TSMC 'very nervous' about AI bubble concerns despite another record-setting quarter, but assured of demand — CEO says careless investment 'would be a disaster for TSMC for sure,' company will invest $52-$56 billion in capex

AI bubble? Haven't heard of it.

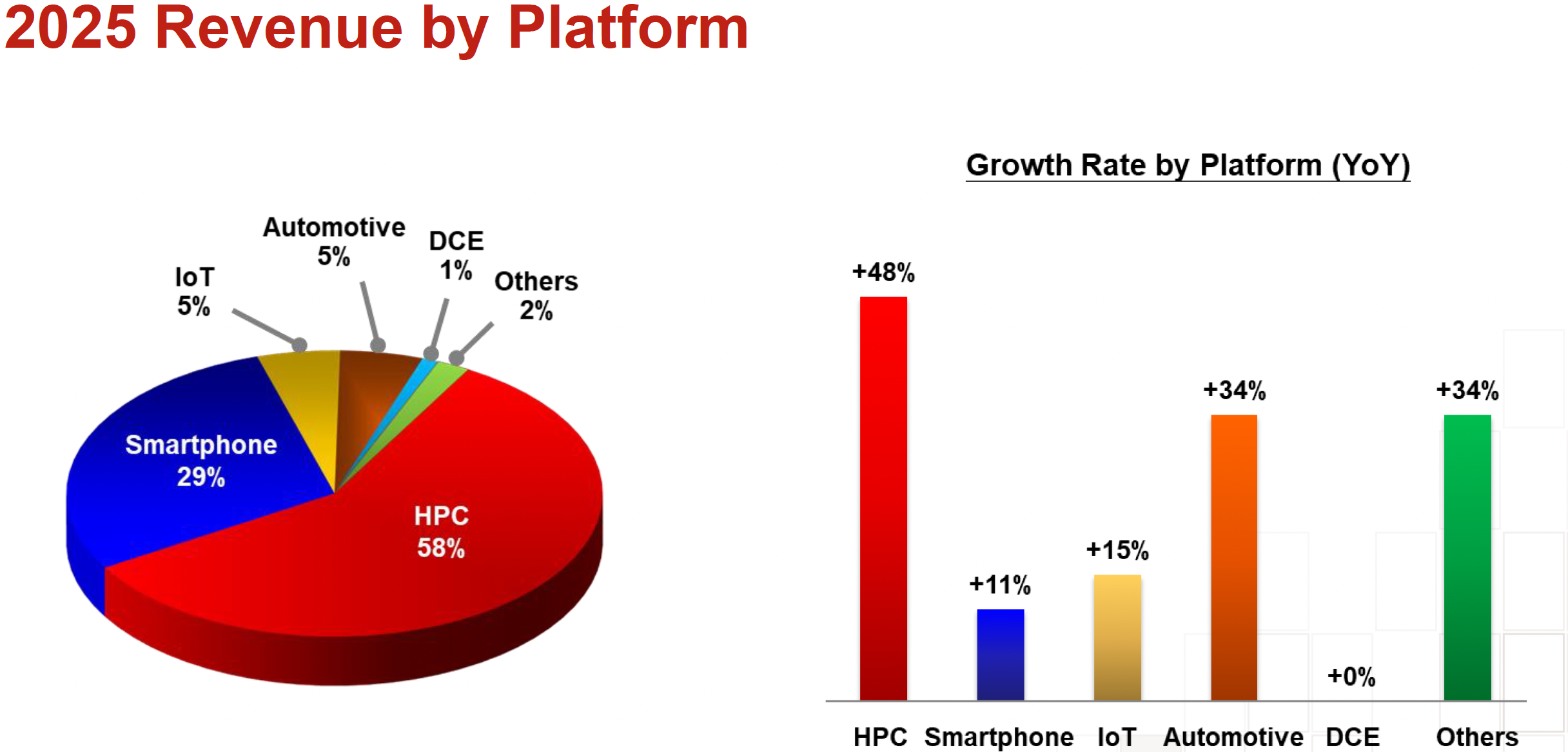

TSMC on Thursday published its financial results for 2025, posting an annual revenue of $122.42 billion for the first time in its history. TSMC's extraordinary results were driven by sales of AI and HPC processors — which accounted for 58% of the company's 2025 revenue — as well as the company's growing market share. To support rising demand for its services as well as tooling of advanced fabs in Taiwan and Arizona, TSMC has committed to increasing its capital expenditure (CapEx) to $52 billion - $56 billion in 2026, which is more than Intel and Samsung spent in 2025 combined. When asked about the prospect of an AI bubble, TSMC's CEO warned the company was "very nervous," hence the hefty CapEx spend. He further warned, "If we did not do it carefully, that would be a disaster for TSMC for sure."

An AI bubble? What AI bubble?

Apparently, TSMC does not expect demand for AI processors to slow down in the foreseeable future, so this year the foundry plans to spend between $52 billion and $56 billion on new production capacity and fabrication/packaging tools.

More specifically, TSMC intends to spend about 10% of its CapEx on specialty technologies, between 10% and 20% of CapEx on advanced packaging, and around 70% will be used to buy sophisticated equipment (both for existing and new fabs) and build new advanced logic fabs. While TSMC certainly understands the risks of the so-called AI bubble, given the lead times for new fabs (about three years) and advanced fab tools, it does not seem to expect that bubble to pop in the coming years, at least based on C.C. Wei's answer to one of the questions.

"You essentially try to ask us whether the AI demand is real or not," C.C. Wei, chief executive of TSMC, asked rhetorically during the company's earnings conference. "I am also very nervous about it. You bet, because we have to invest about $52 billion to $56 billion for the CapEx. If we did not do it carefully, and that would be big disaster to TSMC for sure. So, I spent a lot of time in the last three – four months talking to my customer and my customer's customer, as I want to make sure that my customer's demand is real. So, I talked to those cloud service providers, all of them. […] I am quite satisfied with the answer. Actually, they showed me the evidence that the AI really helps their business. So, they grow their business successfully and healthily in their financial return. I also double checked their financial status: they are very rich […] much better than TSMC."

Indeed, out of $122.42 billion that TSMC earned in 2025, AI and HPC* processors accounted for 58%, or roughly $71 billion, a 48% year-over-year growth, and the highest result for these categories in years.

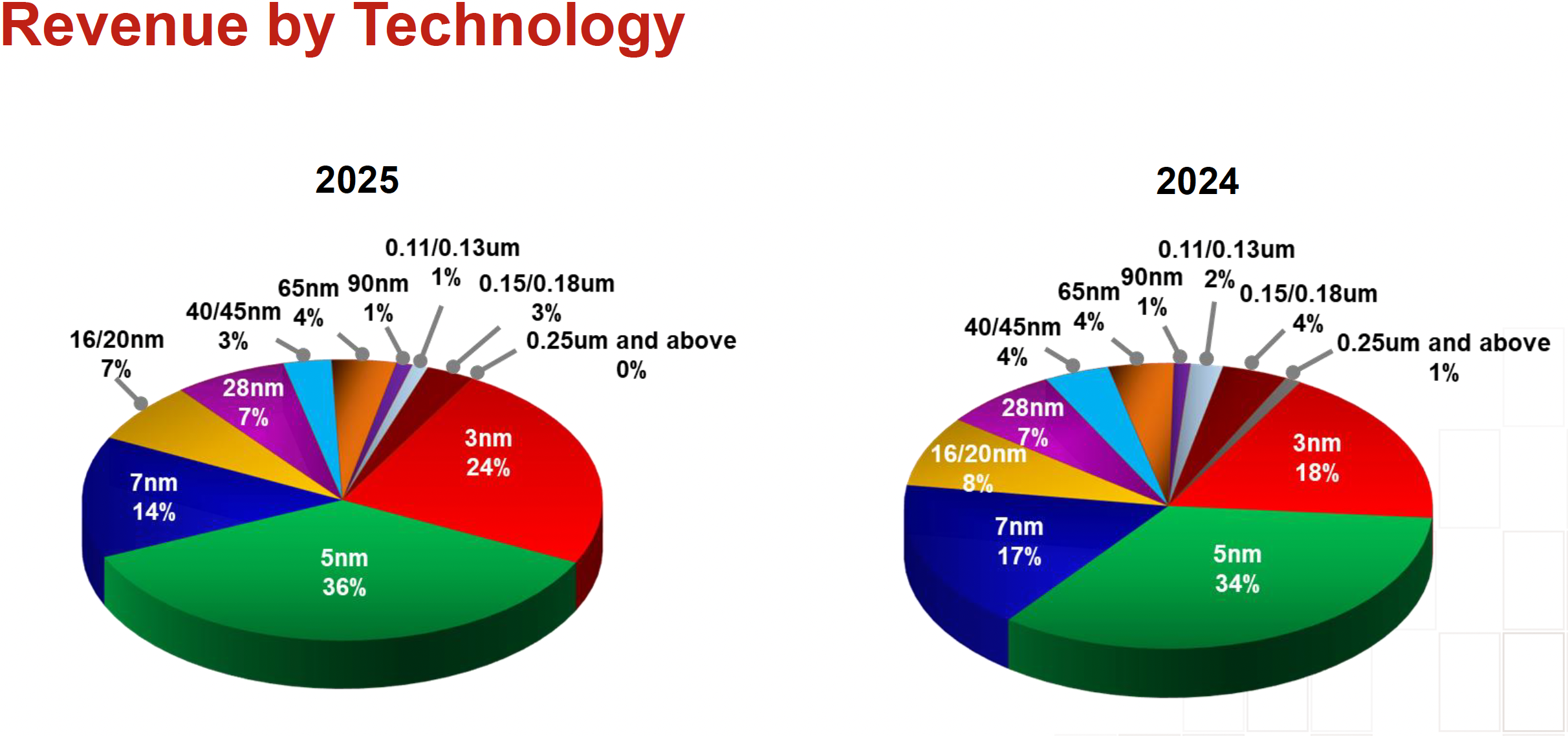

From a node perspective, advanced process technologies accounted for 74% of the foundry's wafer revenue, with 3nm accounting for 24%, 5nm responsible for 36%, and 7nm liable for 14%.

More advanced fab modules to support demand

TSMC began to ramp up production of chips using its N2 (2nm-class) fabrication process at Fab 20 and Fab 22 in Taiwan in the fourth quarter, with more N2 and A16-capable fab modules coming online in the foreseeable future to support unprecedented demand for leading-edge nodes over the coming years.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

As for the $165 billion Arizona Fab 21 campus buildout, C.C. Wei confirmed that Fab 21 phase 2 shell has been constructed, with fab tool installation set to begin in 2026 and first products coming from the fab in the second half of 2027. The Fab 21 phase 3 building is in progress, and TSMC has already obtained permits for Fab 21 phase 4 and the advanced packaging facility in Arizona. Finally, the company has acquired another plot of land to support Fab 21 expansion and "provide more flexibility in response to the very strong multiyear AI-related demand."

"Our plan will enable TSMC to scale up an independent giga-fab cluster in Arizona to support the need of our leading-edge customers in smartphone, AI, and HPC applications," Wei said.

Intel Foundry? Not a competitor any time soon

Pouring in $165 billion in its Fab 21 campus near Phoenix, Arizona, is a tremendous business project full of risks and uncertainties. Competition from other players — such as Intel Foundry and Samsung Foundry — is among the risks for TSMC. Furthermore, with the U.S. government, Nvidia, and Softbank investing in Intel, the company's reputation as a formidable competitor is growing stronger in the eyes of industry observers. However, TSMC chief executive C.C. Wei does not expect Intel Foundry to actually become a competitor that might slow his company's growth any time soon.

Without any doubt, Intel's ramping up of Panther Lake on its leading-edge 18A (1.8nm-class) process technology is an impressive achievement. However, for now, only Intel can build chips on 18A. By contrast, TSMC has multiple alpha customers with its N2 node, who have worked on their chips for years. The message that C.C. Wei sent is that leading-edge foundry competition is constrained by time, not by capital. He said, "it is not money to help you to compete," pushing back against the idea that government support or large investments can instantly create competitiveness at advanced nodes.

C.C. Wei recalled that it takes between two and three years for customers to learn how to design a complex chip on a new process and work closely with the chipmaker on DTCO (design technology co-optimization), followed by another one or two years to qualify and ramp it into high-volume production.

"Today's [leading-edge] technology is so complicated [that] once you want to design [a chip], it takes two to three years to fully utilize that technology," said Wei. "After two to three years of preparation, you can design your product. Once you get your product being approved, it takes another one to two years to ramp it up."

That means even if customers like Apple or Nvidia chose today to use Intel Foundry at the leading-edge, any meaningful commercial impact would likely appear around 2028 – 2030 (both for 18A and 14A), not in the near term. Furthermore, porting a leading-edge design from one foundry to another is an extremely complex task since things like standard-cell libraries, third-party IP blocks, power-delivery techniques, timings, and yield learnings are tightly coupled to a specific manufacturing process, which means that porting equals designing and validating from scratch, something that takes years, costs millions, and there is no guarantee of success.

"So, we have a competitor, no doubt about it, that is a formidable competitor," Wei added. "But first, it takes time. Two, we do not underestimate their progress, but are we afraid of it? For 30-some years, we are always in a competition with our competitors, so no, we have confidence to keep our business grow as we estimate."

Interestingly, the timeline presented by Wei mirrors TSMC's own outlook, where the next two years are about squeezing more output from existing fabs by ramping up N2-capable capacity in Taiwan and by converting N5-capable fabs to N3-capable fabs, while several all-new fabs are set to come online only in 2028 – 2029.

Throughout its history, TSMC has had impressive rivals like IBM, UMC, and Samsung, which TSMC has managed to leave behind. But the complexity of the semiconductor industry in general and leading-edge process technologies in particular is so high today that matching TSMC is not about achieving similar transistor performance, power, and density, but about building an entire development ecosystem that spans from defining a new node with a customer (or customers in case of N2 and A16) and partners to helping them design and optimize their chip and then assisting them with volume ramp it five or six years down the road.

The bottom line about today's leading-edge nodes is that this is a long-term commitment that takes time and a lot of money, and no short-term or mid-term investments from reputable entities can change that.

Good results can only get better

TSMC earned $33.73 billion in revenue for the fourth quarter of 2025, up 20.5% year-over-year, the company's highest quarter revenue ever. The company's gross margin reached 62.3% (up from 59% in Q4 2024) amid the building of multiple manufacturing facilities and ramping up production on TSMC's all-new N2 fabrication process, which typically hurts margins significantly. The foundry's net income reached around $16.012 billion, which also happens to be a record. As for the results for the whole year, TSMC earned $122.42 billion in revenue and $55.133 billion in net income.

It is noteworthy that despite posting the company's best quarter results ever, TSMC's management is confident that the company will earn between $34.6 billion and $35.8 billion in the first quarter, which is traditionally a slow quarter for electronics in general and microelectronics specifically.

*HPC is a vague term TSMC uses to describe everything from laptop CPUs to high-end AI accelerators.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Notton At this point in time, since the shortage is DRAM and NAND, is there any point to increasing production of processors?Reply -

Eximo If the AI bubble pops, there will be less demand for the memory hungry AI chips. I don't think TSMC has to be too worried, though other fabs spooling up in the meantime is probably a greater concern. So they might come out on the other side of this with their additional fab space, Intel's additional fab space, and mainland China getting their fabs up and running.Reply

They have more demand than capacity. I think the concern would be getting used to it and then the demand suddenly shifting which would mean they would have to drop wafer price. They are banking on their returns covering the new fabs they built. -

bigdragon I don't think TSMC would be affected much by the AI bubble popping. Investors would try to create a new bubble to replace the AI bubble just like what they did with crypto, blockchain, big data, web 2.0, and other past tech crazes. Someone is always going to be reliant on the services and technologies TSMC produces.Reply

I think the biggest threat to TSMC is lack of investment in fabs outside of Taiwan. Geopolitical tensions are likely to get worse over the next decade instead of better -- especially if there's a currency crisis that breaks out in one or more heavily-indebted global powers. Regional diversity would help TSMC weather such a crisis. -

Eximo TSMC has a working facility in Arizona (that broke ground in 2022, they started producing last year I believe), it is building another more up to date fab there as well. Should be one node behind the main fab in Taiwan when done. One under construction in Japan (joint venture with Sony). They are also building a less advanced node in Germany for the automotive industry.Reply

They aren't exactly sitting still on that front. -

ravewulf I know nothing but I hope lower consumer purchases from the RAM and NAND shortages puts pressure on the AI bubble. When it pops, RAM prices should go down and consumer purchases will rise again for a new upgrade cycle, so potentially less of an impact on TSMC vs on the DRAM market.Reply -

palladin9479 ReplyEximo said:If the AI bubble pops, there will be less demand for the memory hungry AI chips. I don't think TSMC has to be too worried, though other fabs spooling up in the meantime is probably a greater concern. So they might come out on the other side of this with their additional fab space, Intel's additional fab space, and mainland China getting their fabs up and running.

They have more demand than capacity. I think the concern would be getting used to it and then the demand suddenly shifting which would mean they would have to drop wafer price. They are banking on their returns covering the new fabs they built.

It's about future investment and ROI. Semiconductor fabrication plants are ridiculously expensive capital expenditures, almost on the level of nuclear power plants. This growth is financed through debt, not even Apple has that kind of money just sitting in a bank account. Paying off the loan along with generating enough profit to justify the whole thing is done through selling chips, the most they can get the faster they pay off that loan. If the chips don't sell above a certain amount per wafer, then it won't generate enough revenue to pay off the loan and be worth running. Worse is if demand drops low enough that you have fabs without work to do, generating zero revenue but still have to pay off those loans. All of this also applies to all those hyperscale datacenters being built and filled with chips from TSMC.

There isn't enough potential revenue out there to cover the investment costs for all these hyperscale datacenters being built and capacity being spun up. When the bubble pops and all those AI startups will die causing capacity demand to plummet. When that demand goes south so will the revenue the datacenters were using to pay off the loans for buying nVidia / etc products. That revenue is what nVidia and friends was using to pay off TSMC, who was then using that revenue to pay off their own loans. Insiders know this, it's a race to see who can build out the fastest and be in the best position to survive. Anyone who is short cash could be end up having to be bought out. Whomever survives the bloodbath will be in a position to dominate the market in a decade when the technology starts to actually become useful to consumers.

I don't think TSMC is going to have any issues, even if demand plummets causing price per wafer to go too low, they can always rely on cheap money from the Taiwanese government. This is the same reason nVidia and Intel are getting in bed with the US Government and Military. When / If they end up in trouble, they can argue it's in the US Governments national security interests for them to survive and therefor get cheap money, aka "bail outs". -

bit_user Reply

Yes, apparently.Notton said:At this point in time, since the shortage is DRAM and NAND, is there any point to increasing production of processors?

https://www.tomshardware.com/tech-industry/semiconductors/tsmc-csays-advanced-node-capacity-falls-short-of-ai-demand

Here's a more recent article:

https://wccftech.com/tsmc-demand-is-so-gigantic-that-customers-are-willing-to-pay-up-to-a-100-percent-premium/ -

bit_user Reply

Like they said, Intel isn't a near-term threat. It has neither the capacity, nor customers far enough in the pipeline, for that. The biggest threat to TSMC is actually from the AI boom continuing, which should push more customers towards Intel, in search of capacity. Well, and then there's the Taiwan issue...Eximo said:they might come out on the other side of this with their additional fab space, Intel's additional fab space, and mainland China getting their fabs up and running.

Fabs in mainland China are further behind than even Japan's Rapidus. Mainland China poses a threat mainly to TSMC's revenue streams from legacy nodes. On cutting-edge nodes, I'd call them a long-term threat, but it will probably take them a decade to catch TSMC, if geopolitical environment continued as it is now, because TSMC is moving the goalposts every year.

That's why he said they talked to their customers and their customers' customers, in order to convince themselves the AI demand was real and sufficiently durable.Eximo said:I think the concern would be getting used to it and then the demand suddenly shifting which would mean they would have to drop wafer price. -

bit_user Reply

LOL, with what money? People and institutions that just lost their shirt are not going to be in a mood to make any more big gambles, for a while.bigdragon said:I don't think TSMC would be affected much by the AI bubble popping. Investors would try to create a new bubble to replace the AI bubble

You're conflating public mindshare with actual semiconductor production volume. The actual data tells a different story:bigdragon said:just like what they did with crypto, blockchain, big data, web 2.0, and other past tech crazes.

Source: https://www.semiconductors.org/global-semiconductor-sales-increase-18-0-year-to-year-1-8-month-to-month-in-may/

That's not enough. Their fabs need to be running pretty close to full capacity, in order to get a return on investment. So much of the expense is tied up in the facility and the equipment that you hardly even save any money by idling an assembly line.bigdragon said:Someone is always going to be reliant on the services and technologies TSMC produces.

Besides the US, they're also building fabs in Germany and Japan. Maybe elsewhere. However, I'm not convinced their satellite fabs will even be able to continue operating, if they're cut off from headquarters.bigdragon said:I think the biggest threat to TSMC is lack of investment in fabs outside of Taiwan.