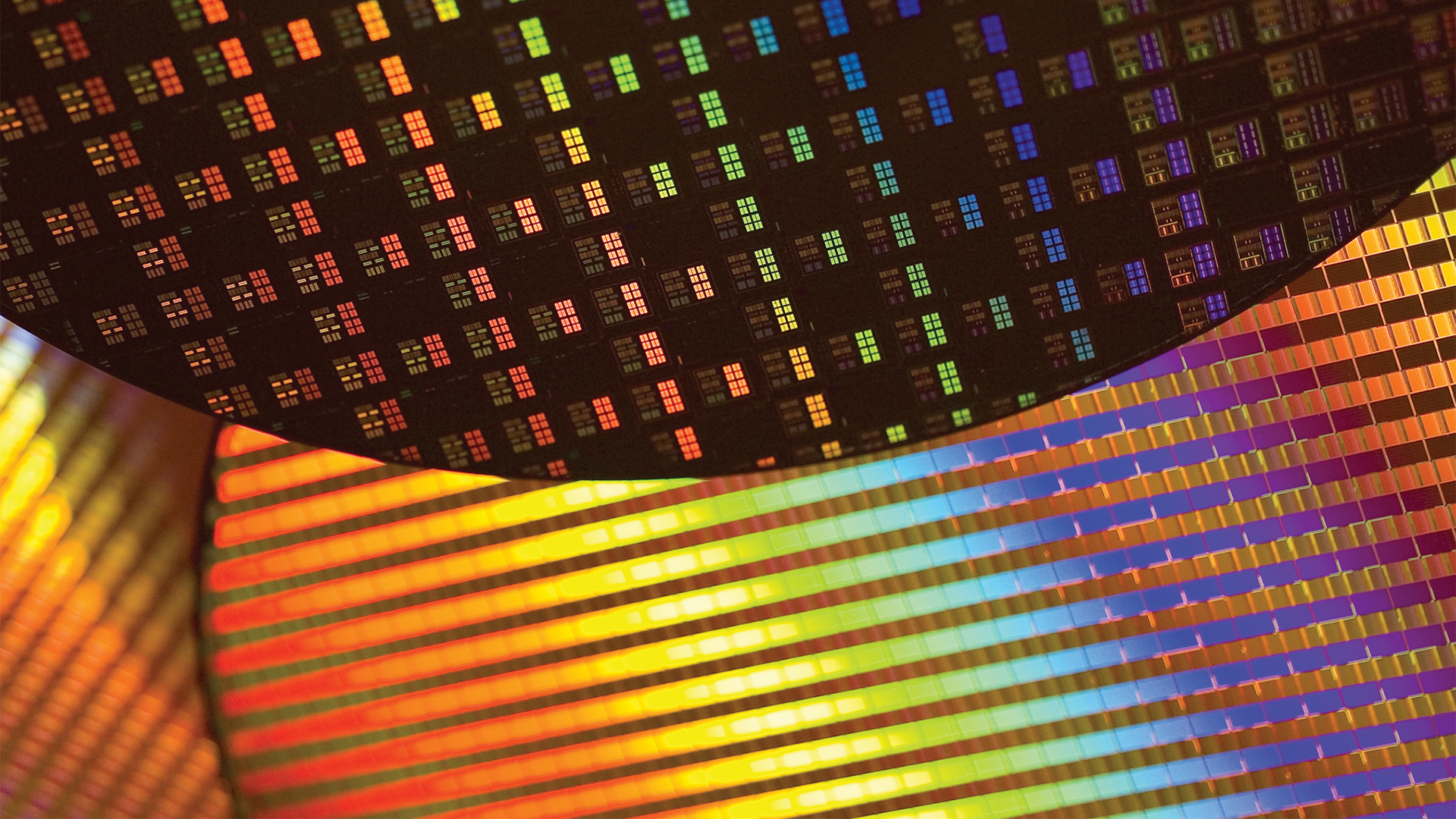

Semiconductor industry enters unprecedented ‘giga cycle’, says report — scale of artificial intelligence is rewriting compute, memory, networking, and storage economics all at once

New industry analysis argues the AI era is reshaping every part of the chip market at once.

A growing body of forecasts from AMD, Nvidia, Broadcom, and major research firms now points toward a semiconductor market that passes the trillion-dollar threshold before the decade closes, driven by an AI infrastructure buildout several times larger than any previous expansion in the industry’s history.

New analysis from Creative Strategies is calling this shift a "giga cycle," arguing that the unprecedented scale of AI demand is restructuring the economics of compute, memory, networking, and storage simultaneously. Global semiconductor revenue was roughly $650 billion in 2024, yet multiple outlooks now place the trillion-dollar mark in 2028 or 2029. AI is responsible for most of that upward revision.

AMD CEO Lisa Su recently lifted the company’s own long-term expectations, describing the AI hardware market as a $1 trillion opportunity by 2030 while projecting 35% compound annual growth for AMD overall and around 60% for its data-center business. She also spoke out against AI bubble talks that have dominated in recent months.

Meanwhile, Nvidia has set even broader expectations, describing the coming five years as a $3 trillion to $4 trillion AI infrastructure opportunity during the company’s Q2 2026 earnings call. This figure is based on system-level deployments across hyperscalers, sovereign AI projects, and enterprise clusters.

The broader implication is that every major category of silicon is expanding at once. Creative Strategies expects data-processing silicon to exceed half of total semiconductor revenue by 2026. AI accelerators, which accounted for under $100 billion in 2024, are projected to reach the $300 billion to $350 billion range by 2029 or 2030. That growth pushes system spending sharply higher. The AI server market is forecast to climb from about $140 billion in 2024 to as much as $850 billion by 2030, a trajectory that will reshape chip demand even before accounting for custom silicon.

This environment has elevated ASIC development to a central role in hyperscaler roadmaps. Broadcom expects its custom-silicon business to exceed $100 billion by decade’s end. The company has already disclosed a $10 billion AI infrastructure order from a customer thought to be OpenAI.

Memory and packaging remain the tightest constraints. HBM revenue is forecast to grow from roughly $16 billion in 2024 to more than $100 billion by 2030. Each HBM generation consumes a larger share of wafer supply than conventional DRAM, pushing the broader memory market upward as AI clusters scale. Advanced packaging faces similar pressure as CoWoS capacity is projected to expand by more than 60% from the end of 2025 to the end of 2026.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

"The defining characteristic of the semiconductor giga cycle is that the market expansion is large enough to create greenfield opportunities across every segment of the value chain," says Creative Strategies, presenting the combined effect as a moment where every segment is growing in unison rather than a cycle concentrated in any particular area.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Luke James is a freelance writer and journalist. Although his background is in legal, he has a personal interest in all things tech, especially hardware and microelectronics, and anything regulatory.

-

vanadiel007 What goes up, must come down. Big rise, big fall.Reply

This pace is simply not sustainable and money eventually will cap out, especially once it's measured in Trillions of USD rather than Billions of UDS. -

Sluggotg The costs associated with these AI farms is beyond what most will make on them. The initial financing, with the huge amount of interest on such large loans combined with the insane electrical requirements to keep them running will require a dramatic amount of money coming in to keep it operating.Reply

What AI Farms are actually making money? This is just like the Dot Com bubble. Billions were blindly invested in businesses that had something to do with the internet, most of which were a total bust. (There were certainly winners too).

I do believe that in 5 years or so, the cost of chip production will drop to very low levels due to all the facilities being financed by AI investment right now. Maybe we will get affordable DIMMS and Graphics Cards again? (Wishful thinking on my part). -

Flemkopf Reply

Wikipedia is quoting about a half trillion in investments in telecoms leading up the the dot com bubble burst. I have no idea what the AI buildout is at, but it's something stupidly massive. I too suspect that silicon prices will plummet sometime in the next few years, but what do I know about how the corporate boards want their half-trillion dollar companies managed?Sluggotg said:The costs associated with these AI farms is beyond what most will make on them. The initial financing, with the huge amount of interest on such large loans combined with the insane electrical requirements to keep them running will require a dramatic amount of money coming in to keep it operating.

What AI Farms are actually making money? This is just like the Dot Com bubble. Billions were blindly invested in businesses that had something to do with the internet, most of which were a total bust. (There were certainly winners too).

I do believe that in 5 years or so, the cost of chip production will drop to very low levels due to all the facilities being financed by AI investment right now. Maybe we will get affordable DIMMS and Graphics Cards again? (Wishful thinking on my part).

I'm just hoping that we can get power prices back to something reasonable when this is all over. Nothing like gigawatt service being set up and then abandoned to make finances for utilities unstable. -

George³ It is possible that artificially inflated hardware prices will fall, but I do not believe that products containing transistors will fall much below the prices before they were inflated. Production with edge lithography will continue to increase in price per processor, and although the cost of production is still well below the selling price, companies will want to be able to pay all their costs, not just the silicon baking, and make a profit that will satisfy shareholders and have money for R&D and pay for the production of the next generations.Reply