secretary Gina Raimondo. “Thanks to President Biden’s leadership and because of CHIPS for America, we are strategically strengthening every part of the semiconductor supply chain to ensure we meet our national security objectives and can out-compete and out-innovate the rest of the world.”

It is noteworthy that recently the U.S. Commerce Department fined GlobalFoundries $500,000 for sending $17.1 million worth of chips to SJ Semiconductor, an affiliate of blacklisted Chinese chipmaker SMIC, without obtaining the required license, reports Reuters.

GlobalFoundries attributed the violation to a data-entry error made before the blacklisting and highlighted its commitment to maintaining a solid trade compliance program. The company voluntarily disclosed the issue and worked with authorities, earning acknowledgment for its cooperation.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

bit_user Maybe this just says the laws or regulators need to be more creative about penalties, especially when in comes to significant players in strategically vital industries.Reply

For sanctions violations, I'm pretty sure they could pursue criminal prosecutions against the key decision makers involved in these activities. They probably just took the easy route of financial penalties, to save time, trouble and the expense of having to find out who was at fault for the violations and undertake a criminal case (which I think has a much higher burden of proof). It would send a strong message though. -

RUSerious Wow. $1.5B - .5B. That's gotta hurt. The company really, really doesn't want to throw it's C-level execs under the bus.Reply -

nightbird321 Reply

"after the company was fined $500 million for violating U.S. export rules"RUSerious said:Wow. $1.5B - .5B. That's gotta hurt. The company really, really doesn't want to throw it's C-level execs under the bus.

typo, thousand, not million -

RUSerious Reply

Oh, a $500K fine is peanuts. Good for GF then! Thanks :cool:nightbird321 said:"after the company was fined $500 million for violating U.S. export rules"

typo, thousand, not million