Lenovo led global PC shipment in 2024 with 61.8 million units — Apple is gaining PC market share with a 17.3% growth

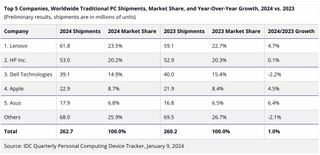

262.7 million PCs shipped in 2024.

According to IDC, the global shipments of PCs totaled 262.7 million units in 2024, which was 1% higher than the previous year, a very modest growth. All leading PC makers, except Dell, managed to sell more client computers than in 2023 and slightly increased their market shares, essentially eating the lunch of smaller PC makers.

Lenovo led with a 23.5% share for the entire year, shipping 61.8 million units, a 4.7% increase. HP retained its somewhat distant second position with 53.0 million shipments, growing 0.1%, while Dell shipped 39.1 million units, down 2.2%. Apple’s shipments rose to 22.9 million, up 4.5%, and Asus saw the largest growth at 6.4%, reaching 17.9 million units. Shipments from smaller vendors declined 2.1%, reflecting consolidation among major players.

"Though the market has been experiencing a slower return to growth, there was some room for optimism in Q4 as government subsidies in China led to better than expected performance within the consumer segment," said Jitesh Ubrani, research manager with IDC's Worldwide Mobile Device Trackers.

Ubrani commented, "Beyond that, the U.S. and some European countries also showed strong performance due to end-of-year sale promotions, as well as enterprises continuing on the path of upgrading hardware before the end of support for Windows 10 which is scheduled for October 2025."

PC shipments increased by 1.8% in the fourth quarterThe fourth quarter saw a 1.8% increase in PC shipments, reaching 68.9 million units. IDC believes this growth was driven by government subsidies in China, year-end sales in the U.S. and Europe, and enterprise hardware upgrades ahead of the October 2025 end-of-support date for Windows 10. While this marked a slow recovery, challenges like economic uncertainty, tariff risks, and high costs for new AI-enabled PCs tempered optimism.

Lenovo maintained its market leadership in the fourth quarter, achieving a 24.5% share with 16.9 million shipments, up 4.8%. HP followed with 19.9% and 13.7 million units but saw a slight decline of 1.7%. Dell held 14.4% in Q4, with a flat performance. Apple showed the highest growth, at 17.3%, as its shipments rose to 7.0 million, a good but not record result. Asus also performed well, growing 11.7% with 4.7 million units shipped, leaving behind Acer.

The outlook for 2025 is mixed. There are obvious opportunities for PC makers in corporate upgrades ahead of Windows 10's end of support and AI PCs in the consumer space. However, the combination of economic instability, potential tariff increases, and evolving customer demands makes forecasting and planning difficult, to put it mildly. Still, the industry seems cautiously optimistic about long-term growth potential.

Stay On the Cutting Edge: Get the Tom's Hardware Newsletter

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

"The overall macroeconomic concerns seem to be overshadowing some of the progress and excitement around AI PCs. However, we maintain the view that the impact that on-device AI will have on the industry will be positive, even if the inflection point is delayed," said Ryan Reith, group vice president with IDC's Worldwide Device Trackers.

Reith added, "When the industry is trying to push new AI PCs that come with higher cost at a time when use cases are still being vetted and budgets are tight, that is clearly going to be a challenge. But on-device AI for PCs is inevitable, therefore, right now it is about suppliers trying to be patient as their customers are dealing with headwinds unrelated to these technology advancements."

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.